- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

3 TSX Growth Stocks With High Insider Ownership And Up To 83% Earnings Growth

Reviewed by Simply Wall St

As the Canadian market continues to navigate trade uncertainties and potential interest rate cuts, the TSX has shown resilience, posting a 67% gain since its October 2022 low. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, potentially aligning well with ongoing earnings growth trends.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.2% | 78% |

| Robex Resources (TSXV:RBX) | 22.3% | 90.3% |

| Propel Holdings (TSX:PRL) | 30.6% | 30.9% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| goeasy (TSX:GSY) | 21.9% | 18% |

| Enterprise Group (TSX:E) | 32.2% | 30.4% |

| Colliers International Group (TSX:CIGI) | 14.0% | 27.2% |

| CEMATRIX (TSX:CEMX) | 10.5% | 77.8% |

| Almonty Industries (TSX:AII) | 12.2% | 64.1% |

| Allied Gold (TSX:AAUC) | 15% | 83.6% |

We're going to check out a few of the best picks from our screener tool.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, along with its subsidiaries, engages in the exploration and production of mineral deposits in Africa and has a market cap of CA$2.97 billion.

Operations: The company's revenue segments comprise $213.19 million from the Agbaou Mine, $247.48 million from the Bonikro Mine, and $497.42 million from the Sadiola Mine.

Insider Ownership: 15%

Earnings Growth Forecast: 83.6% p.a.

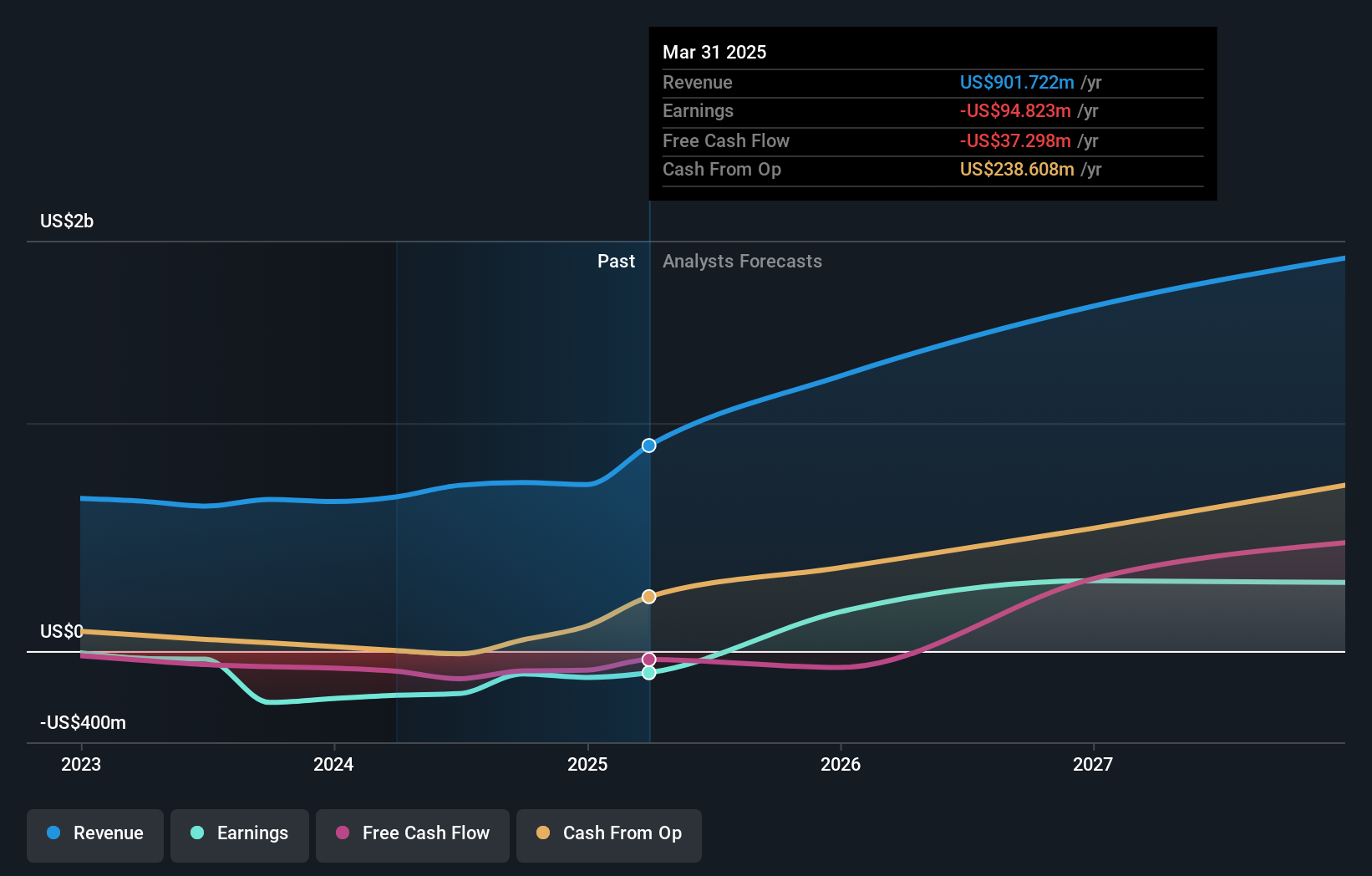

Allied Gold, with significant insider ownership, is poised for growth with revenue expected to outpace the Canadian market at 25.3% annually. Recent insider activity shows substantial buying, indicating confidence in its trajectory. Despite a net loss reported recently, the company anticipates becoming profitable within three years and achieving strong earnings growth of 83.63% annually. A recent CAD 175.04 million equity offering supports expansion plans, aligning with production guidance exceeding 375,000 gold ounces for 2025.

- Navigate through the intricacies of Allied Gold with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Allied Gold shares in the market.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hammond Power Solutions Inc. designs, manufactures, and sells transformers across Canada, the United States, Mexico, and India with a market cap of CA$2.42 billion.

Operations: The company generates revenue of CA$852.64 million from its transformer design, manufacturing, and sales operations across Canada, the United States, Mexico, and India.

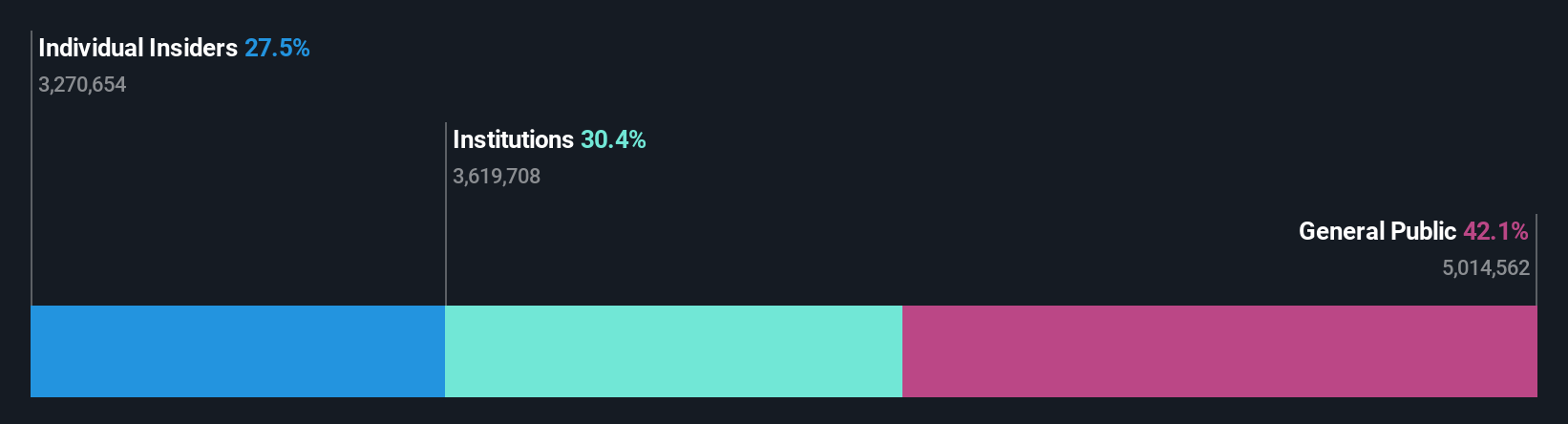

Insider Ownership: 27.5%

Earnings Growth Forecast: 15.4% p.a.

Hammond Power Solutions, with considerable insider ownership, is expected to see earnings grow faster than the Canadian market at 15.4% annually. Recent insider buying, though not substantial, indicates some confidence in its growth trajectory. The company reported increased Q3 sales and net income compared to last year and is actively seeking acquisitions to bolster growth amid rising demand for data and electricity. Its P/E ratio suggests it's valued slightly below industry average levels.

- Unlock comprehensive insights into our analysis of Hammond Power Solutions stock in this growth report.

- The valuation report we've compiled suggests that Hammond Power Solutions' current price could be inflated.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd., with a market cap of CA$20.60 billion, is involved in the mining, development, and exploration of minerals and precious metals in Africa through its subsidiaries.

Operations: Ivanhoe Mines Ltd. operates in Africa, focusing on the mining, development, and exploration of minerals and precious metals through its subsidiaries.

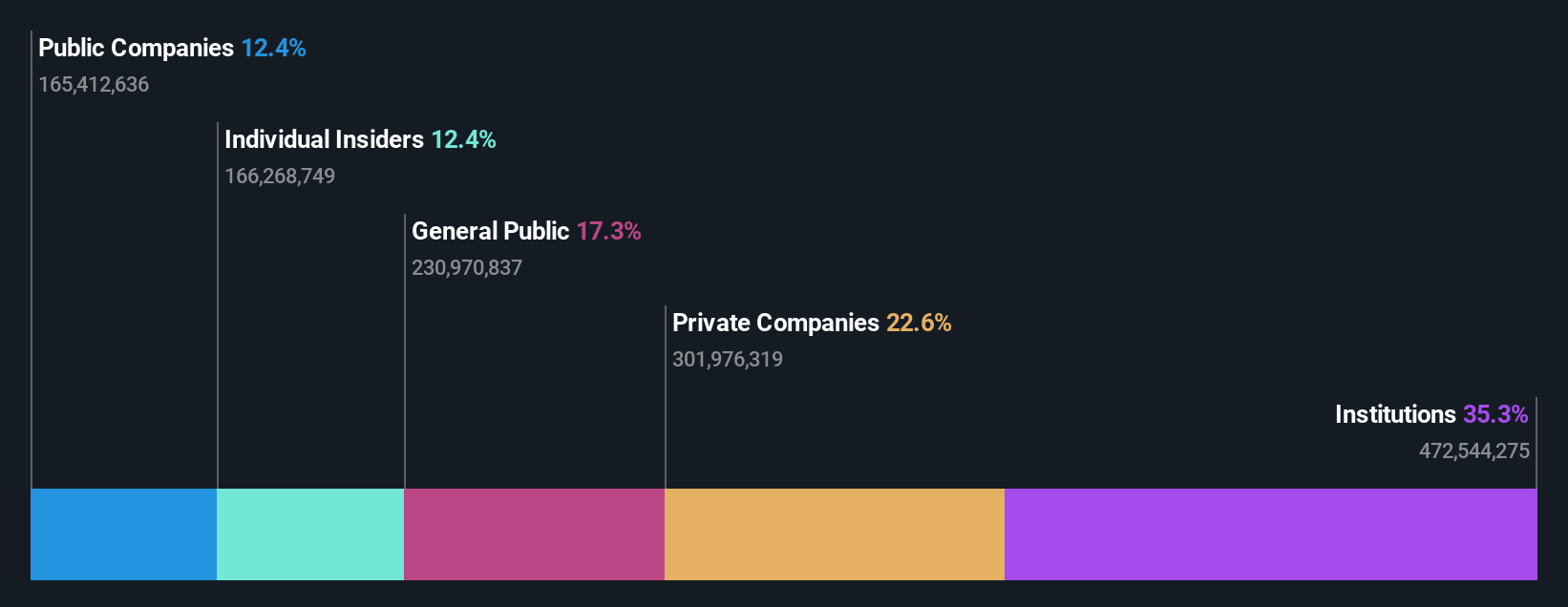

Insider Ownership: 11.7%

Earnings Growth Forecast: 39.1% p.a.

Ivanhoe Mines, benefiting from significant insider ownership, is poised for robust growth with earnings expected to rise significantly above the Canadian market average at 39.1% annually. The company's recent Q3 results showed a decline in net income compared to last year, but revenue and production guidance remain strong. Ivanhoe's strategic focus on expanding copper and zinc production underscores its potential for substantial revenue growth, forecasted at 48.6% annually—well above market averages.

- Take a closer look at Ivanhoe Mines' potential here in our earnings growth report.

- The analysis detailed in our Ivanhoe Mines valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Delve into our full catalog of 40 Fast Growing TSX Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Undervalued with high growth potential.

Market Insights

Community Narratives