- Canada

- /

- Metals and Mining

- /

- TSX:FM

Assessing First Quantum Minerals (TSX:FM) Valuation After Recent Strong Share Price Momentum

Reviewed by Simply Wall St

First Quantum Minerals (TSX:FM) has had a move in its share price that might have some investors pausing to take stock. Whenever a meaningful swing like this shows up, it naturally raises the question of whether there is something fundamental going on or if sentiment is leading the way. There is no specific news event behind the move this time, so it is worth considering if the stock’s changing price is an early signal for something yet to come.

Over the past year, First Quantum Minerals has seen its share price surge by 60%. That momentum has picked up over the past month, as the stock gained 9% during that period. While nothing dramatic has made headlines recently, this pattern follows a year marked by improving financials, with revenue and net income growth both solidly positive. This has kept the company in investor conversations as a potentially compelling story in the materials sector.

This activity raises the question of whether the share price move is creating a new window of opportunity for First Quantum Minerals or if the market is already factoring in expectations for more growth ahead.

Price-to-Earnings of 74.9x: Is it justified?

Based on the price-to-earnings (P/E) ratio, First Quantum Minerals is currently trading above not only its own estimated fair P/E, but also relative to industry peers. The shares are priced at a P/E of 74.9x compared to a fair ratio of 43.3x and an industry average of 18.6x, signaling that investors are paying a premium for current and expected earnings.

The P/E ratio is a widely watched measure of how much investors are willing to pay for a company's profits. For a mining company like First Quantum Minerals, a high P/E can reflect expectations of future earnings growth, operational improvements, or sector outperformance. However, it might also indicate overheated sentiment or underlying risks that are not immediately clear.

At a considerably higher P/E than both its fair value and sector, the market may be overpricing future profitability or placing significant faith in continued financial improvement. Whether this valuation is sustainable will depend on whether forecast earnings growth and profitability materialize as anticipated.

Result: Fair Value of $77.33 (OVERVALUED)

See our latest analysis for First Quantum Minerals.However, risks such as shifts in commodity prices or unexpected operational challenges could quickly change the outlook and reverse recent gains.

Find out about the key risks to this First Quantum Minerals narrative.Another View: What Does Our DCF Model Say?

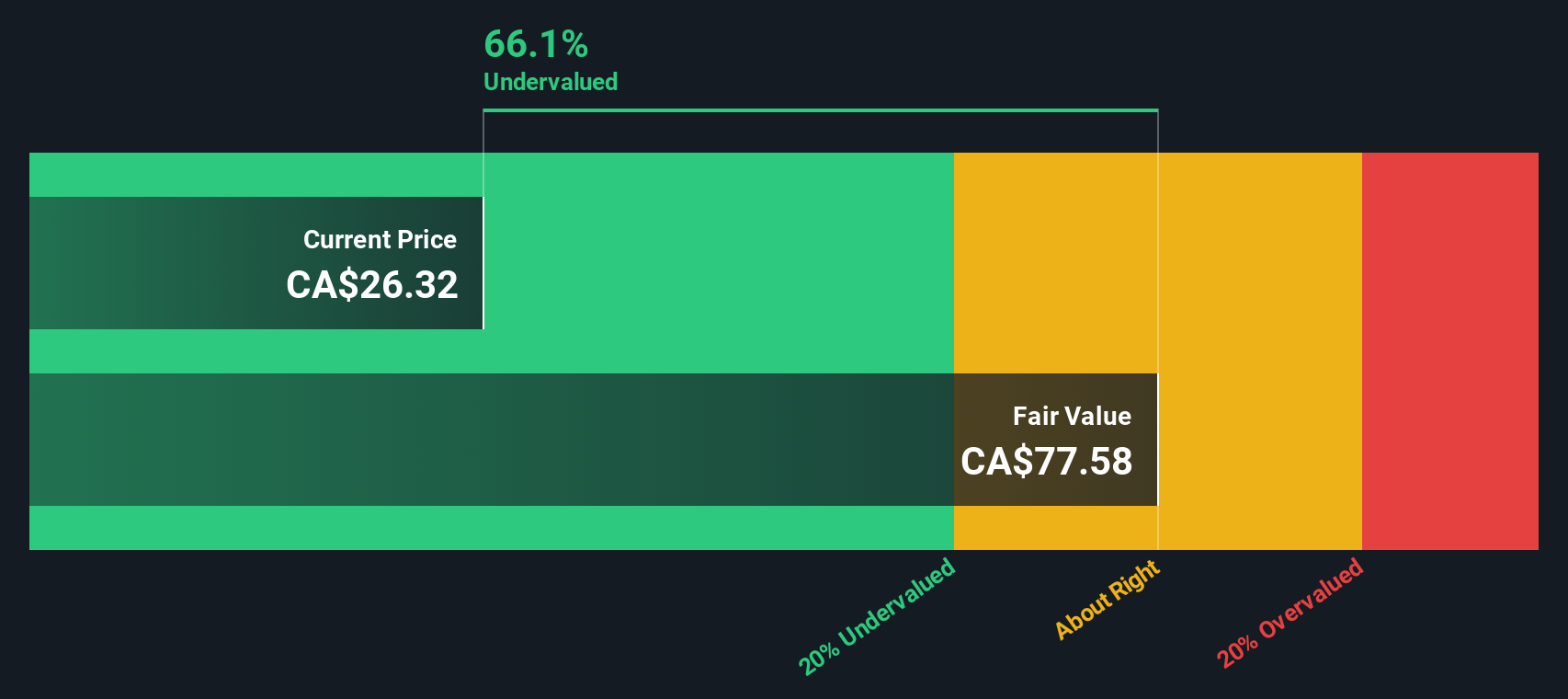

While traditional valuation suggests First Quantum Minerals may be pricey for its earnings, our SWS DCF model offers a different perspective, highlighting underappreciated value beneath the surface. Could this reveal more than meets the eye?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Quantum Minerals Narrative

If you think there’s more to uncover or would rather investigate the numbers directly, you can easily develop your own perspective in just a few minutes. Do it your way.

A great starting point for your First Quantum Minerals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities pass you by when there’s a world of remarkable stocks waiting. Use these focused screeners to target your next winning investment:

- Secure your spot in tomorrow’s biggest breakthroughs as you search for AI penny stocks reshaping entire industries with artificial intelligence innovation.

- Unlock steady streams of income by checking out high-yield picks among dividend stocks with yields > 3% and put compounding to work for you.

- Pinpoint undervalued gems that could power your portfolio’s next leap by pursuing undervalued stocks based on cash flows hiding in plain sight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FM

First Quantum Minerals

Engages in the exploration, development, and production of mineral properties.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives