- Canada

- /

- Metals and Mining

- /

- TSX:MDI

The Major Drilling Group International (TSE:MDI) Share Price Is Up 41% And Shareholders Are Holding On

Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. To wit, the Major Drilling Group International Inc. (TSE:MDI) share price is 41% higher than it was a year ago, much better than the market return of around 1.8% (not including dividends) in the same period. That's a solid performance by our standards! The longer term returns have not been as good, with the stock price only 15% higher than it was three years ago.

View our latest analysis for Major Drilling Group International

Given that Major Drilling Group International didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Major Drilling Group International saw its revenue shrink by 11%. Despite the lack of revenue growth, the stock has returned a solid 41% the last twelve months. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

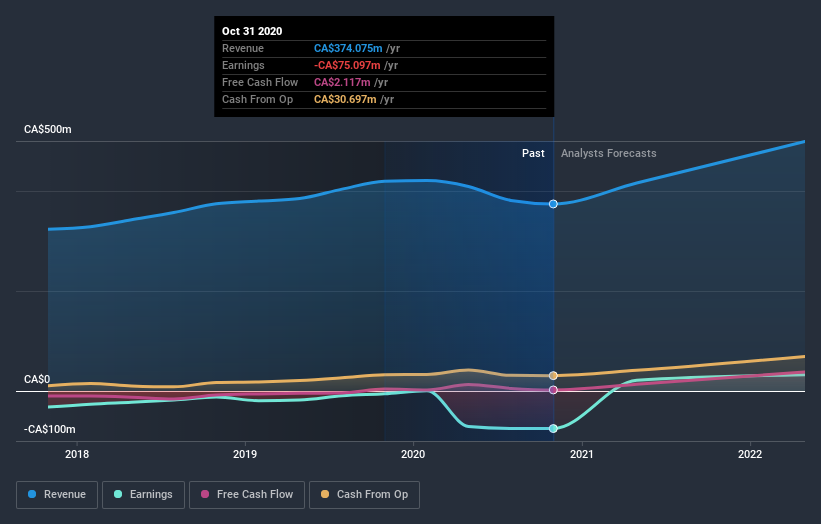

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that Major Drilling Group International has rewarded shareholders with a total shareholder return of 41% in the last twelve months. That's better than the annualised return of 5% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Major Drilling Group International by clicking this link.

Major Drilling Group International is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

When trading Major Drilling Group International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:MDI

Major Drilling Group International

Provides contract drilling services to mining and mineral exploration companies in the United States, Canada, South and Central America, Australasia, and Africa.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives