- Canada

- /

- Metals and Mining

- /

- TSX:MPVD

Mountain Province Diamonds Inc. (TSE:MPVD) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Those holding Mountain Province Diamonds Inc. (TSE:MPVD) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

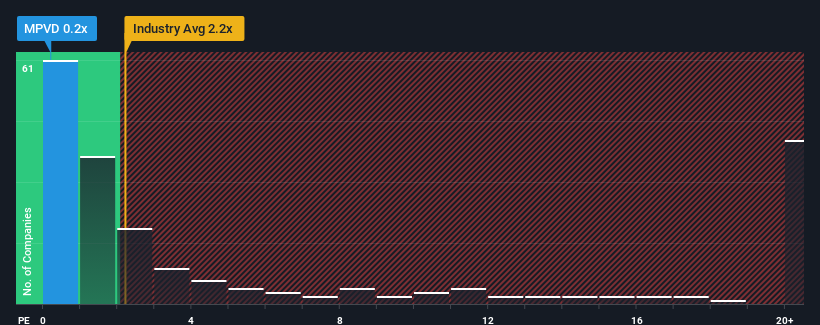

Although its price has surged higher, Mountain Province Diamonds may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 2.2x and even P/S higher than 14x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Mountain Province Diamonds

How Has Mountain Province Diamonds Performed Recently?

Mountain Province Diamonds could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mountain Province Diamonds.Is There Any Revenue Growth Forecasted For Mountain Province Diamonds?

Mountain Province Diamonds' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 8.6% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 63% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth is heading into negative territory, declining 10% over the next year. Meanwhile, the broader industry is forecast to expand by 16%, which paints a poor picture.

With this in consideration, we find it intriguing that Mountain Province Diamonds' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Mountain Province Diamonds' P/S

Mountain Province Diamonds' stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's clear to see that Mountain Province Diamonds maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Mountain Province Diamonds' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Mountain Province Diamonds (2 shouldn't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Mountain Province Diamonds' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MPVD

Mountain Province Diamonds

Focuses on the mining and marketing of rough diamonds worldwide.

Good value with mediocre balance sheet.

Market Insights

Community Narratives