- Canada

- /

- Metals and Mining

- /

- TSX:JAG

Improved Earnings Required Before Jaguar Mining Inc. (TSE:JAG) Stock's 39% Jump Looks Justified

Jaguar Mining Inc. (TSE:JAG) shares have continued their recent momentum with a 39% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.0% in the last twelve months.

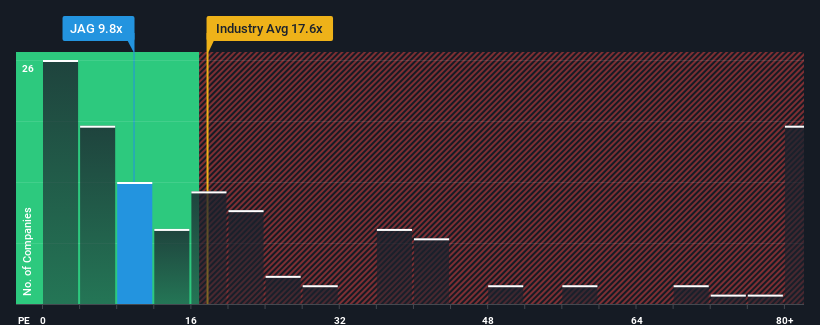

In spite of the firm bounce in price, Jaguar Mining's price-to-earnings (or "P/E") ratio of 9.8x might still make it look like a buy right now compared to the market in Canada, where around half of the companies have P/E ratios above 15x and even P/E's above 29x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Jaguar Mining's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Jaguar Mining

Is There Any Growth For Jaguar Mining?

There's an inherent assumption that a company should underperform the market for P/E ratios like Jaguar Mining's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 28%. The last three years don't look nice either as the company has shrunk EPS by 80% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 18% shows it's an unpleasant look.

In light of this, it's understandable that Jaguar Mining's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Jaguar Mining's P/E

The latest share price surge wasn't enough to lift Jaguar Mining's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Jaguar Mining maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Jaguar Mining, and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:JAG

Jaguar Mining

A junior gold mining company, engages in the acquisition, exploration, development, and operation of gold mineral properties in Brazil.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026