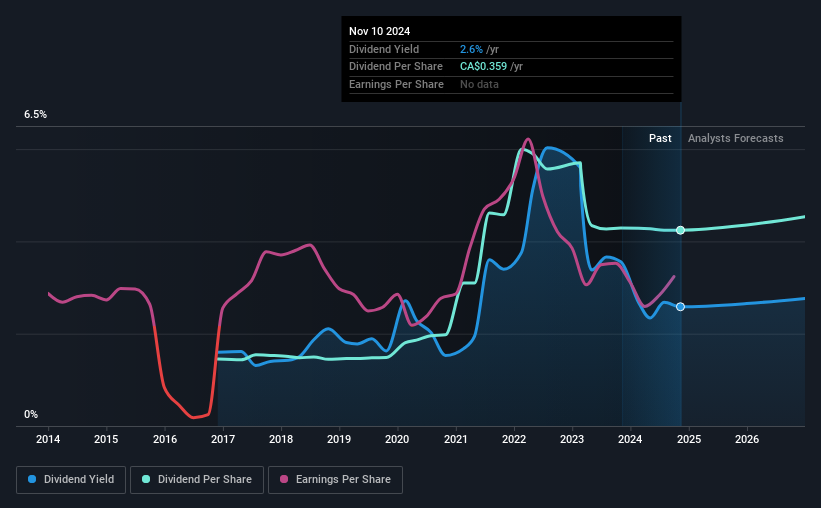

Lundin Mining Corporation (TSE:LUN) will pay a dividend of $0.09 on the 11th of December. This means the dividend yield will be fairly typical at 2.6%.

Check out our latest analysis for Lundin Mining

Lundin Mining's Projected Earnings Seem Likely To Cover Future Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, Lundin Mining was paying out 77% of earnings and more than 75% of free cash flows. This indicates that the company is more focused on returning cash to shareholders than growing the business, but it is still in a reasonable range to continue with.

Over the next year, EPS is forecast to expand by 166.7%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 46% which would be quite comfortable going to take the dividend forward.

Lundin Mining's Dividend Has Lacked Consistency

Looking back, Lundin Mining's dividend hasn't been particularly consistent. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The annual payment during the last 8 years was $0.0882 in 2016, and the most recent fiscal year payment was $0.258. This means that it has been growing its distributions at 14% per annum over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Lundin Mining's Dividend Might Lack Growth

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Lundin Mining has seen EPS rising for the last five years, at 21% per annum. Fast growing earnings are great, but this can rarely be sustained without some reinvestment into the business, which Lundin Mining hasn't been doing.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Lundin Mining's payments, as there could be some issues with sustaining them into the future. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Lundin Mining that you should be aware of before investing. Is Lundin Mining not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:LUN

Lundin Mining

A diversified base metals mining company, engages in the exploration, development, and mining of mineral properties in Chile, Brazil, the United States, Portugal, Sweden, and Argentina.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion