- Canada

- /

- Metals and Mining

- /

- TSX:FOM

Foran Mining (TSX:FOM): Valuation Perspective as McIlvenna Bay Advances With Federal Backing and New Project Milestones

Reviewed by Kshitija Bhandaru

If you have been tracking Foran Mining (TSX:FOM), the recent flurry of project updates might have you considering whether the company’s big copper and zinc push is entering a new chapter. Just in the last week, Foran Mining confirmed its flagship McIlvenna Bay project is 56% complete, has surpassed the 100,000 tonne ore stockpile mark, and is staying on both budget and schedule for commercial production in mid-2026. The company has also received more federal funding, and the project’s referral to Canada’s Major Projects Office positions it as a possible Project of National Interest, signaling a fresh level of attention at both the strategic and governmental level.

These moves have not gone unnoticed by the market. Foran Mining stock has rebounded nearly 19% over the past month and added 4% in the past week, reversing some of the losses earlier this year. Despite these recent gains, shares are still down 17% over the last twelve months, and longer-term investors will remember the solid five-year return above 16%. Short-term interest appears to be climbing, but this follows a period of price weakness and cautious optimism over project execution and funding milestones.

Are investors finally recognizing untapped value, or is the latest rally fully accounting for the company’s progress, leaving little room for further upside from here?

Price-to-Book of 1.6x: Is it justified?

Foran Mining currently trades at a price-to-book (P/B) ratio of 1.6x. This figure places it below both the Canadian Metals and Mining industry average of 2.3x and its peer average of 42.9x. Based on this comparison, the market appears to assign a lower value to Foran’s assets than to comparable mining companies.

The price-to-book ratio is a common tool for valuing resource-sector companies, especially those that are still pre-profit or in the development stage. By comparing a company’s current market value to its book value, investors can gauge whether the stock price reflects a discount or premium to the firm’s underlying assets.

This suggests that the market may be underpricing Foran Mining’s potential, especially relative to its industry and peer group. While this low ratio might signal opportunity, it could also reflect investor caution given Foran’s current unprofitability and project execution risks.

Result: Fair Value of $3.35 (UNDERVALUED)

See our latest analysis for Foran Mining.However, ongoing unprofitability and uncertainties around project execution could still weigh on Foran Mining’s share price, even with encouraging recent progress.

Find out about the key risks to this Foran Mining narrative.Another View: What Does Our DCF Model Say?

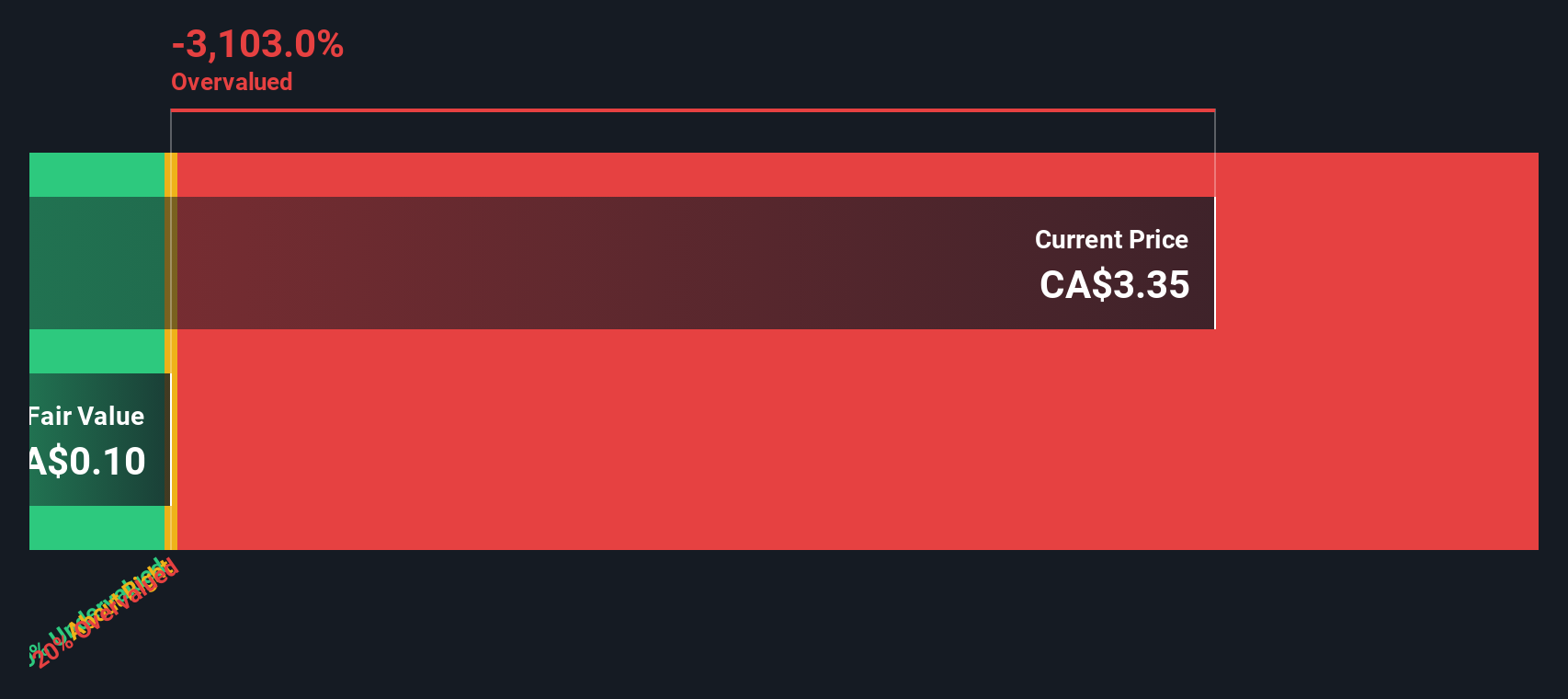

Taking a different angle, our DCF model suggests a far more conservative picture and indicates that Foran Mining could be overvalued based on future cash flow estimates. Does this challenge the optimism from the asset-based approach?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Foran Mining Narrative

If you see things differently or want to dig into the numbers and build your own perspective, you can generate your personalized analysis in just a few minutes. Do it your way.

A great starting point for your Foran Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Winning Ideas?

Smart investors know that the best opportunities rarely wait. Use the Simply Wall St screener to pinpoint stocks with great potential and avoid missing out on tomorrow’s outperformers.

- Spot companies delivering reliable passive income by checking out dividend stocks with yields > 3% brimming with strong yielding opportunities above 3%.

- Get ahead of trends in healthcare innovation when you browse healthcare AI stocks, your shortcut to breakthroughs powered by medical artificial intelligence.

- Unearth tomorrow’s undervalued gems before the market catches on using undervalued stocks based on cash flows. This is ideal if you want value positions based on real cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FOM

Foran Mining

Engages in the acquisition, exploration, and development of mineral properties.

High growth potential and fair value.

Market Insights

Community Narratives