- Canada

- /

- Metals and Mining

- /

- TSX:FNV

Franco-Nevada (TSX:FNV): Revisiting Valuation as Royalty Strategy Gains Attention and Share Price Outpaces Recent Averages

Reviewed by Simply Wall St

Franco-Nevada (TSX:FNV) is back on investors radar as its royalty focused model draws fresh attention amid shifting sentiment in precious metals and a recent move in the stock above familiar trading averages.

See our latest analysis for Franco-Nevada.

Despite a softer 7 day share price return, Franco-Nevada’s latest share price of $283.25 reflects a healthy 30 day share price return of 6.72 percent and a standout 1 year total shareholder return of 67.45 percent. This suggests momentum in the royalty story rather than a fading spike.

If Franco-Nevada’s run has you thinking about what else could surprise to the upside, this is a good moment to explore fast growing stocks with high insider ownership for other potential outperformers.

But with earnings still growing, a premium valuation, and the share price now well above analyst targets, investors face a key question: is Franco-Nevada still a buy, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 18% Undervalued

With Franco-Nevada last closing at CA$283.25 against a narrative fair value of about CA$343, the story leans toward meaningful upside from here.

Recent and ongoing acquisitions of high quality, long life assets (e.g., Cote Gold, Arthur/AngloGold's Nevada projects, Yanacocha, Western Limb) have substantially diversified the portfolio, decreasing operational risk and underpinning a stronger, more stable growth trajectory for revenues and cash flow.

Curious how robust double digit growth, resilient margins, and a premium future earnings multiple can still line up as reasonable assumptions? The full narrative unpacks the cash flow math, the timeline for new projects to ramp, and the discount rate that turns these forecasts into that higher fair value estimate.

Result: Fair Value of $343.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should keep an eye on prolonged gold price weakness and setbacks at major assets like Candelaria or Cobre Panama, which could quickly derail that upside case.

Find out about the key risks to this Franco-Nevada narrative.

Another Lens On Valuation

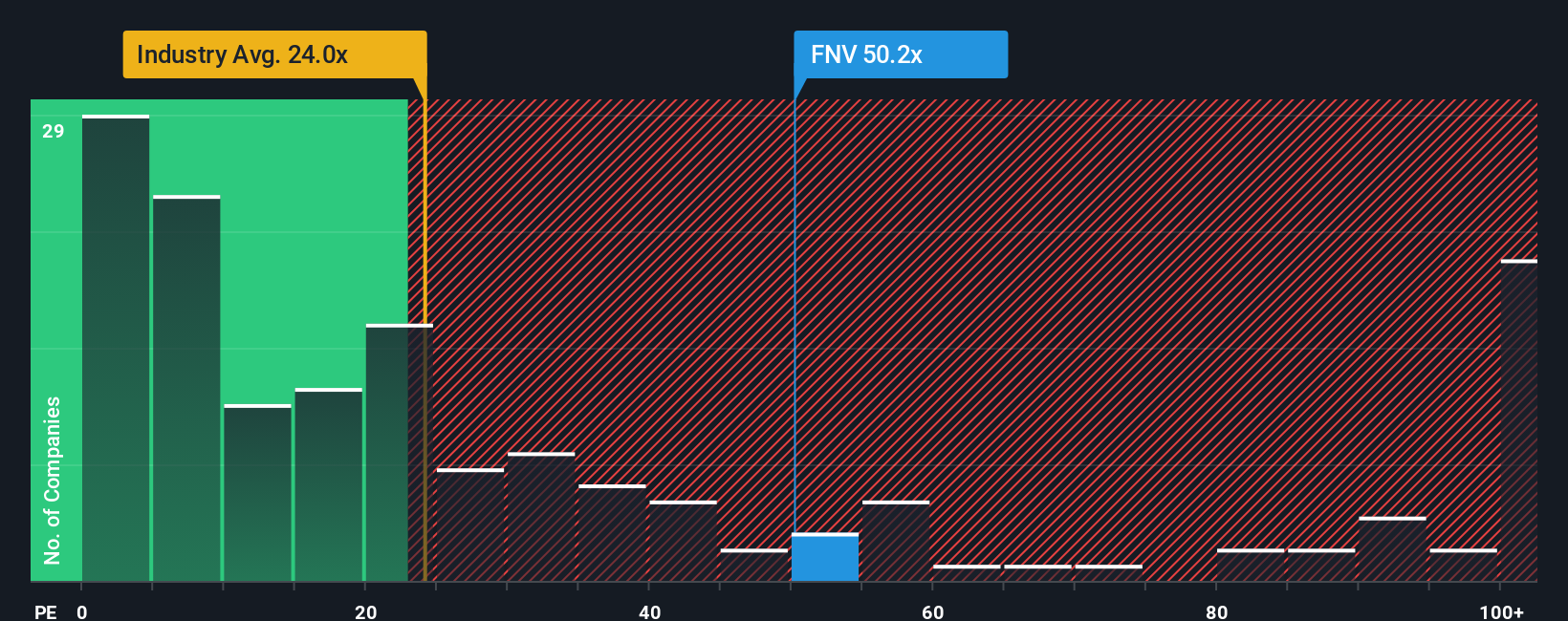

On earnings, Franco-Nevada looks stretched. Its P/E of 42.5 times towers over both the Canadian metals and mining average of 21.2 times and a fair ratio of 22.9 times, as well as the peer average of 28.8 times. That premium may reward growth, or simply raise downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franco-Nevada Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized Franco-Nevada outlook in just minutes: Do it your way.

A great starting point for your Franco-Nevada research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you stop at Franco-Nevada, sharpen your edge by scanning fresh opportunities on the Simply Wall Street Screener so potential winners do not slip past you.

- Target steady income streams by reviewing these 15 dividend stocks with yields > 3% that aim to balance yield with underlying business strength.

- Capture long term growth themes by assessing these 26 AI penny stocks positioned at the forefront of intelligent automation and data driven innovation.

- Strengthen your value toolkit by weighing up these 912 undervalued stocks based on cash flows that market pessimism may have unfairly punished.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FNV

Franco-Nevada

Operates as a royalty and stream company focused on precious metals in South America, Central America, Mexico, the United States, Canada, Australia, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026