- Canada

- /

- Metals and Mining

- /

- TSXV:ALDE

TSX Penny Stocks Spotlight GoldMining And 2 Others

Reviewed by Simply Wall St

As the U.S. government shutdown brings uncertainty to economic data releases, the Canadian market remains a focal point for investors seeking stability and growth opportunities. Penny stocks, often seen as remnants of past market trends, continue to offer potential value by providing access to smaller or newer companies that could benefit from current economic conditions. In this article, we will spotlight GoldMining and two other penny stocks that stand out for their financial strength and potential for long-term growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.74 | CA$70.03M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.41 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.36 | CA$54.07M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.40 | CA$911.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$22.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$3.00 | CA$453.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.40 | CA$170.54M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.21 | CA$206M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 415 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoldMining Inc. is a mineral exploration company focused on acquiring, exploring, and developing gold and copper assets in the Americas, with a market cap of CA$392.13 million.

Operations: GoldMining Inc. has not reported any specific revenue segments.

Market Cap: CA$392.13M

GoldMining Inc., with a market cap of CA$392.13 million, is pre-revenue and debt-free, offering a potential opportunity in the penny stock segment. The company has recently reported significant antimony mineralization at its Crucero Project in Peru, alongside existing gold resources, which could enhance its economic profile given antimony's strategic importance. Additionally, developments in infrastructure projects like the West Susitna Access Project may benefit its Whistler Gold-Copper Project through improved accessibility and economic potential. Despite these prospects, GoldMining remains unprofitable with net losses reported for recent periods.

- Take a closer look at GoldMining's potential here in our financial health report.

- Evaluate GoldMining's prospects by accessing our earnings growth report.

Aldebaran Resources (TSXV:ALDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aldebaran Resources Inc. is involved in acquiring, exploring, and evaluating mineral properties in Canada and Argentina, with a market cap of CA$436.68 million.

Operations: Aldebaran Resources Inc. does not report any specific revenue segments.

Market Cap: CA$436.68M

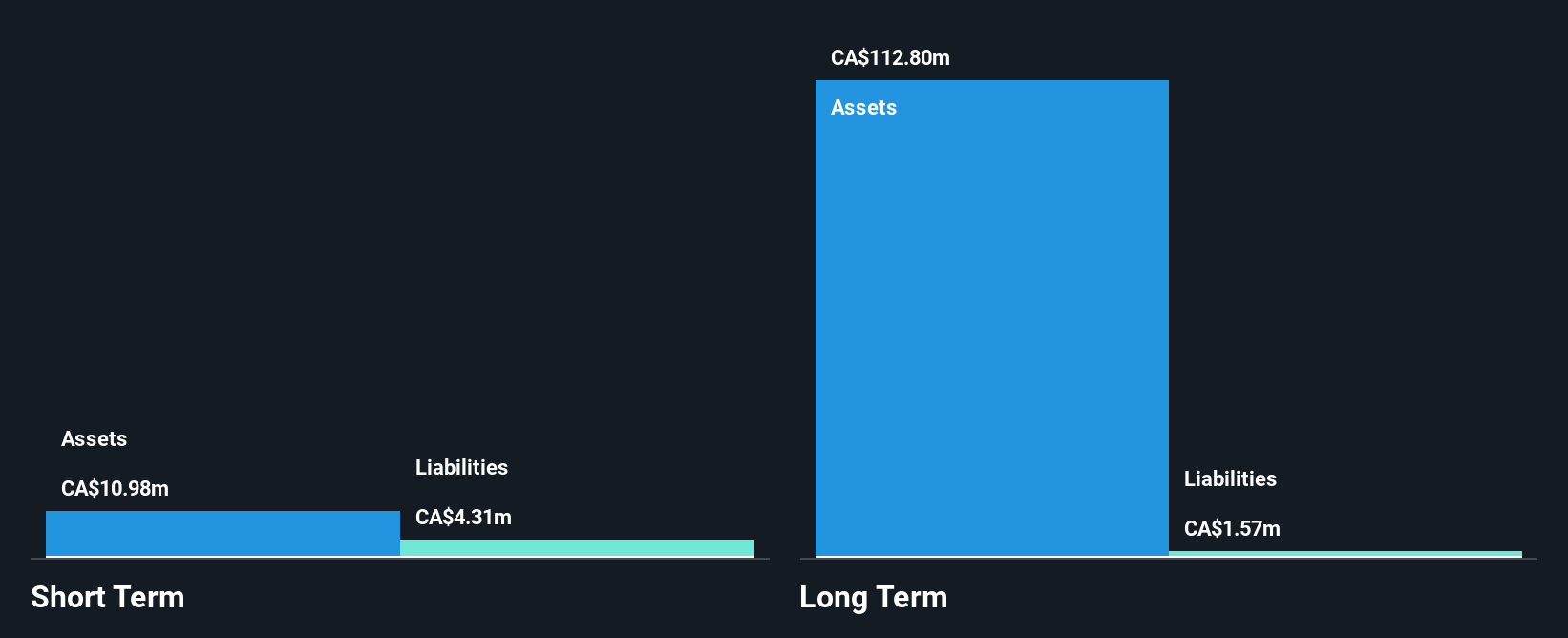

Aldebaran Resources Inc., with a market cap of CA$436.68 million, is pre-revenue and focuses on copper-gold exploration, particularly at the Altar project in Argentina. Recent drilling results from Altar show promising copper equivalent grades, potentially enhancing resource estimates. The company plans to spin off its Argentine projects into a new subsidiary, appointing experienced executive Sam Leung as CEO. Despite being unprofitable, Aldebaran has reduced its losses over five years and maintains financial stability with short-term assets exceeding liabilities and no debt burden. However, it faces challenges with less than one year of cash runway based on current free cash flow levels.

- Navigate through the intricacies of Aldebaran Resources with our comprehensive balance sheet health report here.

- Learn about Aldebaran Resources' future growth trajectory here.

Neptune Digital Assets (TSXV:NDA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Neptune Digital Assets Corp. builds, owns, and operates infrastructure supporting the digital currency ecosystem in Canada, with a market cap of CA$148.14 million.

Operations: The company's revenue is primarily generated from data processing, amounting to CA$1.84 million.

Market Cap: CA$148.14M

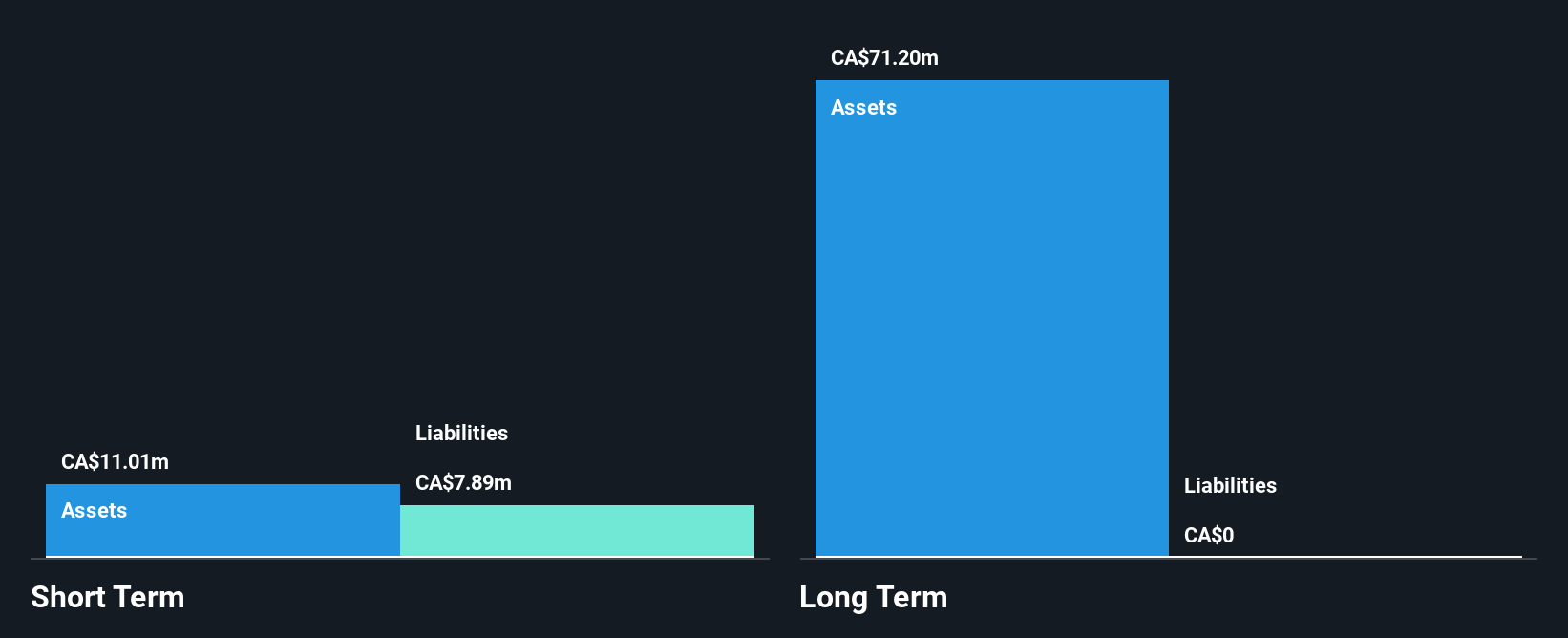

Neptune Digital Assets Corp., with a market cap of CA$148.14 million, is navigating the volatile penny stock landscape by focusing on digital currency infrastructure. Despite being unprofitable and having a negative return on equity, it benefits from experienced management and no long-term liabilities. The company's recent earnings report shows declining revenue to CA$1.39 million for the nine months ended May 31, 2025, alongside a net loss increase compared to the previous year. However, Neptune's financial position remains relatively stable with more cash than debt and sufficient short-term assets to cover liabilities while maintaining an adequate cash runway for over three years.

- Get an in-depth perspective on Neptune Digital Assets' performance by reading our balance sheet health report here.

- Explore Neptune Digital Assets' analyst forecasts in our growth report.

Next Steps

- Unlock our comprehensive list of 415 TSX Penny Stocks by clicking here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ALDE

Aldebaran Resources

Engages in the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.