- Canada

- /

- Metals and Mining

- /

- TSX:MPVD

Investors Give Mountain Province Diamonds Inc. (TSE:MPVD) Shares A 31% Hiding

Mountain Province Diamonds Inc. (TSE:MPVD) shares have had a horrible month, losing 31% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

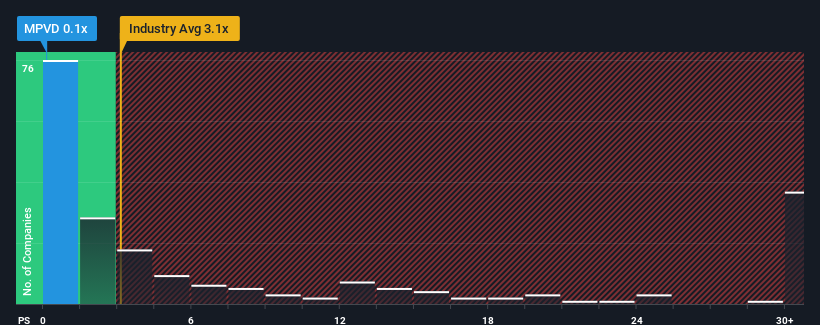

Since its price has dipped substantially, Mountain Province Diamonds' price-to-sales (or "P/S") ratio of 0.1x might make it look like a strong buy right now compared to the wider Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 3.1x and even P/S above 16x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Mountain Province Diamonds

What Does Mountain Province Diamonds' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Mountain Province Diamonds over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Mountain Province Diamonds will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Mountain Province Diamonds' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Mountain Province Diamonds?

The only time you'd be truly comfortable seeing a P/S as depressed as Mountain Province Diamonds' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. Even so, admirably revenue has lifted 45% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 12% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Mountain Province Diamonds is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From Mountain Province Diamonds' P/S?

Shares in Mountain Province Diamonds have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Mountain Province Diamonds currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

Plus, you should also learn about this 1 warning sign we've spotted with Mountain Province Diamonds.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MPVD

Mountain Province Diamonds

Focuses on the mining and marketing of rough diamonds worldwide.

Good value with mediocre balance sheet.