- Canada

- /

- Metals and Mining

- /

- TSX:FNV

Franco-Nevada (TSX:FNV) Valuation: Analyzing Post-Earnings Growth After Strong Q2 Results

Reviewed by Simply Wall St

Franco-Nevada (TSX:FNV) just released its second quarter earnings, and the results paint a compelling picture for anyone watching the stock. Sales and revenue surged compared to last year, with net income for the quarter more than tripling. For investors tracking growth stories within the mining royalty sector, these kinds of earnings jumps are difficult to ignore. They often act as catalysts that reset expectations and trigger new debates about the company's valuation.

This strong quarterly update adds fuel to a stock that was already moving higher. Franco-Nevada shares are up 55% over the past year, including a 15% climb in the past month. Positive sentiment has been building since the start of the year, stoked by rising commodity prices and Franco-Nevada's steady execution. Along the way, the board has also reaffirmed its dividend payout, underlining management’s confidence in the business.

With growth numbers like these, is there still an opportunity for investors to buy Franco-Nevada before the market prices in all that future upside, or has the stock already sprinted ahead of itself?

Most Popular Narrative: 6.4% Undervalued

According to community narrative, Franco-Nevada is currently viewed as undervalued, with analysts projecting more upside ahead based on robust future prospects.

Recent and ongoing acquisitions of high-quality, long-life assets (for example, Cote Gold, Arthur/AngloGold's Nevada projects, Yanacocha, and Western Limb) have substantially diversified the portfolio, decreasing operational risk and supporting a stronger and more stable growth trajectory for revenues and cash flow.

Can Franco-Nevada continue to build on its value, or is this growth streak close to leveling off? The main driver behind this high fair value is not what most investors expect. It is a unique combination of operational catalysts and ambitious financial forecasts, with details that may change your expectations about how much further this stock could go.

Result: Fair Value of $273.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, concentrated exposure to key assets and ongoing dependence on high gold prices could quickly reverse Franco-Nevada's current growth momentum.

Find out about the key risks to this Franco-Nevada narrative.Another View: Rethinking the Upside

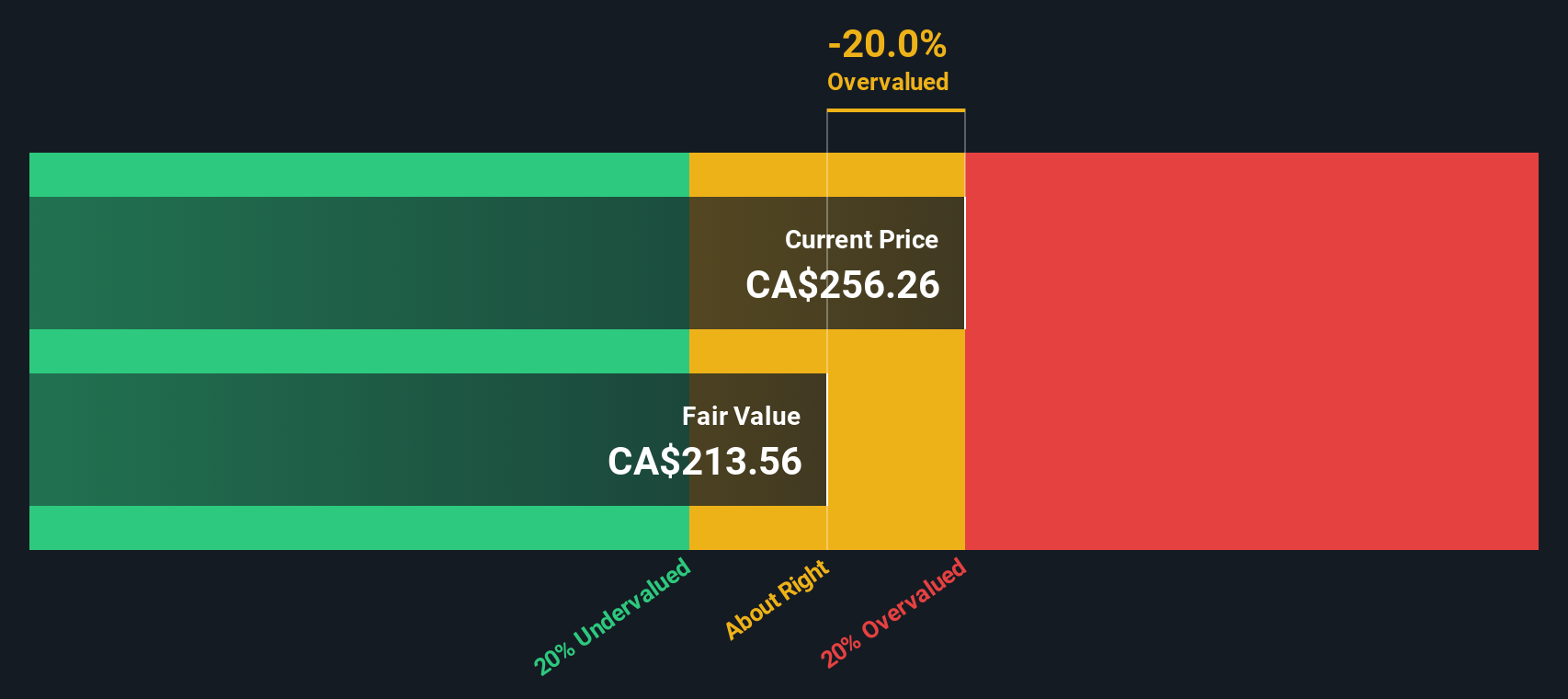

Looking at valuation from a different angle, our DCF model tells a different story compared to analyst forecasts. This suggests the stock may not be as attractively priced as it first appears. What if this method has it right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Franco-Nevada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Franco-Nevada Narrative

If the current outlook does not quite fit your perspective, or you prefer digging into the details yourself, you can shape a Franco-Nevada narrative of your own in just a few minutes. So why not do it your way?

A great starting point for your Franco-Nevada research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Do not settle for just one success story when there are plenty of promising stocks out there waiting to be found. Set yourself up for smarter decisions and potential gains by tapping into unique strategies tailored by our screeners. Start your search now and you might just spot your next big winner before everyone else.

- Maximize income potential with stocks offering strong, reliable yields by checking out dividend stocks with yields > 3%.

- Ride the momentum in artificial intelligence and tap into the next wave of innovation by exploring fast-growing companies spotlighted in AI penny stocks.

- Capture value by seeking companies the market is undervaluing today, all highlighted within undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FNV

Franco-Nevada

Operates as a royalty and stream company focused on precious metals in South America, Central America, Mexico, the United States, Canada, Australia, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives