- Canada

- /

- Metals and Mining

- /

- TSX:K

Kinross Gold Corporation (TSE:K) Passed Our Checks, And It's About To Pay A US$0.03 Dividend

Kinross Gold Corporation (TSE:K) stock is about to trade ex-dividend in four days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. This means that investors who purchase Kinross Gold's shares on or after the 2nd of June will not receive the dividend, which will be paid on the 17th of June.

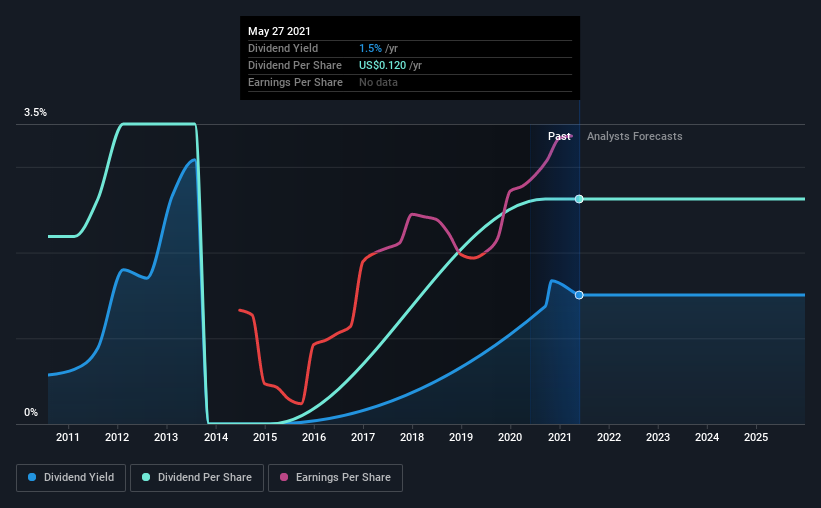

The company's next dividend payment will be US$0.03 per share, on the back of last year when the company paid a total of US$0.12 to shareholders. Based on the last year's worth of payments, Kinross Gold has a trailing yield of 1.5% on the current stock price of CA$9.64. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Kinross Gold

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Kinross Gold paid out just 8.3% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. A useful secondary check can be to evaluate whether Kinross Gold generated enough free cash flow to afford its dividend. It paid out 12% of its free cash flow as dividends last year, which is conservatively low.

It's positive to see that Kinross Gold's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. It's encouraging to see Kinross Gold has grown its earnings rapidly, up 72% a year for the past five years. Kinross Gold looks like a real growth company, with earnings per share growing at a cracking pace and the company reinvesting most of its profits in the business.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Kinross Gold has delivered 1.8% dividend growth per year on average over the past 10 years. Earnings per share have been growing much quicker than dividends, potentially because Kinross Gold is keeping back more of its profits to grow the business.

Final Takeaway

Is Kinross Gold worth buying for its dividend? Kinross Gold has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past 10 years, but the conservative payout ratio makes the current dividend look sustainable. It's a promising combination that should mark this company worthy of closer attention.

On that note, you'll want to research what risks Kinross Gold is facing. Every company has risks, and we've spotted 2 warning signs for Kinross Gold (of which 1 is a bit concerning!) you should know about.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026