- Canada

- /

- Metals and Mining

- /

- TSX:KNT

Is K92 Mining Still an Opportunity After 107.7% Rally and Kainantu Expansion News?

Reviewed by Bailey Pemberton

- If you have ever wondered whether K92 Mining is a hidden gem or already priced for perfection, this breakdown will make things clear.

- The stock has delivered a staggering 107.7% return so far this year and is up 97.8% over the last 12 months, catching the attention of growth investors and raising fresh questions about what the market is expecting next.

- K92 Mining’s recent surge in price comes on the heels of new developments at their Kainantu Gold Mine. Expansion plans and updated resource estimates have attracted investor interest and industry buzz. Major project milestones and increased production guidance have kept the company in the headlines, fueling both optimism and debate around the stock’s true value.

- The company clocks a perfect 6 out of 6 on our core undervaluation checks, which is rare among mining stocks. Let’s walk through how we get to that number using classic valuation approaches. There may be an even more insightful perspective to consider before you decide what the stock is really worth.

Approach 1: K92 Mining Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today’s value. This approach helps investors understand what a business is fundamentally worth by focusing on how much actual cash it will generate, rather than just reported earnings or asset values.

K92 Mining’s current Free Cash Flow is $38.5 million. Analysts forecast significant growth, with projections reaching $502.7 million by 2028. The cash flow is expected to continue rising, with Simply Wall St extending estimates out to 2035. These estimates are based on both analyst opinions for the next five years and reasonable long-term assumptions. All figures are reported in US dollars.

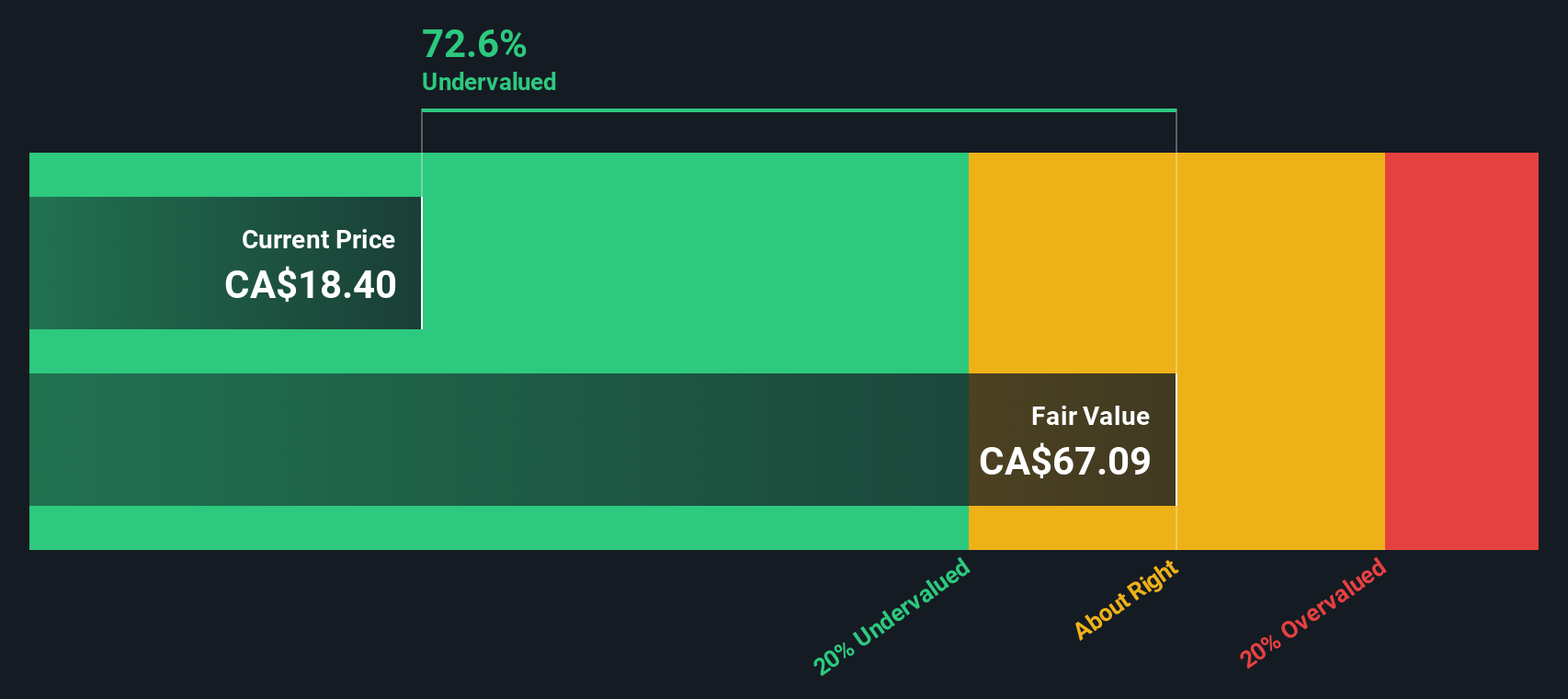

Using the 2 Stage Free Cash Flow to Equity DCF model, the intrinsic value for K92 Mining is estimated at $65.53 per share. This represents a notable premium compared to today’s share price. The DCF suggests the stock is about 71.5% undervalued based on these projections.

In summary, the DCF analysis indicates that the company is generating strong and accelerating cash flows, making the current market price appear appealing from a long-term value perspective.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests K92 Mining is undervalued by 71.5%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: K92 Mining Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a favored valuation metric for profitable companies like K92 Mining because it directly compares a company’s share price to its earnings per share. It offers a straightforward way for investors to gauge how much they are paying for each dollar of earnings generated by the company.

Growth expectations and risk play a big role in determining what a “normal” or “fair” PE ratio should be. Faster-growing or more stable companies typically warrant higher PE ratios, while slower growth or higher risk will push the fair value multiple down.

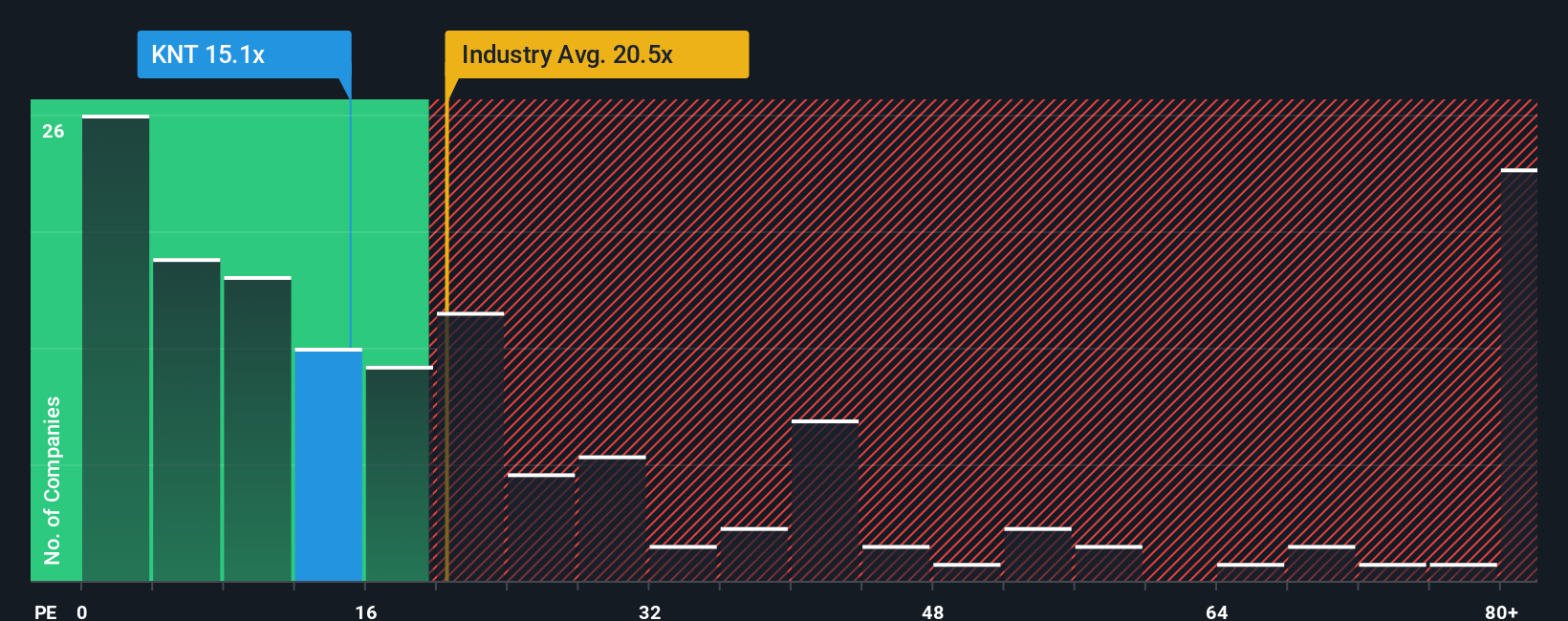

K92 Mining currently trades at a PE ratio of 15.29x. This is notably lower than both the Metals and Mining industry average of 20.92x and the average for its peers, which sits at 43.26x. At first glance, this may imply that the stock is undervalued relative to its sector and peers, but a deeper look is needed.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated to be 20.48x for K92 Mining, is more insightful because it considers not just industry averages and peer multiples, but also the company’s unique growth prospects, risks, profit margins, and market capitalization. This proprietary measure helps strip out market noise and provides a realistic benchmark for what K92 should be worth based on its fundamentals, rather than a generic one-size-fits-all comparison.

Comparing K92’s current PE ratio (15.29x) with the Fair Ratio (20.48x) shows the stock is trading below what the fundamentals warrant. This suggests that, according to Simply Wall St’s assessment, K92 Mining is undervalued on a PE basis, especially given its current growth outlook and profitability.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your K92 Mining Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a practical, user-friendly tool that allow investors to connect their personal story or outlook for a company, such as their views on K92 Mining’s future gold production, margin expansion or regional risks, to the numbers behind a fair value calculation.

Essentially, a Narrative takes your viewpoint about the company’s future growth, profitability, and industry developments, links it to a specific set of financial forecasts, and then shows you what that belief implies for fair value. Narratives are available for free on the Simply Wall St Community page, where millions of investors share and compare their perspectives with live market prices.

The biggest advantage of Narratives is how they simplify buy and sell decisions. You can immediately see if the Fair Value that comes from your (or others') story is above or below today’s share price, allowing you to act with confidence or caution. Narratives also update automatically whenever new news, results, or company updates hit the market, so your perspective and its conclusions stay relevant.

For example, one K92 Mining Narrative expects robust expansion and margin improvement, pointing to a Fair Value of CA$22.00, while another, focused on operational risks and lower gold prices, suggests a Fair Value of just CA$14.03.

Do you think there's more to the story for K92 Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K92 Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KNT

K92 Mining

Engages in the exploration and development of mineral deposits in Papua New Guinea.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives