- Canada

- /

- Metals and Mining

- /

- TSX:FOM

Foran Mining (TSX:FOM): Evaluating Valuation Following Recent 22% Share Price Climb

Reviewed by Kshitija Bhandaru

Foran Mining (TSX:FOM) has recently caught the attention of market watchers as its stock showed solid momentum over the past month, rising 22%. This uptick is sparking curiosity about what could be driving the gains and whether it is sustainable.

See our latest analysis for Foran Mining.

After a year marked by some volatility, Foran Mining’s recent 22% share price climb suggests momentum is building again. This may indicate that investors are reacting to fresh optimism about its long-term growth potential. With a 3-year total shareholder return of 62% and a five-year figure nearing 2000%, the longer-term story is one of significant overall value creation despite short-term fluctuations.

If the renewed momentum has you wondering what else is out there, this is a perfect chance to broaden your investing horizons and discover fast growing stocks with high insider ownership

This brings investors to a pivotal question: Is Foran Mining’s recent surge just catching up to its fundamentals, or is the market already factoring in future potential, leaving little room for further upside?

Price-to-Book of 1.8x: Is it justified?

Foran Mining’s current price-to-book ratio stands at 1.8x, placing it below both the Canadian Metals and Mining industry average of 2.5x and the peer average of 51.5x. With a last close price of CA$3.77, the stock looks attractively valued relative to similar companies in its sector.

The price-to-book ratio is a key metric for asset-heavy companies like Foran Mining. It indicates how much investors are paying for each dollar of net assets. A lower ratio suggests that the market is not pricing in aggressive future growth or that the underlying assets could be undervalued.

When compared to the industry, Foran Mining is trading at a discount. This valuation could imply skepticism about the company’s current lack of profitability or that the market expects future performance to fall behind sector peers. However, its price-to-book level provides a margin of safety for investors cautious about overpaying, particularly in a cyclical sector.

Result: Price-to-Book of 1.8x (UNDERVALUED)

See what the numbers say about this price — find out in our valuation breakdown.

However, continued net losses and lack of current revenue could challenge investor optimism if not addressed in upcoming quarters.

Find out about the key risks to this Foran Mining narrative.

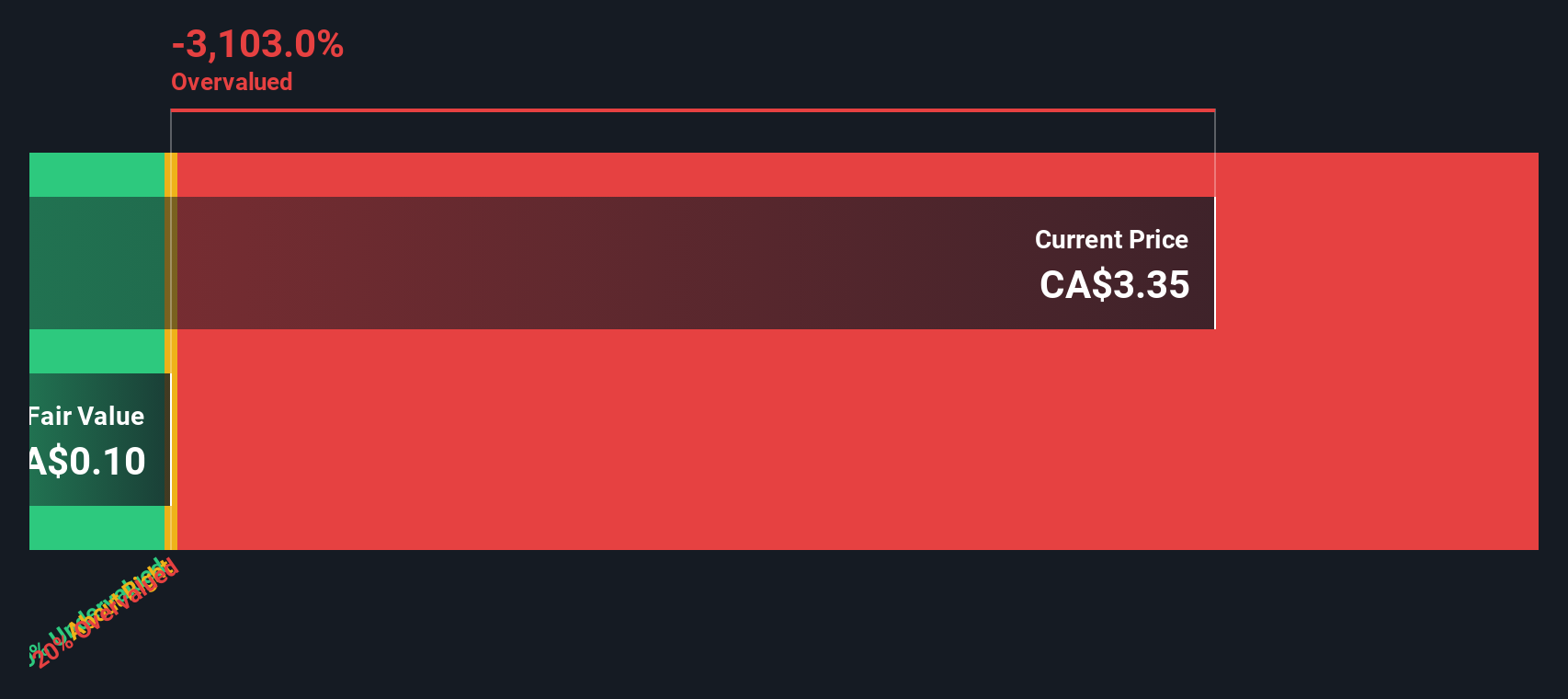

Another View: Discounted Cash Flow Raises Questions

While the price-to-book ratio paints Foran Mining as undervalued, our DCF model offers a different perspective. The SWS DCF model estimates fair value at just CA$0.18, which is far below the current share price of CA$3.77. Does this divergence suggest the market is overlooking risk, or is the DCF being too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Foran Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Foran Mining Narrative

If you want to challenge these conclusions or rely on your own analysis, you can easily create a personal narrative in just a few minutes, Do it your way.

A great starting point for your Foran Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity. Make sure you’re seeing the full potential by targeting other promising stocks that could elevate your portfolio right now.

- Capitalize on the tech revolution and unlock growth by starting with these 24 AI penny stocks, which are leading innovation in artificial intelligence markets.

- Strengthen your income stream by exploring these 19 dividend stocks with yields > 3%, offering generous yields and consistent dividend histories.

- Seize early opportunities in emerging sectors through these 78 cryptocurrency and blockchain stocks, which are shaping the future of decentralized finance and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FOM

Foran Mining

Engages in the acquisition, exploration, and development of mineral properties.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives