- Canada

- /

- Capital Markets

- /

- TSX:FSZ

3 TSX Growth Companies With High Insider Ownership And Up To 49% Earnings Growth

Reviewed by Simply Wall St

As the Canadian TSX has shown resilience with a recent 2% uptick amidst global tariff uncertainties, investors are keenly observing how these economic factors influence market dynamics. In such a volatile environment, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the business and potential for robust earnings growth.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 35.8% |

| Discovery Silver (TSX:DSV) | 17.4% | 47% |

| Robex Resources (TSXV:RBX) | 25.6% | 147.4% |

| Allied Gold (TSX:AAUC) | 17.7% | 67.9% |

| West Red Lake Gold Mines (TSXV:WRLG) | 12.5% | 76.8% |

| Almonty Industries (TSX:AII) | 16.6% | 50.1% |

| Aritzia (TSX:ATZ) | 17.5% | 38.5% |

| Enterprise Group (TSX:E) | 32.2% | 41.9% |

| Burcon NutraScience (TSX:BU) | 16.4% | 152.2% |

| SolarBank (NEOE:SUNN) | 17.6% | 178.3% |

Here's a peek at a few of the choices from the screener.

Fiera Capital (TSX:FSZ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fiera Capital Corporation is an employee-owned investment manager with a market cap of CA$664.87 million.

Operations: The company generates revenue primarily from its Asset Management Services, amounting to CA$688.62 million.

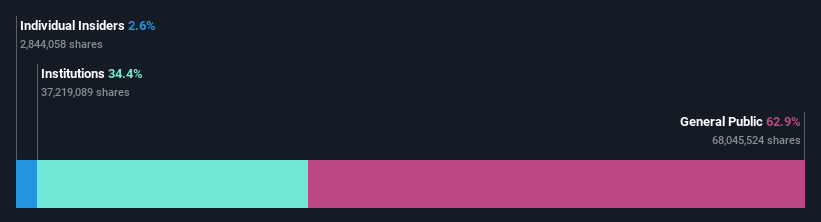

Insider Ownership: 11%

Earnings Growth Forecast: 31.2% p.a.

Fiera Capital's earnings are forecast to grow significantly at 31.2% annually, outpacing the Canadian market's 16.4%. However, revenue growth is slower than the market average, and profit margins have declined from last year. Despite trading below fair value, dividends remain unsustainable due to insufficient earnings coverage. Recent financials show a slight revenue increase but a notable drop in net income and EPS compared to the previous year, while insider trading activity remains minimal.

- Navigate through the intricacies of Fiera Capital with our comprehensive analyst estimates report here.

- The analysis detailed in our Fiera Capital valuation report hints at an inflated share price compared to its estimated value.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd., along with its subsidiaries, focuses on the mining, development, and exploration of minerals and precious metals in Africa, with a market cap of CA$16.08 billion.

Operations: The company's revenue primarily comes from its Kipushi Properties, generating $40.82 million.

Insider Ownership: 12.5%

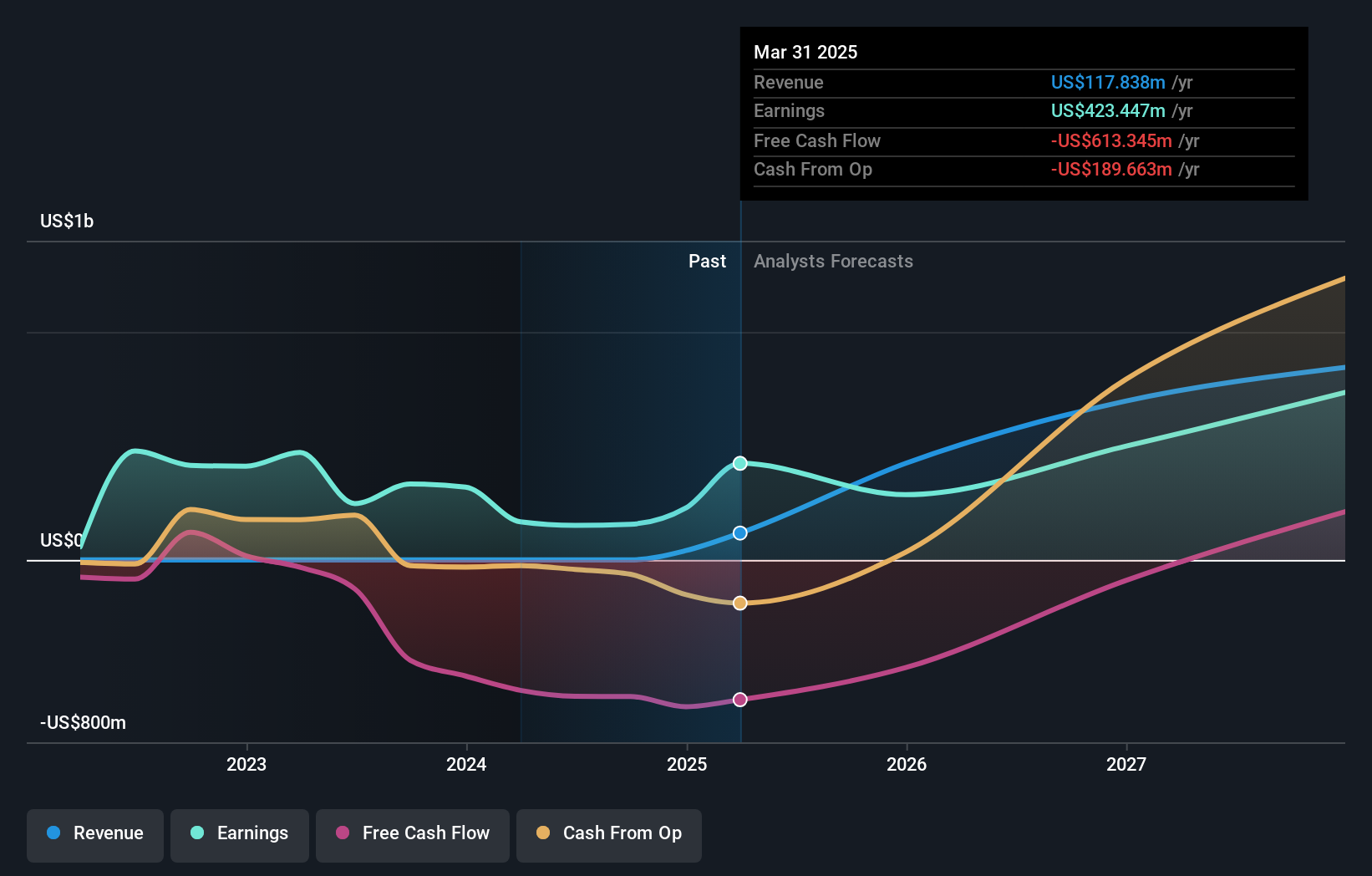

Earnings Growth Forecast: 43.1% p.a.

Ivanhoe Mines demonstrates strong growth potential with expected annual earnings and revenue growth rates significantly exceeding Canadian market averages. Recent production results from Kamoa-Kakula and Kipushi mines show near-record outputs, supporting robust operational performance. The company maintains high insider ownership, aligning management interests with shareholders. However, despite trading below estimated fair value, Ivanhoe's return on equity is forecasted to be modest. Strategic expansions at Platreef and Western Forelands projects further enhance its long-term growth prospects in the mining sector.

- Get an in-depth perspective on Ivanhoe Mines' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Ivanhoe Mines' share price might be on the expensive side.

Kits Eyecare (TSX:KITS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kits Eyecare Ltd. operates a digital eyecare platform in the United States and Canada, with a market cap of CA$357.88 million.

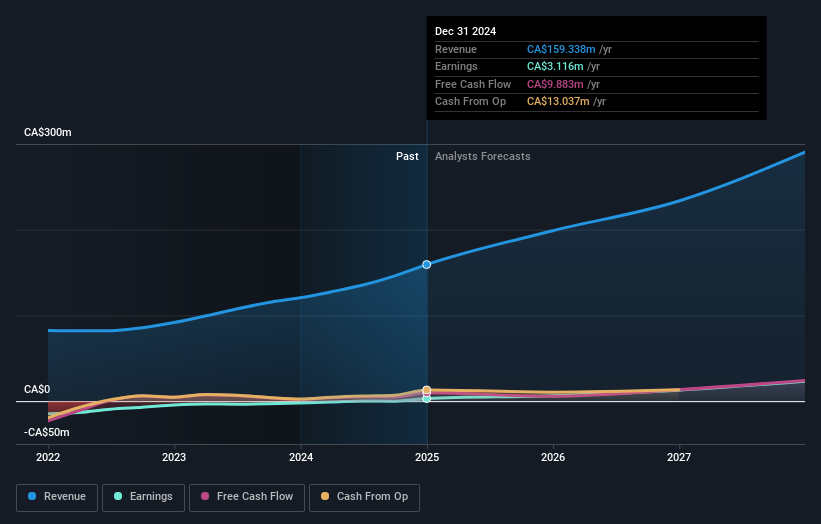

Operations: The company's revenue primarily comes from the sale of eyewear products, amounting to CA$159.34 million.

Insider Ownership: 22.3%

Earnings Growth Forecast: 49.5% p.a.

Kits Eyecare shows promising growth potential with insider buying activity and no substantial selling, indicating confidence in its future. Its revenue is forecasted to grow faster than the Canadian market, supported by strategic partnerships like the recent Medavie Blue Cross collaboration. The company has turned profitable, reporting CAD 3.12 million net income for 2024, and trades significantly below fair value estimates. While return on equity is expected to remain low, earnings are projected to grow significantly above market averages.

- Dive into the specifics of Kits Eyecare here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Kits Eyecare is trading behind its estimated value.

Make It Happen

- Navigate through the entire inventory of 38 Fast Growing TSX Companies With High Insider Ownership here.

- Ready For A Different Approach? We've found 27 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FSZ

Slight risk second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion