- Canada

- /

- Metals and Mining

- /

- TSX:MAG

Undiscovered Canadian Gems With Strong Fundamentals February 2025

Reviewed by Simply Wall St

In the face of potential trade tensions and tariff implications, the Canadian market is navigating a complex landscape where diversification remains crucial. Despite these challenges, opportunities abound for investors to identify stocks with strong fundamentals that can weather economic fluctuations and capitalize on growth prospects. In this context, discovering companies with solid financial health and resilience becomes essential as they are better positioned to thrive amidst market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.24% | 12.63% | 23.89% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Genesis Land Development | 47.40% | 28.61% | 52.30% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Medical Facilities (TSX:DR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Medical Facilities Corporation, with a market cap of CA$387.56 million, owns and operates specialty hospitals and ambulatory surgery centers in the United States through its subsidiaries.

Operations: The company's revenue primarily comes from its healthcare facilities and services, totaling $441.27 million.

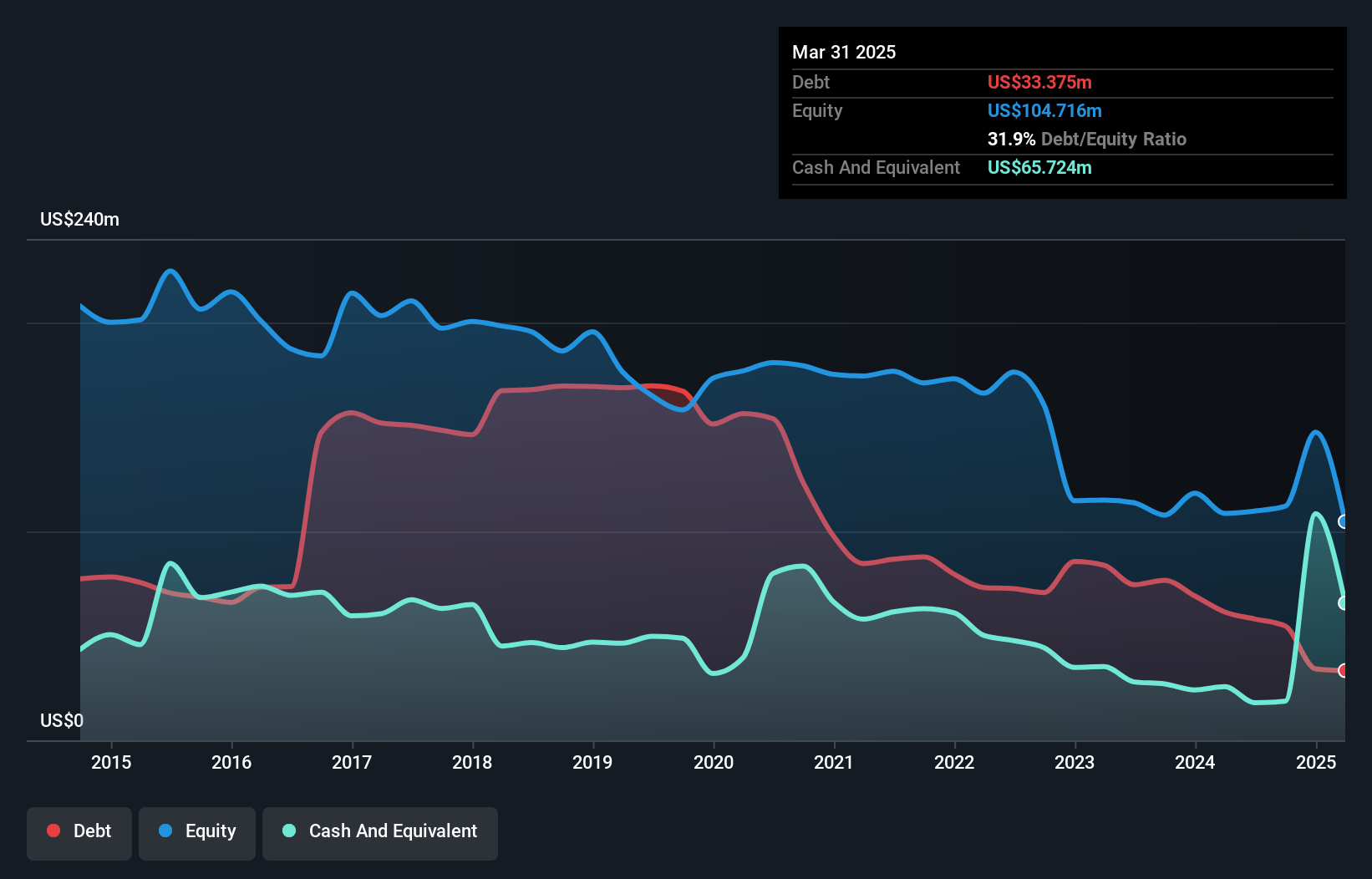

Medical Facilities, a small Canadian healthcare player, has shown remarkable earnings growth of 265.2% over the past year, outpacing the industry average of 22.3%. The company's debt situation appears satisfactory with a net debt to equity ratio of 32.2%, down from 105.7% five years ago, indicating improved financial health. Despite this progress, significant insider selling in recent months raises questions about internal confidence. Additionally, Medical Facilities announced a share repurchase program worth CAD 80.75 million to buy back shares priced between CAD 15.50 and CAD 17 each by February 24, which could potentially enhance shareholder value if executed wisely.

- Click to explore a detailed breakdown of our findings in Medical Facilities' health report.

Examine Medical Facilities' past performance report to understand how it has performed in the past.

MAG Silver (TSX:MAG)

Simply Wall St Value Rating: ★★★★★★

Overview: MAG Silver Corp. is engaged in the development and exploration of precious metal properties in Canada, with a market capitalization of CA$2.39 billion.

Operations: MAG Silver generates revenue primarily from its precious metal exploration activities in Canada. The company has a market capitalization of approximately CA$2.39 billion.

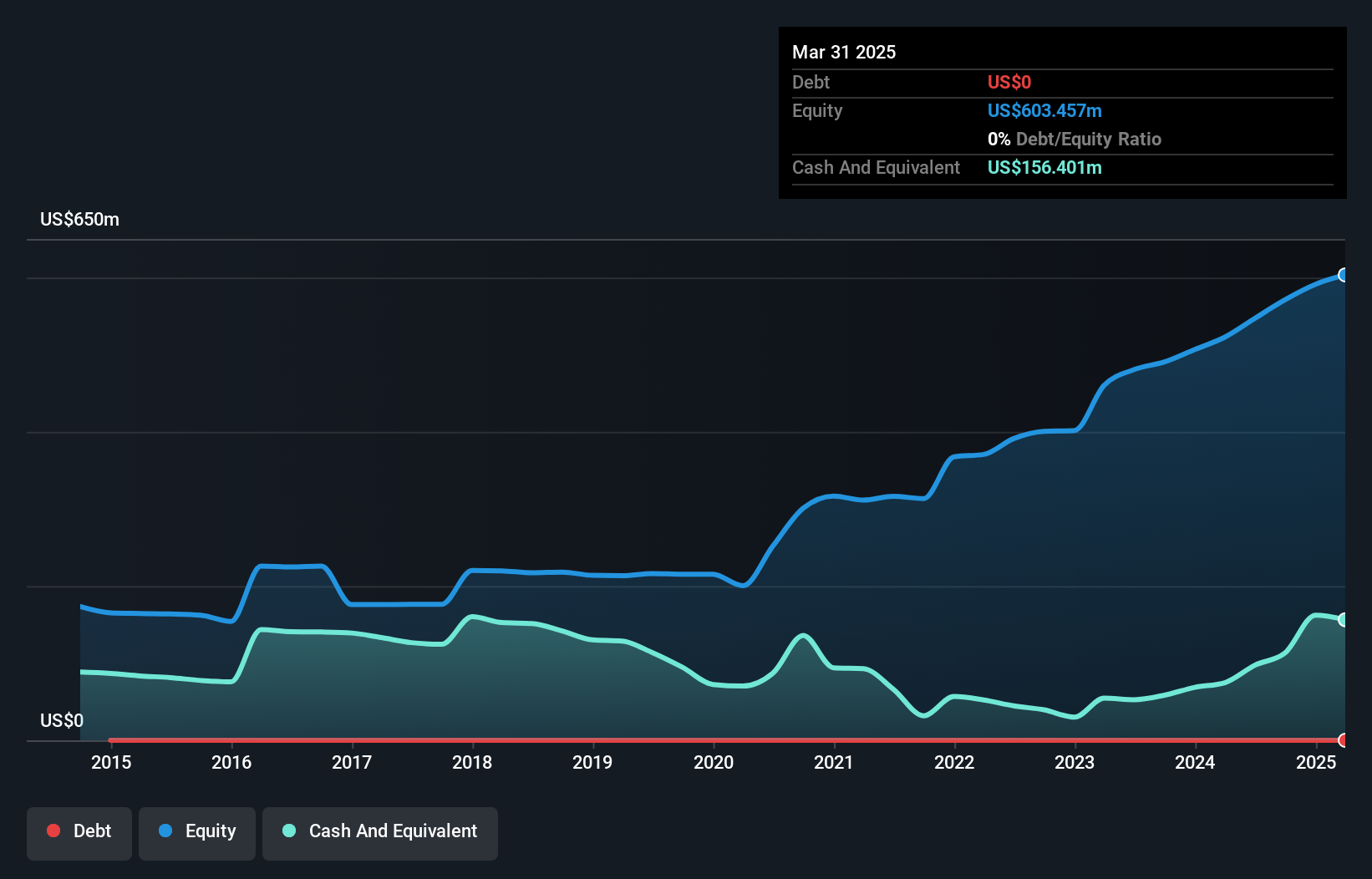

MAG Silver, a noteworthy player in the Canadian mining sector, is trading at 16.4% below its estimated fair value. The company has shown impressive earnings growth of 131.8% over the past year, significantly outpacing the industry average of 35.7%. Despite having no debt for five years and maintaining a high level of non-cash earnings, MAG faces challenges with significant insider selling recently and negative free cash flow. Recent production results from Juanicipio show increased silver output to 18,571 koz for the year compared to last year's 16,812 koz. Looking ahead, silver production is expected between 14.7 million and 16.7 million ounces in 2025 due to mine sequencing adjustments.

- Delve into the full analysis health report here for a deeper understanding of MAG Silver.

Review our historical performance report to gain insights into MAG Silver's's past performance.

TWC Enterprises (TSX:TWC)

Simply Wall St Value Rating: ★★★★★★

Overview: TWC Enterprises Limited owns, operates, and manages golf clubs under the ClubLink One Membership More Golf brand in Canada and the United States with a market capitalization of CA$432.75 million.

Operations: TWC Enterprises generates revenue primarily from its Canadian Golf Club Operations, which account for CA$153.38 million, followed by Corporate activities at CA$88.36 million and US Golf Club Operations at CA$23.76 million.

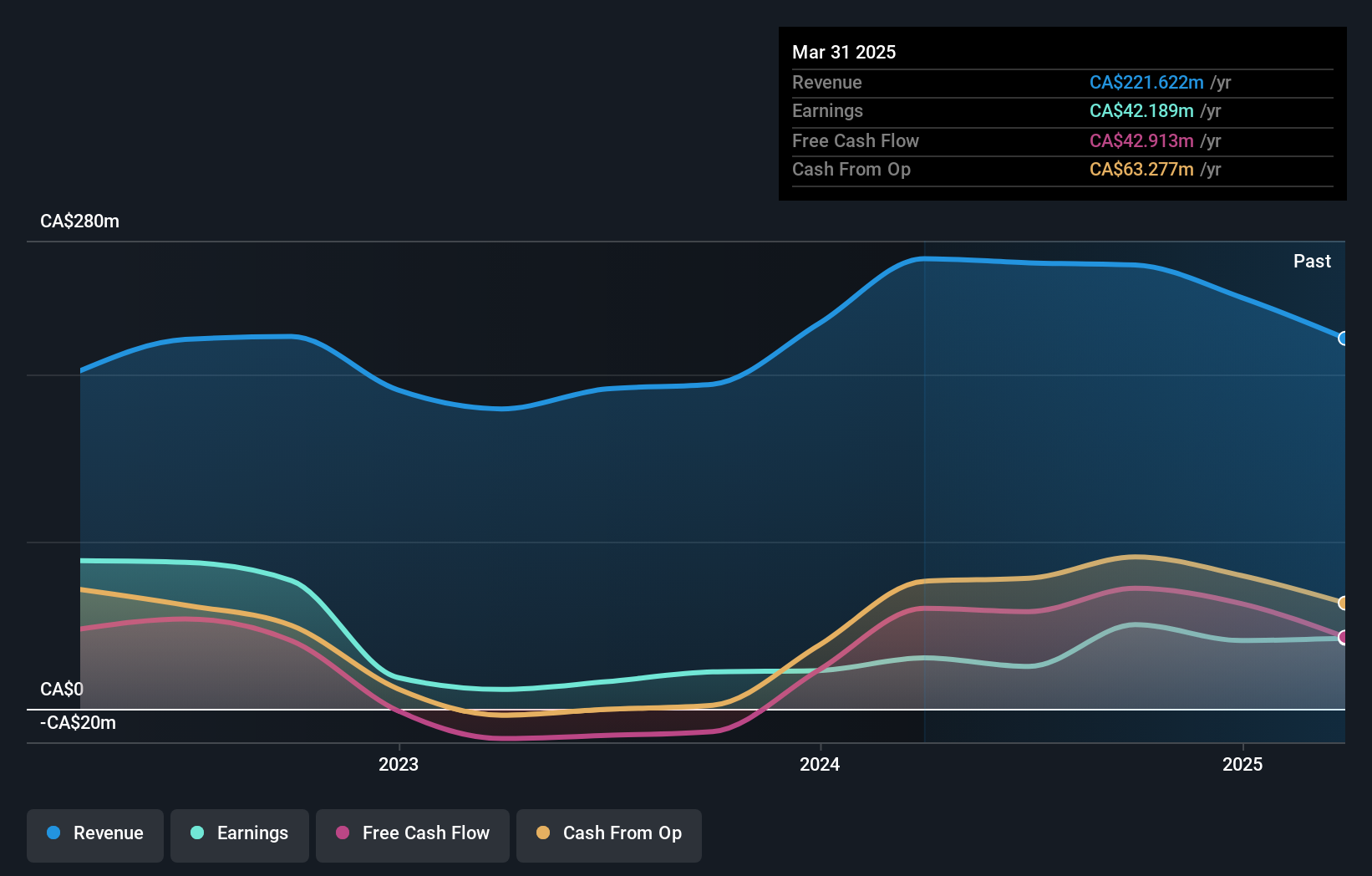

Trading at 87.4% below its estimated fair value, TWC Enterprises offers a compelling opportunity in the Canadian market. Over the past year, its earnings surged by 127.9%, significantly outpacing the hospitality industry's modest growth of 1.2%. The company is free cash flow positive and has reduced its debt to equity ratio from 31.5% to a more manageable 6.2% over five years, indicating improved financial health. However, a CA$33.9M one-off gain has impacted recent results, suggesting some caution is warranted when evaluating profitability trends moving forward despite these promising figures.

- Click here to discover the nuances of TWC Enterprises with our detailed analytical health report.

Gain insights into TWC Enterprises' past trends and performance with our Past report.

Where To Now?

- Delve into our full catalog of 49 TSX Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MAG

MAG Silver

A mining and exploration company, engages in the acquisition, exploration, and advancement of mineral projects in Canada, the United States, and Mexico.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026