- Canada

- /

- Paper and Forestry Products

- /

- TSX:IFP

Exploring Three Undervalued Small Caps With Insider Actions In June 2024 In Canada

As of June 2024, the Canadian market is showing signs of adapting to economic shifts, with the Bank of Canada's recent decision to cut interest rates reflecting a moderated inflation rate and a tempered growth outlook. This evolving economic landscape could present opportunities for investors interested in undervalued small-cap stocks, particularly those where insider actions suggest unrecognized potential.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 8.0x | 2.8x | 47.52% | ★★★★★★ |

| Nexus Industrial REIT | 2.3x | 2.8x | 20.37% | ★★★★★★ |

| Canaccord Genuity Group | NA | 0.5x | 39.89% | ★★★★★★ |

| Guardian Capital Group | 9.9x | 3.8x | 35.24% | ★★★★★☆ |

| Calfrac Well Services | 2.2x | 0.2x | 5.58% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 11.5x | 3.0x | 35.06% | ★★★★★☆ |

| Sagicor Financial | 1.2x | 0.4x | -95.16% | ★★★★☆☆ |

| Gear Energy | 19.0x | 1.3x | 32.10% | ★★★☆☆☆ |

| Freehold Royalties | 15.2x | 6.5x | 48.09% | ★★★☆☆☆ |

| AutoCanada | 11.4x | 0.1x | -120.02% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

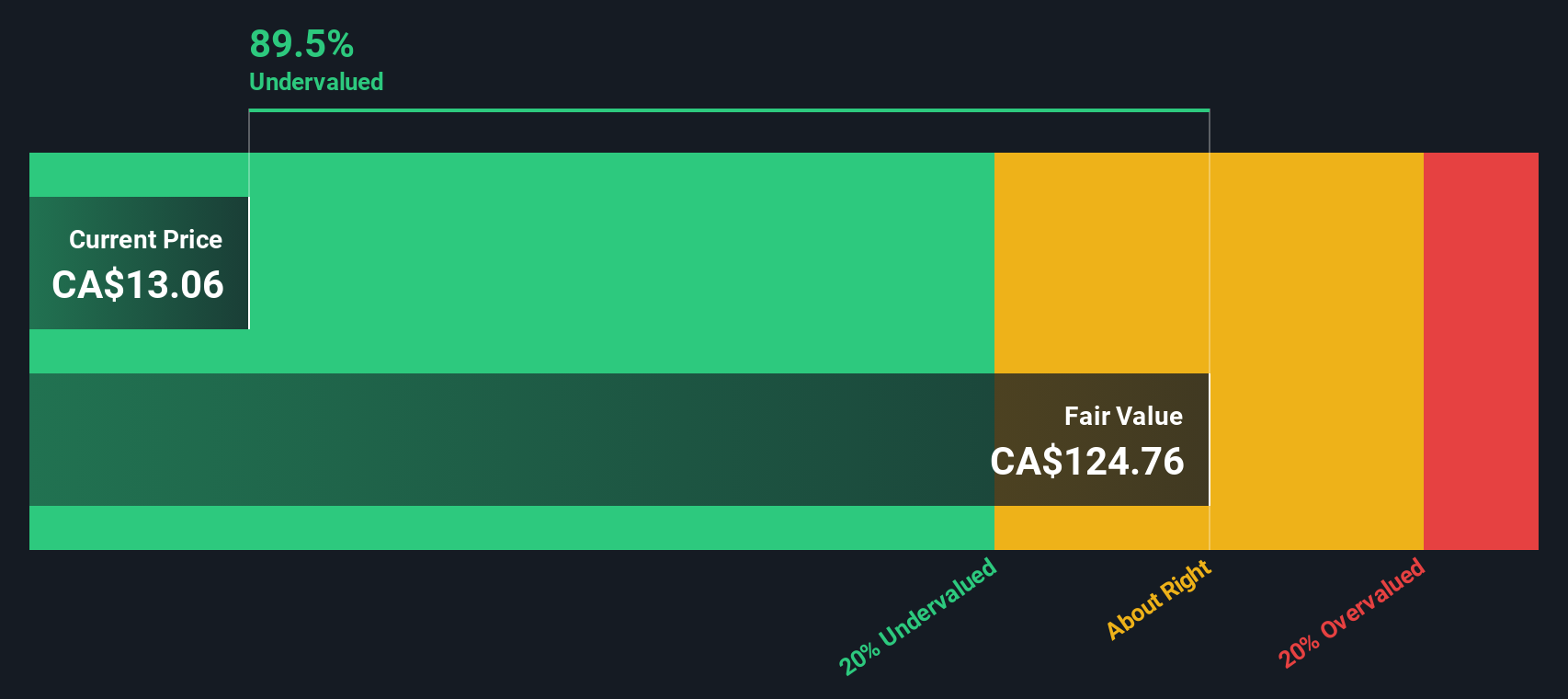

Interfor (TSX:IFP)

Simply Wall St Value Rating: ★★★★★★

Overview: Interfor is a lumber company specializing in solid wood products with a market capitalization of approximately CA$1.27 billion.

Operations: Solid Wood generated CA$3.30 billion in revenue, with a notable shift in gross profit margin from 0.036% to 0.159% over recent periods, reflecting significant fluctuations in operational efficiency and market conditions.

PE: -3.1x

Despite a challenging quarter where Interfor reported a net loss and a slight drop in sales, the company showcased resilience by increasing lumber production year-over-year. This growth in output, alongside recent insider confidence demonstrated through share purchases, suggests a robust belief in the firm's potential. With no customer deposits and liabilities fully covered by external borrowings, financial agility remains evident. Looking ahead, this blend of insider activity and operational adjustments positions Interfor intriguingly for those eyeing underpriced opportunities within Canada’s smaller companies landscape.

- Click here to discover the nuances of Interfor with our detailed analytical valuation report.

-

Evaluate Interfor's historical performance by accessing our past performance report.

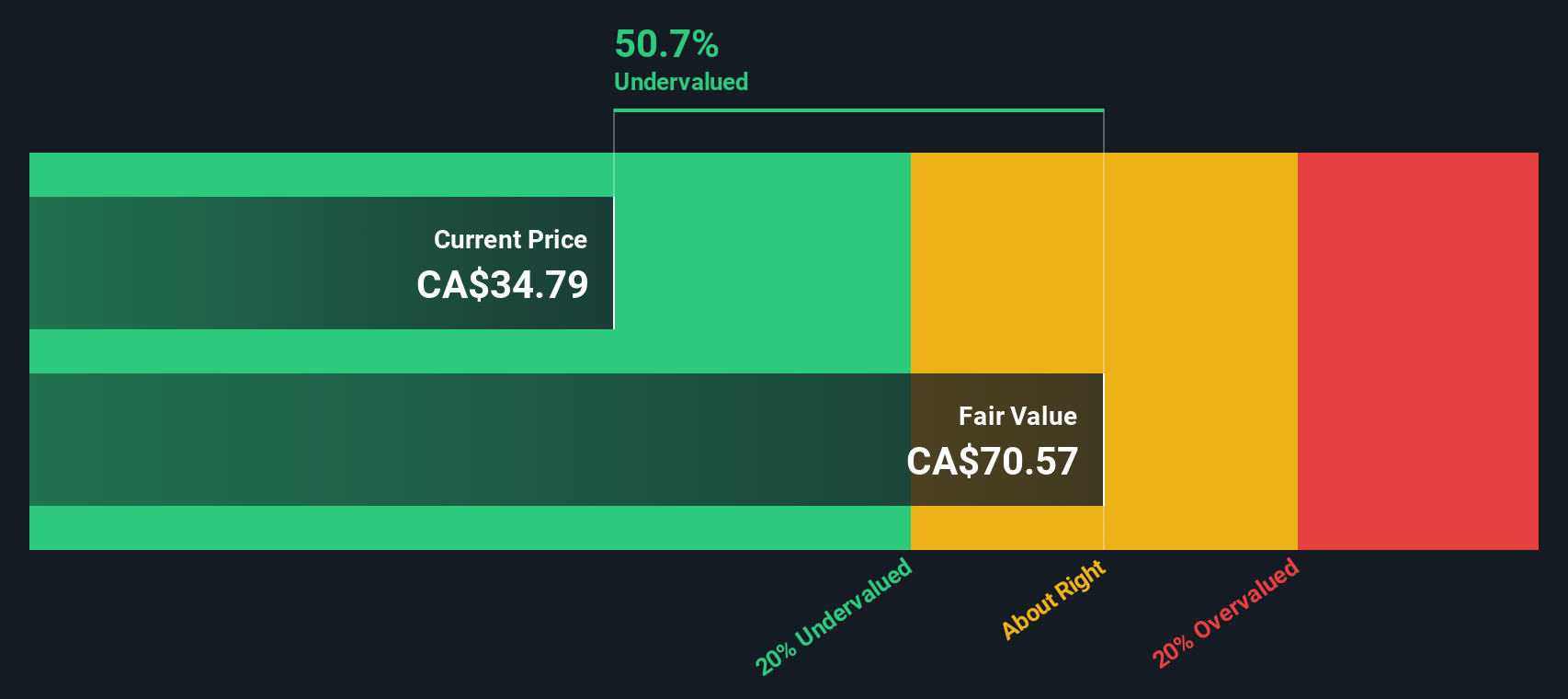

Jamieson Wellness (TSX:JWEL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Jamieson Wellness is a company specializing in the manufacture and distribution of natural health products, with a market capitalization of approximately CA$1.08 billion.

Operations: Jamieson Brands and Strategic Partners generated revenues of CA$558.41 million and CA$109.08 million respectively, with a notable gross profit margin increase to 35.40% by the end of the reporting period from an earlier 26.73%. This reflects a rising efficiency in managing production costs relative to sales over time.

PE: 31.6x

Despite a challenging quarter where Jamieson Wellness reported a net loss and decreased sales, insider confidence remains high with recent share purchases signaling strong belief in the company's resilience. Maintaining its revenue outlook for 2024, the company projects significant growth, expecting revenues between CA$720 million to CA$760 million. This projection alongside consistent dividend payments underscores its potential rebound and appeal as an attractively priced entity in the market.

- Unlock comprehensive insights into our analysis of Jamieson Wellness stock in this valuation report.

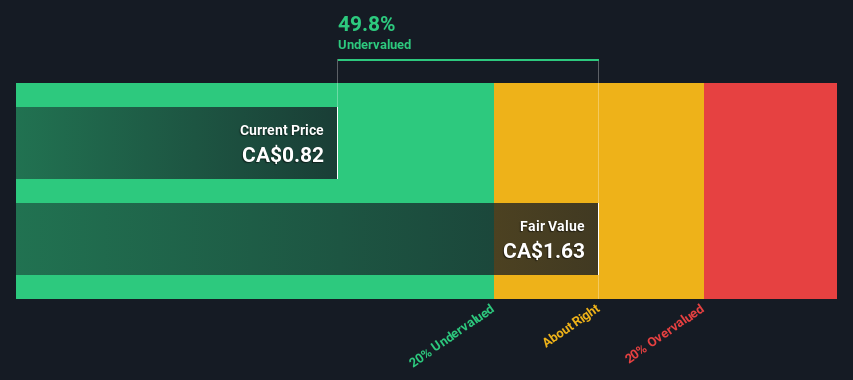

Queen's Road Capital Investment (TSX:QRC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Queen's Road Capital Investment primarily focuses on the selection, acquisition, and management of investments.

Operations: The company generates revenue through the selection, acquisition, and management of investments, achieving a gross profit margin consistently at 100% across various reporting periods. Notably, from the last available data point in 2024, it reported a net income of $69.34 million on revenues of $73.40 million, reflecting an efficient operational structure with operating expenses at $3.39 million and a high net income margin of approximately 94.46%.

PE: 4.0x

Queen's Road Capital Investment recently showcased a significant turnaround, with its second-quarter revenue jumping to US$18.42 million from a negative figure last year, alongside a net income of US$16.82 million. This performance marks an impressive recovery, reflecting strong earnings quality driven by substantial non-cash components. Additionally, insiders demonstrated confidence in the company's trajectory through recent share purchases, further underscoring its potential despite relying solely on higher-risk external borrowing for funding.

Taking Advantage

- Dive into all 31 of the Undervalued TSX Small Caps With Insider Buying we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IFP

Interfor

Produces and sells wood products in Canada, the United States, Japan, China, Taiwan, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives