- Canada

- /

- Metals and Mining

- /

- CNSX:AUCU

3 TSX Penny Stocks With Market Caps Over CA$20M

Reviewed by Simply Wall St

As we move through the early months of the year, Canadian markets are navigating a complex landscape marked by persistent inflation and solid corporate earnings. Amid these crosscurrents, investors are increasingly looking for opportunities that balance potential growth with financial stability. While penny stocks might seem like a term from another era, they continue to offer intriguing possibilities, particularly when these smaller or newer companies demonstrate strong fundamentals. In this article, we explore three such penny stocks on the TSX that could provide promising prospects for those seeking to uncover hidden value in today's market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.875 | CA$176.94M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.75 | CA$442.31M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$638.07M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.19 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.90 | CA$416.12M | ★★★★★☆ |

| New Gold (TSX:NGD) | CA$4.28 | CA$3.26B | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.03 | CA$196.4M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.15 | CA$222.42M | ★★★★☆☆ |

Click here to see the full list of 933 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Inflection Resources (CNSX:AUCU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Inflection Resources Ltd. is involved in the exploration and evaluation of mineral properties in New South Wales and Queensland, Australia, with a market cap of CA$24.27 million.

Operations: Inflection Resources Ltd. currently does not report any revenue segments.

Market Cap: CA$24.27M

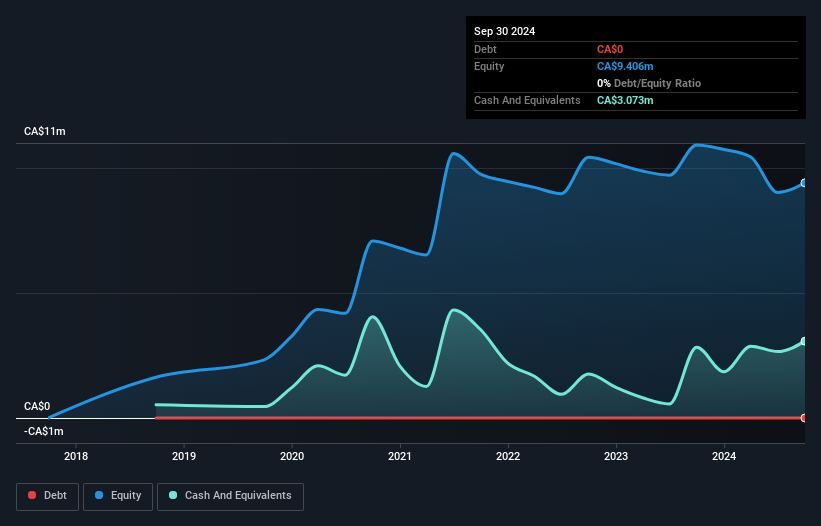

Inflection Resources Ltd., with a market cap of CA$24.27 million, is pre-revenue and currently unprofitable, reporting a net loss of CA$2.9 million for the year ended September 30, 2024. Despite having no debt and short-term assets covering liabilities, it faces auditor concerns about its ability to continue as a going concern due to less than one year of cash runway. Recent drilling updates from projects in New South Wales indicate promising mineralization potential in collaboration with AngloGold Ashanti but highlight the company's high share price volatility and financial instability challenges.

- Unlock comprehensive insights into our analysis of Inflection Resources stock in this financial health report.

- Learn about Inflection Resources' historical performance here.

GoGold Resources (TSX:GGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoGold Resources Inc. is involved in the exploration, development, and production of silver, gold, and copper mainly in Mexico with a market cap of CA$526.25 million.

Operations: The company generates revenue from its Metals & Mining segment, specifically focusing on gold and other precious metals, amounting to $48.80 million.

Market Cap: CA$526.25M

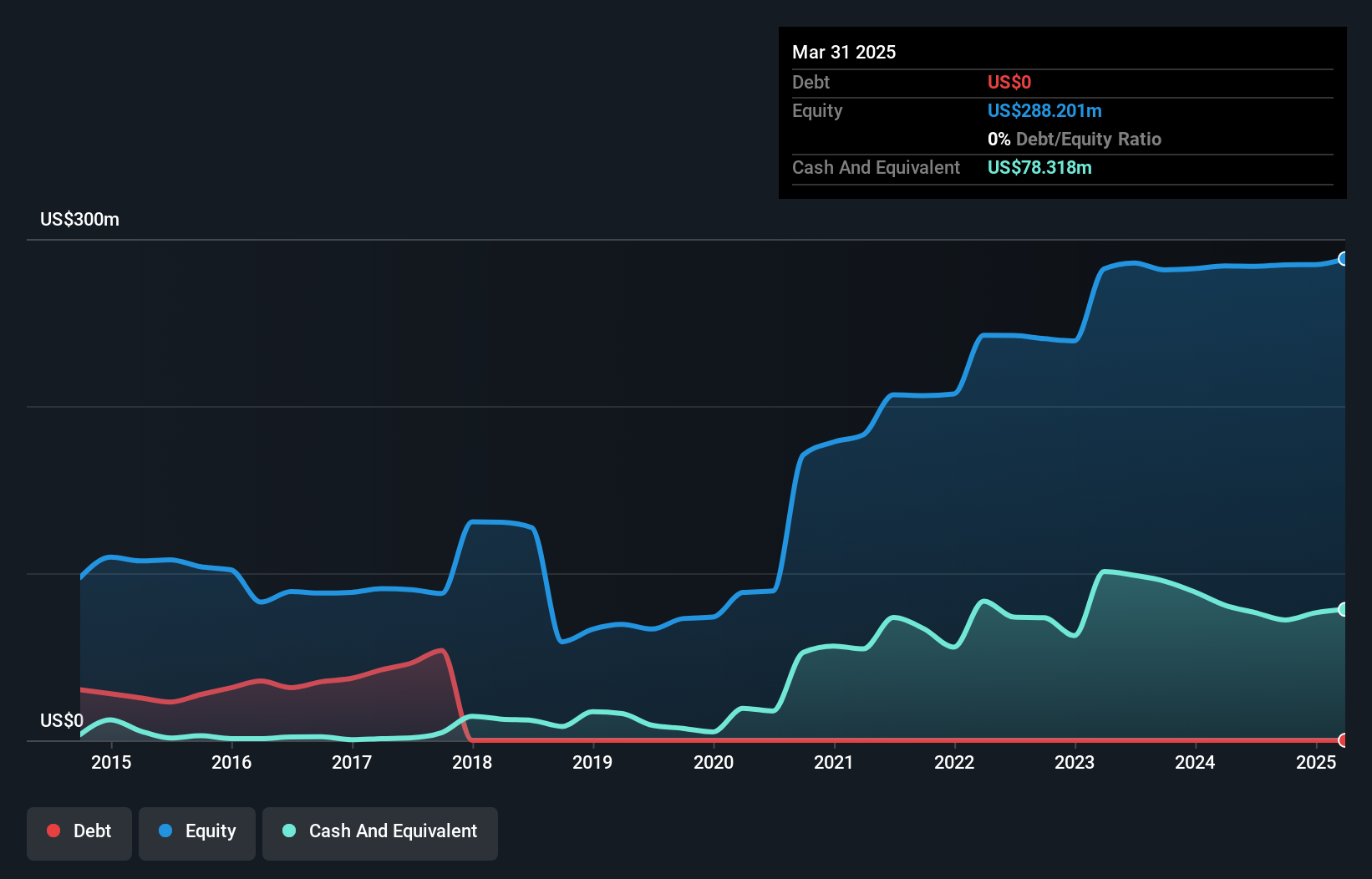

GoGold Resources, with a market cap of CA$526.25 million, has transitioned to profitability over the past year in the metals and mining sector. The company reported first-quarter sales of US$19.1 million, up from US$6.8 million a year ago, though it posted a slight net loss of US$0.136 million for the quarter due to large one-off items impacting financial results. With no debt and strong short-term assets exceeding liabilities, GoGold's recent feasibility study at its Los Ricos South Project suggests potential growth in underground mining operations, supported by experienced management and board appointments enhancing strategic direction.

- Click here to discover the nuances of GoGold Resources with our detailed analytical financial health report.

- Gain insights into GoGold Resources' outlook and expected performance with our report on the company's earnings estimates.

Orogen Royalties (TSXV:OGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orogen Royalties Inc. is a mineral exploration company active in Canada, the United States, Mexico, Argentina, and Kenya with a market cap of CA$308.52 million.

Operations: The company generates revenue primarily from its mineral exploration activities, amounting to CA$7.33 million.

Market Cap: CA$308.52M

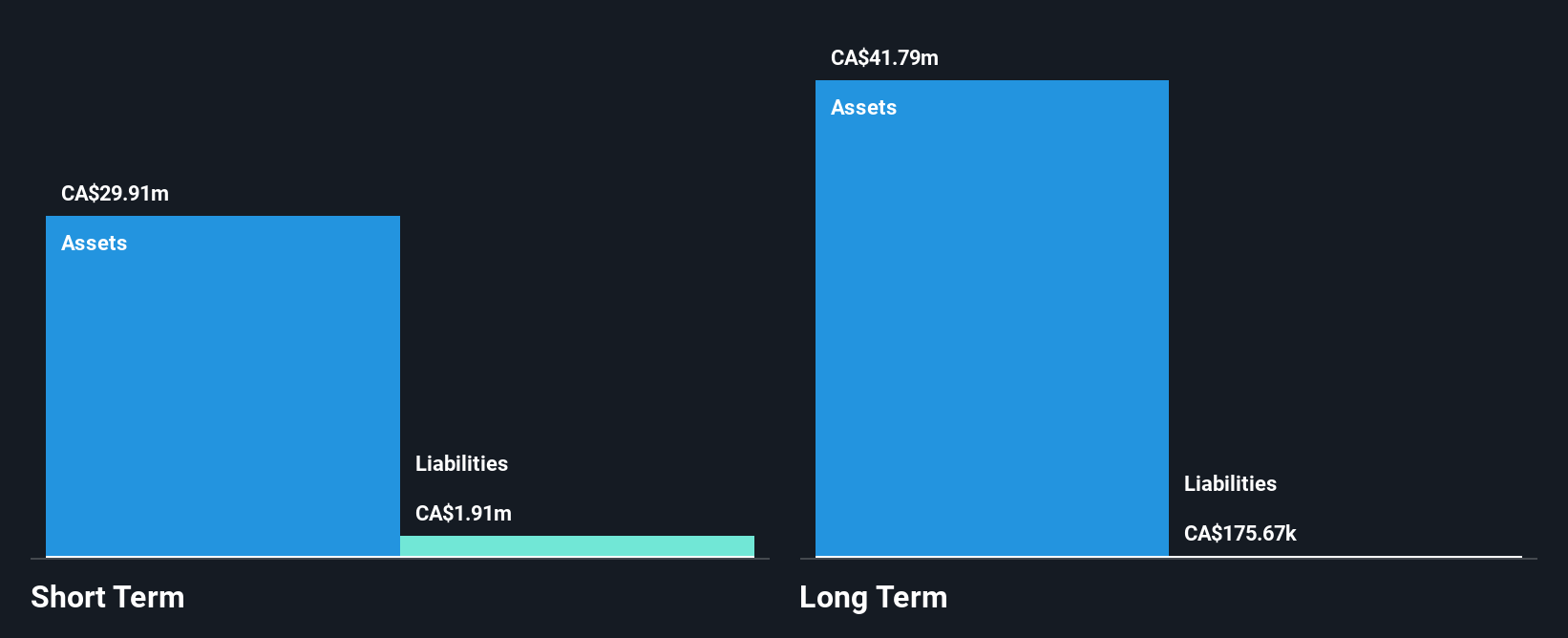

Orogen Royalties, with a market cap of CA$308.52 million, has experienced financial fluctuations recently, reporting a net loss of CA$0.36 million for Q3 2024 compared to a profit the previous year. Despite this, the company benefits from its debt-free status and strong short-term assets exceeding liabilities. Recent developments include significant expansion at its Navidad gold-silver target in Mexico, where Orogen holds a cash-flowing 2% NSR royalty. The company's management and board are seasoned with average tenures over three years, though profitability challenges persist amid large one-off losses impacting earnings stability.

- Take a closer look at Orogen Royalties' potential here in our financial health report.

- Explore Orogen Royalties' analyst forecasts in our growth report.

Key Takeaways

- Explore the 933 names from our TSX Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:AUCU

Inflection Resources

Engages in the exploration and evaluation of mineral properties in New South Wales and Queensland, Australia.

Moderate with adequate balance sheet.

Market Insights

Community Narratives