- Canada

- /

- Metals and Mining

- /

- TSX:GMIN

How Should Investors Value G Mining Ventures After Its 177% Surge in 2025?

Reviewed by Bailey Pemberton

Trying to decide what to do with G Mining Ventures stock? You’re not alone. With shares closing at 32.04 and recent gains that would thrill even the most bullish investor, there is a buzz around this name that is hard to ignore. In just the past week, the stock jumped 15.9%, and over the last month, it soared an impressive 45.0%. Year-to-date, it’s up 177.2%, and the 1-year return stands at a staggering 248.3%. Zoom out to three and five years, and the numbers become almost surreal: up 1095.5% and 1700.0%, respectively.

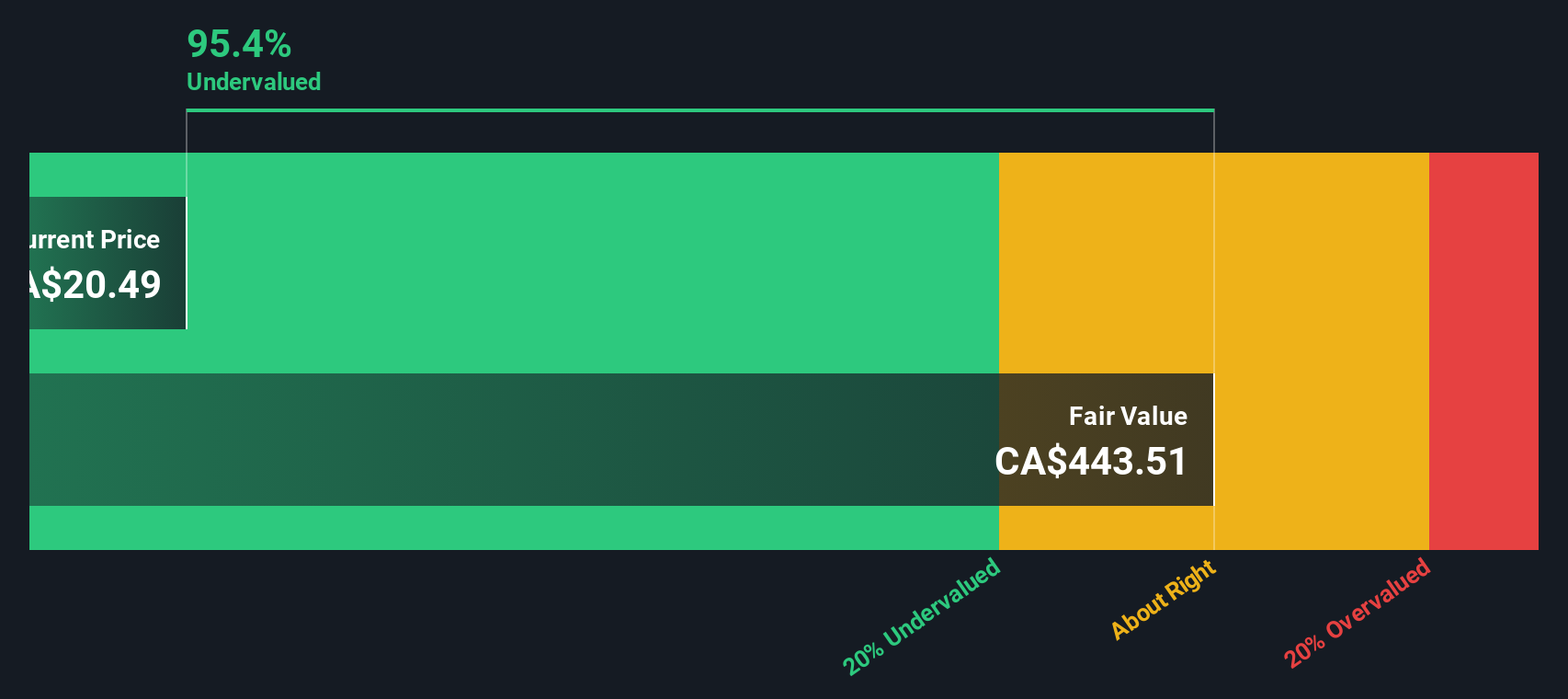

These eye-catching returns are not just about momentum. The company’s performance is being carefully watched in the context of ongoing developments in the mining sector, and investors are reassessing what “fair value” really means here. The current valuation score is 2 out of 6, which tells us G Mining Ventures is undervalued by two key methods, but not across the board. This may be a sign that the market is waking up to new growth potential or that risk perception is shifting.

If you are wondering how that value score stacks up, and how to make sense of these jaw-dropping gains, the next step is to dig deeper into the different ways analysts and investors approach valuation. And stick around, because there is an even more insightful perspective on G Mining Ventures’ true worth coming up at the end of this article.

G Mining Ventures scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: G Mining Ventures Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model evaluates a company's true worth by projecting its future cash flows and discounting them back to today's value. This approach helps to estimate what G Mining Ventures could be worth based on expectations for its cash generation power over the coming years.

Currently, G Mining Ventures has a Free Cash Flow (FCF) of -$461.35 Million. Looking ahead, analysts forecast substantial improvements, with the company anticipated to turn positive and reach $731.31 Million by 2028. While detailed projections are available for the next five years, estimates beyond that point are extrapolated. By 2035, the company could be generating over $4.28 Billion in free cash flow.

The DCF model applied here uses a 2 Stage Free Cash Flow to Equity approach, which factors in both the near-term analyst outlook and longer-term trends. Based on these calculations, G Mining Ventures' intrinsic value is estimated at $428.43 per share. This represents a 92.5% discount compared to the current share price, indicating the stock is seen as deeply undervalued using this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests G Mining Ventures is undervalued by 92.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: G Mining Ventures Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used yardstick for valuing profitable companies, as it compares a company’s share price to its earnings. This makes it especially relevant when those earnings are positive and steady. PE ratios help investors judge if a stock might be expensive or cheap relative to its profits. What is “normal” varies based on expectations for growth and the perceived riskiness of the company’s operations. High-growth, lower-risk companies typically command higher multiples, while more mature or riskier firms trade at lower PEs.

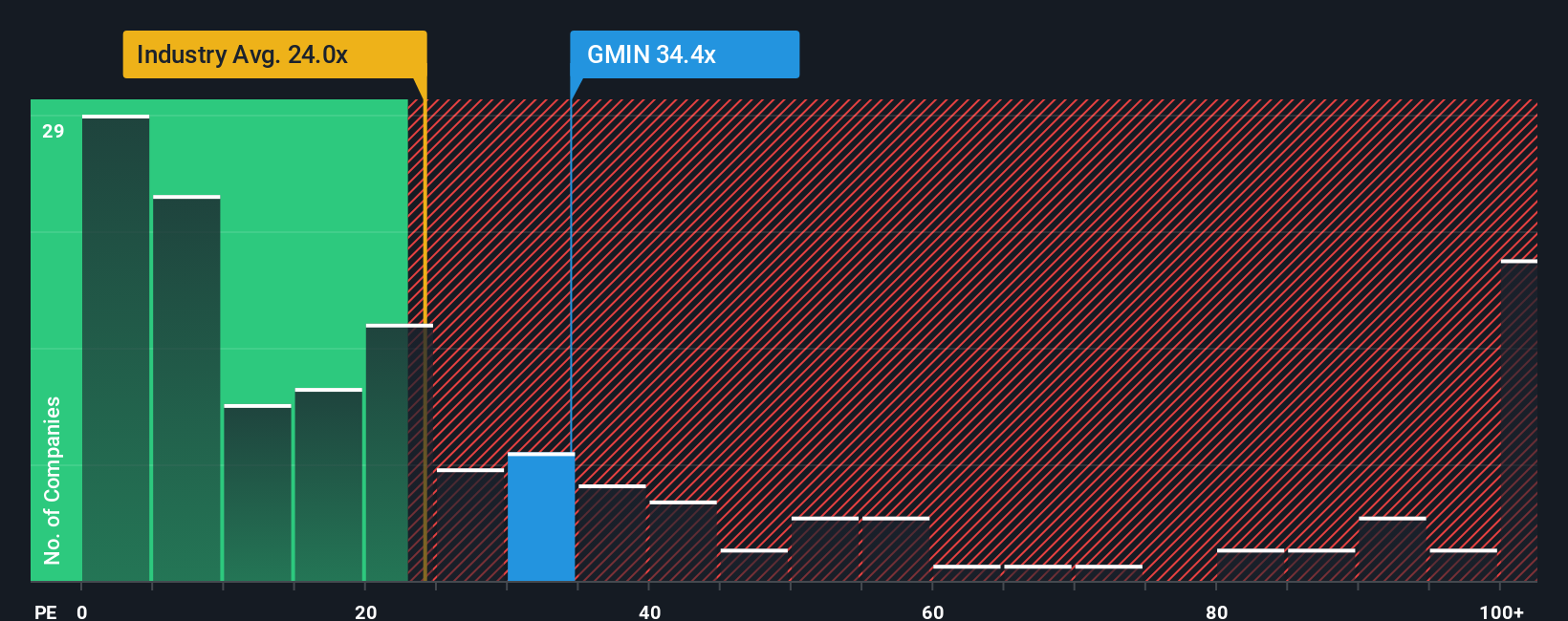

Currently, G Mining Ventures is trading at a PE ratio of 36.0x. For context, the average PE for companies in the Metals and Mining industry sits at 23.5x, and its closest peers average around 25.7x. At first glance, this puts G Mining Ventures at a notable premium compared to the sector and its direct competitors.

However, Simply Wall St’s proprietary "Fair Ratio" considers more nuanced factors, including the company’s earnings growth outlook, risk profile, profit margins, industry dynamics, and even its market cap. For G Mining Ventures, the Fair Ratio is estimated at 32.9x, which provides a more tailored benchmark than a simple comparison to the industry or peer averages. Because the current PE is only slightly above this Fair Ratio, the stock appears to be valued about right when accounting for its growth trajectory and unique factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your G Mining Ventures Narrative

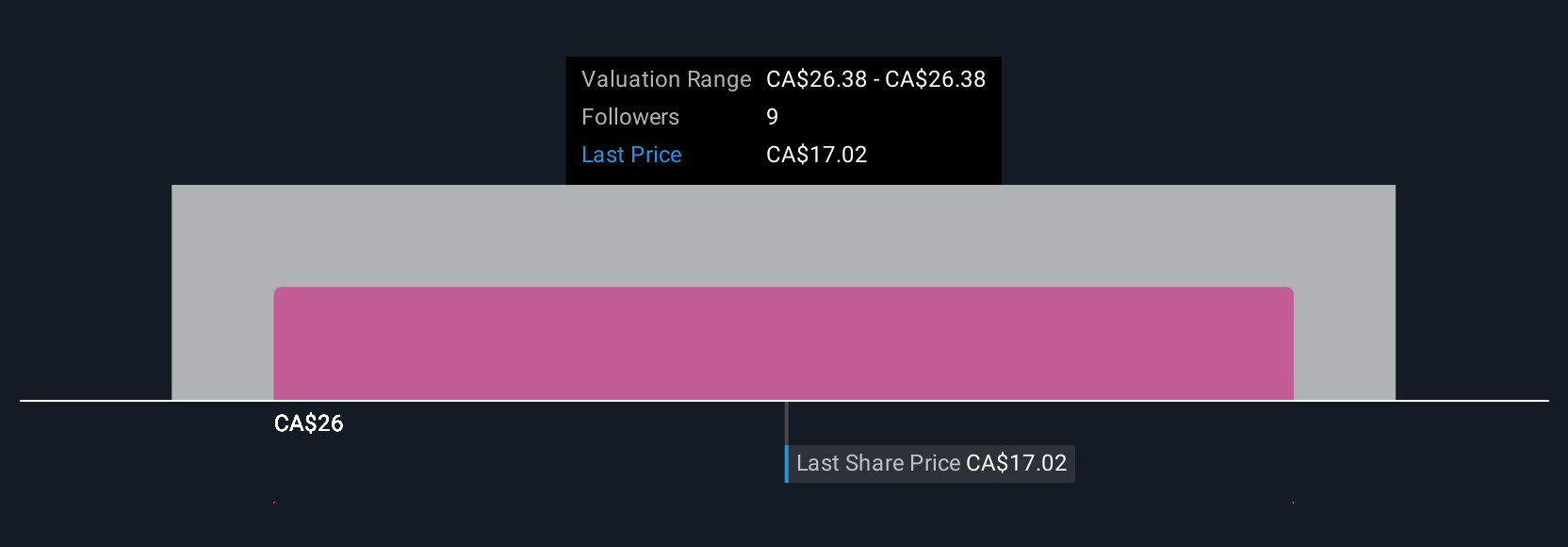

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. Put simply, a Narrative is your investment story: your way to link what you believe about G Mining Ventures' future with the numbers, like fair value, long-term revenues, or profit margins. Narratives bring together a company’s story, your assumptions about its future, and a financial forecast that leads to a fair value estimate.

This approach makes investing personal, approachable, and powerful. On Simply Wall St's Community page, millions of investors create, share, and update Narratives that are instantly recalculated whenever fresh news or results emerge. This ensures you always have the latest perspective. With Narratives, you can see how your Fair Value compares to today’s share price, making it clear whether it might be time to buy or sell.

For example, among G Mining Ventures Narratives, some investors see explosive upside and assign the highest fair values, while others take a more cautious view and set the lowest targets. With Narratives, you can explore these different viewpoints and quickly build your conviction.

Do you think there's more to the story for G Mining Ventures? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GMIN

G Mining Ventures

A mining company, engages in the acquisition, exploration, and development of precious metal projects.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives