- Canada

- /

- Metals and Mining

- /

- TSX:FOM

Foran Mining (TSX:FOM): Valuation Insight After $70 Million Tax Credit Secures Provincial Backing

Reviewed by Simply Wall St

If you have been following Foran Mining (TSX:FOM), the latest news out of Saskatchewan might have given you pause. The company just secured approval to earn up to $70 million in transferable royalty tax credits under the province’s Critical Minerals Processing Investment Incentive. This provincial support is a big win, especially as Foran advances construction of the McIlvenna Bay Project toward its target production start in 2026. The financial boost both offsets future obligations and sends a clear signal about the government’s confidence in the project’s potential.

In the wake of this announcement, interest in Foran Mining has ramped up, and it is not hard to see why. Over the past month, shares have climbed 22%, hinting at renewed optimism for future growth even as year-to-date and one-year returns are still in the red. It is also worth noting that Foran has kept up momentum through recent milestones, such as the completion of its major winter-spring drilling campaign at McIlvenna Bay, which uncovered some of the most significant grade-thickness intersections at the Tesla Zone yet.

After a strong one-month move but continued weak performance over the last year, the key question for investors is clear: does the latest news mark a true turning point for Foran, or is the market already pricing in the future growth?

Price-to-Book of 1.6x: Is it justified?

Foran Mining is currently trading at a price-to-book (P/B) ratio of 1.6x, which is below both the Canadian Metals and Mining industry average of 2.3x and the peer average of 6.1x. This suggests the market is valuing Foran’s assets less aggressively than most of its competitors.

The price-to-book ratio measures how much investors are willing to pay for each dollar of a company's net assets. In asset-heavy sectors like mining, the P/B ratio is commonly used to gauge whether a stock is undervalued or overvalued relative to its book value. A lower ratio may imply undervaluation, caution about the company's future profitability, or both.

The current P/B ratio positions Foran as good value compared to its industry and peer group. This could reflect skepticism about near-term profits or simply a conservative market stance until revenues materialize.

Result: Fair Value of $3.29 (ABOUT RIGHT)

See our latest analysis for Foran Mining.However, risks remain if Foran cannot sustain recent momentum or if construction delays push back its 2026 production target.

Find out about the key risks to this Foran Mining narrative.Another View: Discounted Cash Flow Perspective

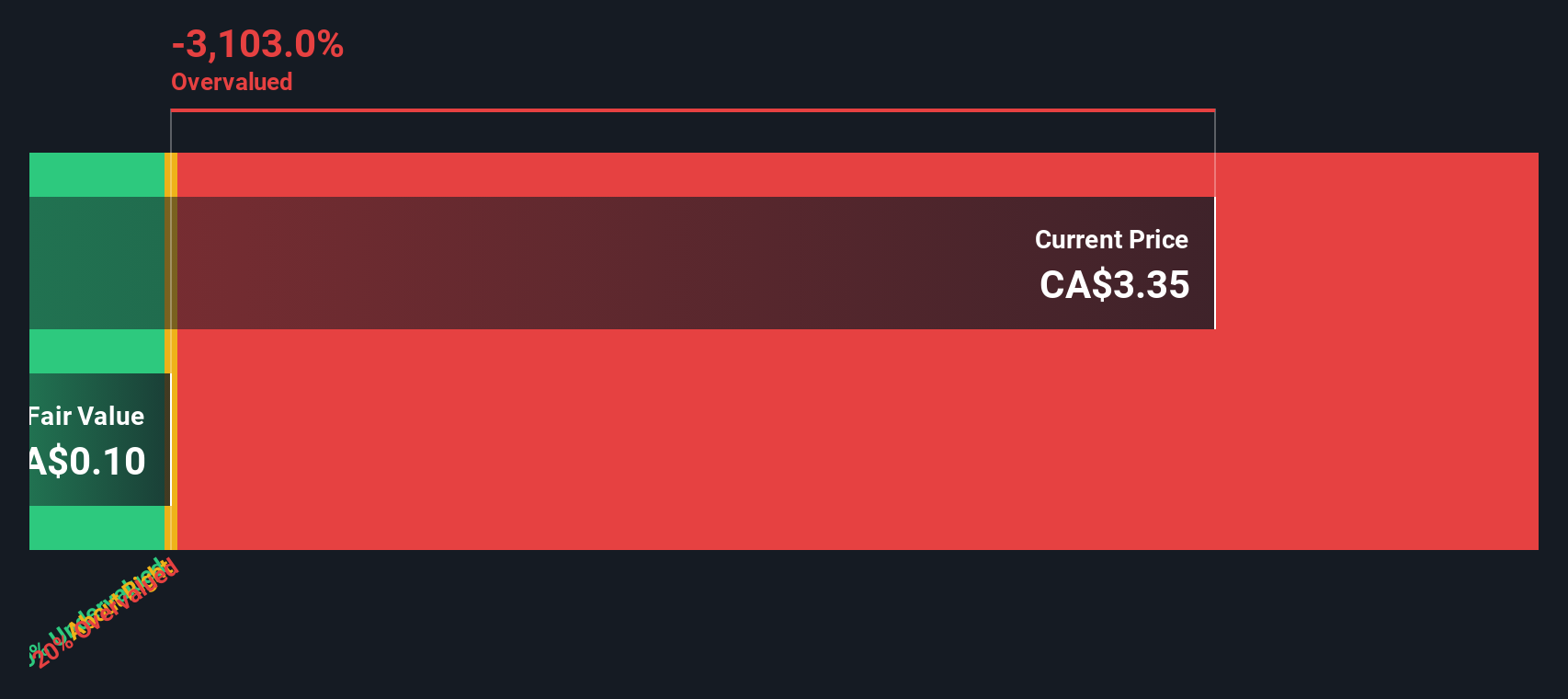

While Foran’s price-to-book ratio looks attractive, our DCF model paints a far less optimistic picture and suggests the shares could be overvalued. Could the assumptions behind each method be distorting the true outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Foran Mining Narrative

If you have a different perspective or want to test your own assumptions, it takes just a few minutes to build your own view of the company. Do it your way.

A great starting point for your Foran Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to just one opportunity. Uncover where the next big wins could come from by using these powerful research tools right now.

- Grow your portfolio with companies at the forefront of artificial intelligence breakthroughs. Tap into AI penny stocks to see what’s driving tomorrow’s innovations.

- Take charge of your income strategy and access dividend stocks with yields > 3% to find shares offering stable yields above 3% and consistent payout performance.

- Unlock value now by scanning undervalued stocks based on cash flows for stocks that may be overlooked by the market but have high potential based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FOM

Foran Mining

Engages in the acquisition, exploration, and development of mineral properties.

High growth potential and fair value.

Market Insights

Community Narratives