- Canada

- /

- Metals and Mining

- /

- TSX:AG

Investors Still Aren't Entirely Convinced By First Majestic Silver Corp.'s (TSE:FR) Revenues Despite 27% Price Jump

Those holding First Majestic Silver Corp. (TSE:FR) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

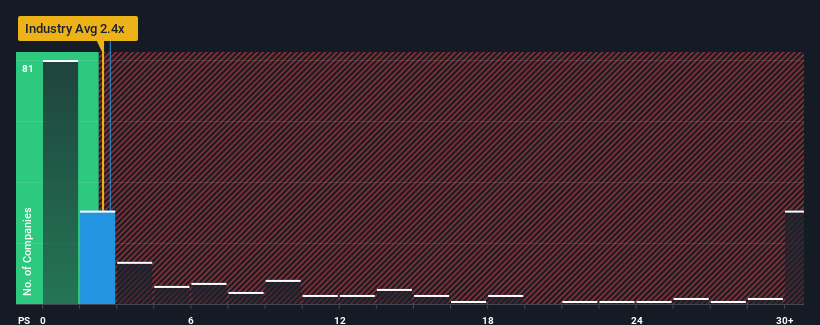

Even after such a large jump in price, it's still not a stretch to say that First Majestic Silver's price-to-sales (or "P/S") ratio of 2.7x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in Canada, where the median P/S ratio is around 2.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for First Majestic Silver

What Does First Majestic Silver's Recent Performance Look Like?

While the industry has experienced revenue growth lately, First Majestic Silver's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on First Majestic Silver.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like First Majestic Silver's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.1%. Still, the latest three year period has seen an excellent 58% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 13% per year during the coming three years according to the three analysts following the company. That's shaping up to be materially higher than the 8.1% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that First Majestic Silver's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does First Majestic Silver's P/S Mean For Investors?

Its shares have lifted substantially and now First Majestic Silver's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, First Majestic Silver's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you settle on your opinion, we've discovered 1 warning sign for First Majestic Silver that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives