- Canada

- /

- Metals and Mining

- /

- TSX:ARG

3 TSX Penny Stocks With Market Caps Over CA$30M

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has remained flat, but it is up 22% over the past year with earnings forecast to grow by 16% annually. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. These smaller or newer companies can offer great value when built on solid financials, and we've identified three examples that combine balance sheet strength with potential for growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.64 | CA$173.17M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$286.83M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$116.04M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$584.01M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.38 | CA$325.16M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.75M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.10 | CA$207.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 966 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

NetraMark Holdings (CNSX:AIAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NetraMark Holdings Inc. develops artificial intelligence and machine learning solutions for the pharmaceutical industry in Canada, with a market cap of CA$38.12 million.

Operations: The company generates revenue from its healthcare software segment, totaling CA$0.35 million.

Market Cap: CA$38.12M

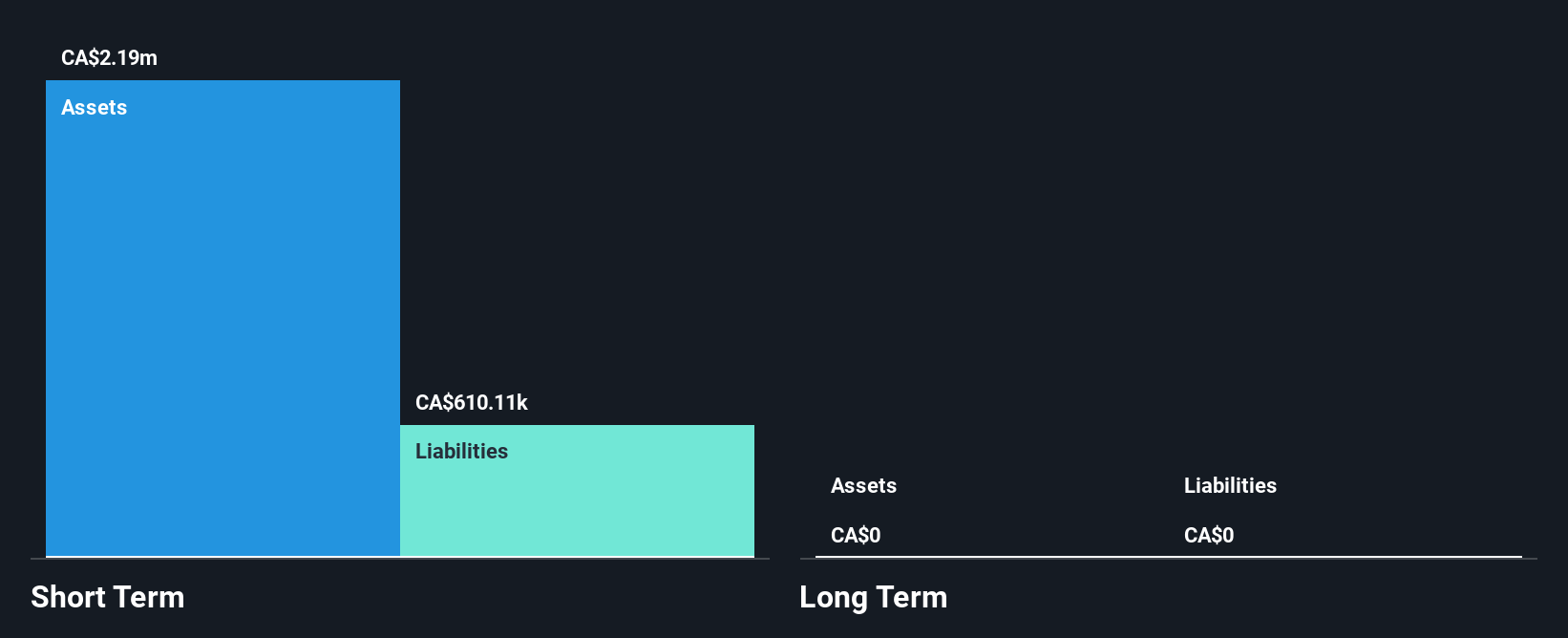

NetraMark Holdings, with a market cap of CA$38.12 million, is a pre-revenue company in the AI and machine learning space for pharmaceuticals, generating CA$0.35 million from its healthcare software segment. Recent board changes include the appointment of P.J. Haley, bringing significant commercial expertise from Exelixis Inc., which may enhance strategic growth initiatives. The company has expanded its product suite to improve clinical trial outcomes and market access strategies, though it remains unprofitable with increasing losses over five years and less than one year of cash runway despite no long-term liabilities or debt.

- Unlock comprehensive insights into our analysis of NetraMark Holdings stock in this financial health report.

- Examine NetraMark Holdings' past performance report to understand how it has performed in prior years.

Amerigo Resources (TSX:ARG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amerigo Resources Ltd., with a market cap of CA$286.83 million, operates through its subsidiary Minera Valle Central S.A. to produce and sell copper and molybdenum concentrates from Codelco’s El Teniente underground mine in Chile.

Operations: The company's revenue is primarily derived from the production of copper concentrates under a tolling agreement with DET, generating $184.41 million.

Market Cap: CA$286.83M

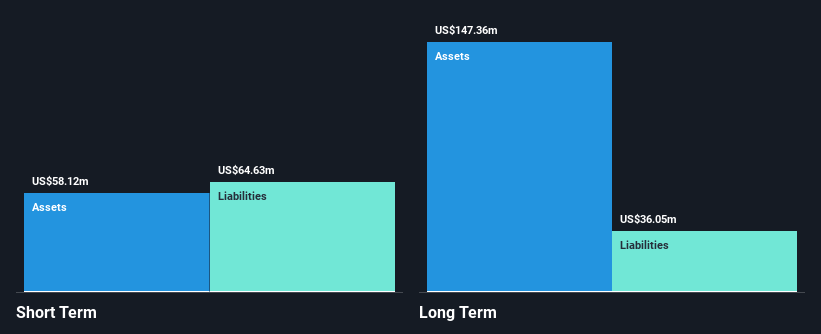

Amerigo Resources Ltd., with a market cap of CA$286.83 million, has shown significant financial improvement, reporting third-quarter sales of US$45.44 million and net income of US$2.78 million, reversing a net loss from the previous year. The company benefits from strong cash reserves exceeding its total debt and robust operating cash flow coverage at 320.1% of its debt level, indicating sound financial health despite short-term liabilities slightly surpassing short-term assets by US$4.8 million. With seasoned management and board teams, Amerigo is trading significantly below estimated fair value while maintaining stable weekly volatility over the past year.

- Click here to discover the nuances of Amerigo Resources with our detailed analytical financial health report.

- Assess Amerigo Resources' future earnings estimates with our detailed growth reports.

Geodrill (TSX:GEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Geodrill Limited, along with its subsidiaries, offers mineral exploration drilling services to mining companies in West Africa, Egypt, Chile, and Peru and has a market cap of CA$126.87 million.

Operations: The company generates revenue of $140.00 million from its business services segment.

Market Cap: CA$126.87M

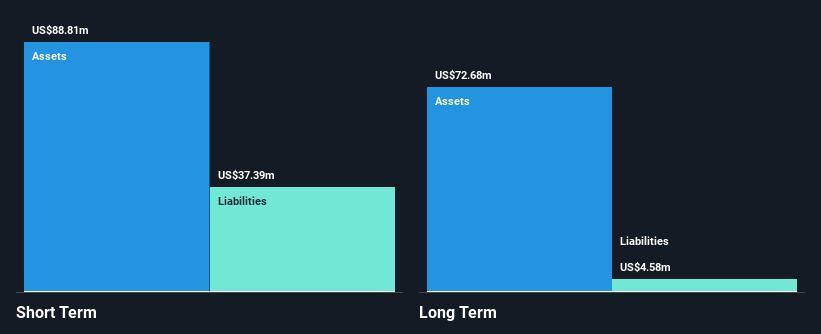

Geodrill Limited, with a market cap of CA$126.87 million, reported third-quarter sales of US$34.09 million and net income of US$2.68 million, marking a turnaround from the previous year's loss. The company benefits from strong financials with cash exceeding total debt and short-term assets significantly surpassing both short-term and long-term liabilities. Despite experiencing negative earnings growth over the past year, Geodrill maintains high-quality earnings and robust interest coverage at 15.4 times EBIT. Trading well below estimated fair value, it has seasoned management with an average tenure of 12.3 years, though return on equity remains low at 6.8%.

- Get an in-depth perspective on Geodrill's performance by reading our balance sheet health report here.

- Evaluate Geodrill's prospects by accessing our earnings growth report.

Taking Advantage

- Explore the 966 names from our TSX Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARG

Amerigo Resources

Through its subsidiary, Minera Valle Central S.A., engages in the production and sale of copper and molybdenum concentrates from Codelco’s El Teniente underground mine in Chile.

Excellent balance sheet, good value and pays a dividend.