- Canada

- /

- Metals and Mining

- /

- TSX:IMG

IAMGOLD (TSE:IMG) shareholders are up 9.1% this past week, but still in the red over the last five years

While it may not be enough for some shareholders, we think it is good to see the IAMGOLD Corporation (TSE:IMG) share price up 22% in a single quarter. But don't envy holders -- looking back over 5 years the returns have been really bad. In that time the share price has delivered a rude shock to holders, who find themselves down 52% after a long stretch. So we're hesitant to put much weight behind the short term increase. But it could be that the fall was overdone.

While the stock has risen 9.1% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for IAMGOLD

Given that IAMGOLD didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, IAMGOLD saw its revenue increase by 1.5% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 9% for the last five years. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in IAMGOLD. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

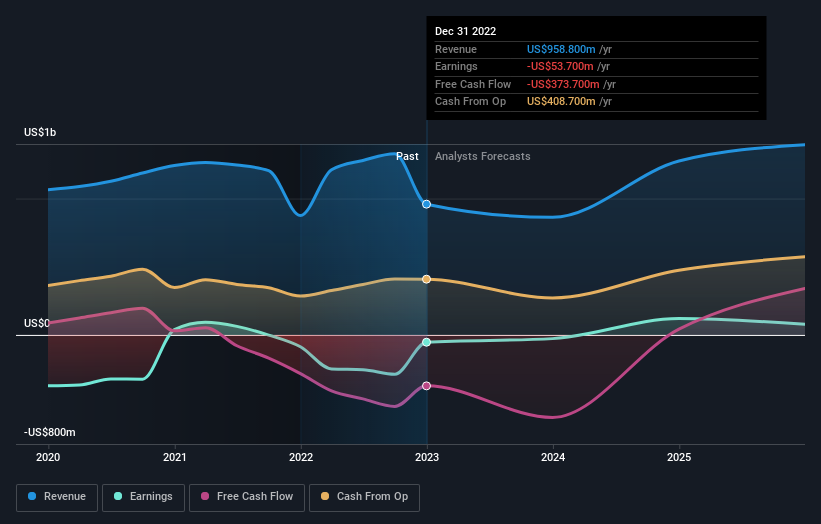

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that IAMGOLD shareholders are down 22% for the year. Unfortunately, that's worse than the broader market decline of 8.4%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that IAMGOLD is showing 1 warning sign in our investment analysis , you should know about...

But note: IAMGOLD may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IMG

IAMGOLD

Through its subsidiaries, operates as a gold producer and developer in Canada and Burkina Faso.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives