While shareholders of NanoXplore (TSE:GRA) are in the black over 3 years, those who bought a week ago aren't so fortunate

Some NanoXplore Inc. (TSE:GRA) shareholders are probably rather concerned to see the share price fall 34% over the last three months. But in three years the returns have been great. In three years the stock price has launched 284% higher: a great result. It's not uncommon to see a share price retrace a bit, after a big gain. If the business can perform well for years to come, then the recent drop could be an opportunity.

Although NanoXplore has shed CA$76m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for NanoXplore

Because NanoXplore made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

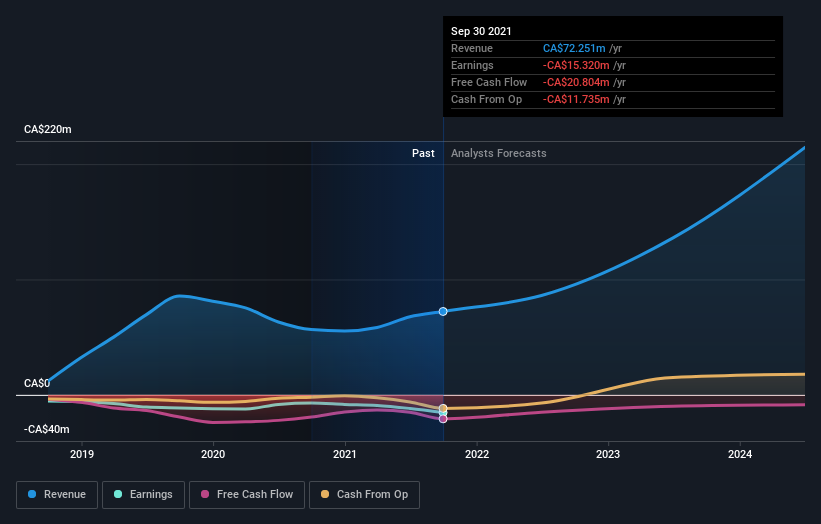

NanoXplore's revenue trended up 17% each year over three years. That's pretty nice growth. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 57% per year over three years. It's hard to value pre-profit businesses, but it seems like the market has become a lot more optimistic about this one! Some investors like to buy in just after a company becomes profitable, since that can be a powerful inflexion point.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think NanoXplore will earn in the future (free profit forecasts).

A Different Perspective

NanoXplore shareholders have gained 18% over twelve months. This isn't far from the market return of 19%. Notably, the longer term shareholders are better off with their TSR of 57% per year over the last three years. In the best case scenario the share price is simply plateauing while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for NanoXplore (of which 1 makes us a bit uncomfortable!) you should know about.

NanoXplore is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NanoXplore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GRA

NanoXplore

A graphene company, manufactures and supplies graphene powder for use in transportation and industrial markets in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)