- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Ivanhoe Mines (TSX:IVN): Valuation Insights as Kakula Smelter Nears Start and Project Milestones Accelerate

Reviewed by Kshitija Bhandaru

Ivanhoe Mines (TSX:IVN) is attracting renewed attention as it checks off major milestones at its Kakula copper project. With the smelter’s start-up approaching and smoother operations in place, investors are sizing up its evolving potential.

See our latest analysis for Ivanhoe Mines.

With Ivanhoe Mines recently joining the FTSE All-World Index and securing major investments, momentum is building as the company moves closer to launching its Kakula smelter. While the one-year total shareholder return remains almost flat, recent operational wins and tightening global copper supply have investors cautiously optimistic about the longer-term outlook.

If copper’s supply squeeze or Ivanhoe’s milestones have you scanning for new ideas, now might be the perfect moment to seek out fast growing stocks with high insider ownership.

With analysts lifting their price targets and copper supply concerns mounting, the question remains: is Ivanhoe Mines still trading at an attractive value, or has the market already factored in its next phase of growth?

Most Popular Narrative: 3.5% Undervalued

Ivanhoe Mines' fair value, as estimated by the most widely followed narrative, sits just above its last close. While the gap is modest, the underlying growth assumptions and project milestones may hold the key to why analysts see more upside at current levels.

Ongoing capacity expansions at Kamoa-Kakula (Phases 1 to 3) and de-bottlenecking at Kipushi, alongside operational recovery from the recent seismic event, are projected to drive substantial increases in copper and zinc output. This is expected to support strong top-line revenue growth in the next 12 to 24 months as production returns to full scale.

Want to know what’s fueling analyst optimism behind Ivanhoe’s above-market valuation? Analysts are pinning their fair value on bold multi-year revenue, profit, and margin projections, plus an aggressive future profit multiple. The full narrative reveals which numbers set the bar for Ivanhoe’s next phase.

Result: Fair Value of $15.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering operational risks and the threat of further disruptions at Kamoa-Kakula could quickly challenge analysts’ optimistic projections for Ivanhoe Mines.

Find out about the key risks to this Ivanhoe Mines narrative.

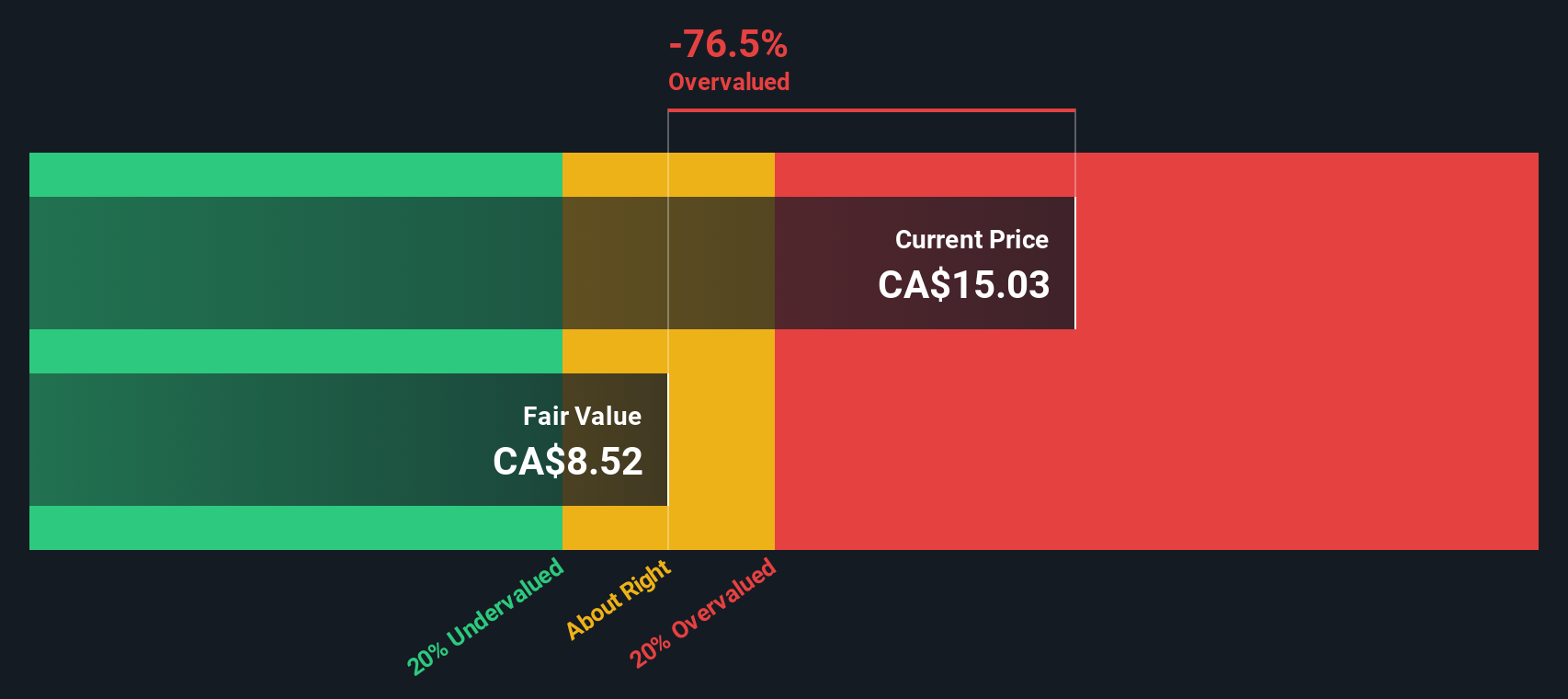

Another View: Discounted Cash Flow Model

While analysts see Ivanhoe Mines as slightly undervalued based on growth forecasts and peer comparisons, our DCF model paints a less optimistic picture. According to the SWS DCF model, Ivanhoe's current share price is trading well above its estimated fair value. This gap may suggest the market is placing significant expectations on future growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ivanhoe Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ivanhoe Mines Narrative

If you want to dig into the numbers and come to your own conclusion, you can easily shape your personal Ivanhoe Mines story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ivanhoe Mines.

Looking for more investment ideas?

If you want to be truly ahead of the curve, don’t stop at Ivanhoe. Unlock exclusive stock ideas you might be missing by trying these curated shortlists now:

- Explore potential high-yield opportunities by checking out these 19 dividend stocks with yields > 3%, which offers solid returns above 3% and steady income streams.

- Tap into innovation and growth by reviewing these 24 AI penny stocks, focusing on artificial intelligence breakthroughs.

- Discover undervalued gems before they gain wider attention with these 902 undervalued stocks based on cash flows, emphasizing cash-flow strength and proven value signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives