- Canada

- /

- Metals and Mining

- /

- TSX:IMG

IAMGOLD Corporation (TSE:IMG) Stock Rockets 31% But Many Are Still Ignoring The Company

IAMGOLD Corporation (TSE:IMG) shareholders have had their patience rewarded with a 31% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 29%.

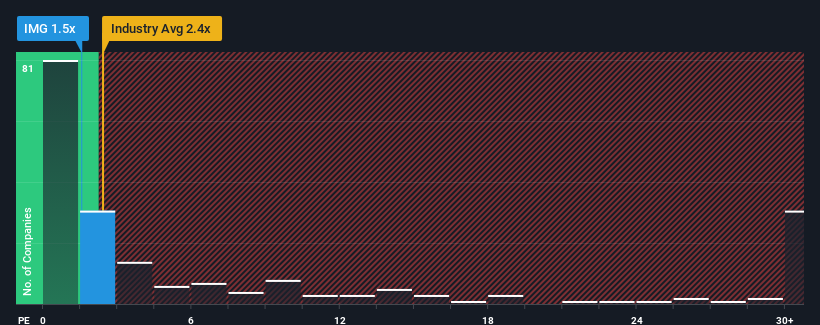

In spite of the firm bounce in price, IAMGOLD may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.5x, considering almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 2.4x and even P/S higher than 14x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for IAMGOLD

What Does IAMGOLD's Recent Performance Look Like?

Recent times haven't been great for IAMGOLD as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think IAMGOLD's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For IAMGOLD?

The only time you'd be truly comfortable seeing a P/S as low as IAMGOLD's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 3.0% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 21% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 23% per annum during the coming three years according to the four analysts following the company. That's shaping up to be materially higher than the 8.1% per annum growth forecast for the broader industry.

With this information, we find it odd that IAMGOLD is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift IAMGOLD's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems IAMGOLD currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 2 warning signs for IAMGOLD (1 is a bit concerning!) that you need to take into consideration.

If you're unsure about the strength of IAMGOLD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IMG

IAMGOLD

Through its subsidiaries, operates as a gold producer and developer in Canada and Burkina Faso.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives