- Canada

- /

- Metals and Mining

- /

- TSX:AG

3 TSX Stocks Estimated To Be Trading At Discounts Ranging From 21.5% To 42.7%

Reviewed by Simply Wall St

As the Canadian market navigates potential interest rate cuts and fluctuating bond yields, investors are keeping a close watch on economic stabilization efforts and the implications for stock valuations. In this environment, identifying undervalued stocks can present opportunities for investors to potentially capitalize on discrepancies between current prices and intrinsic values, especially as markets may experience volatility in the months ahead.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vitalhub (TSX:VHI) | CA$11.01 | CA$20.65 | 46.7% |

| Versamet Royalties (TSXV:VMET) | CA$7.91 | CA$13.96 | 43.3% |

| TerraVest Industries (TSX:TVK) | CA$138.40 | CA$265.88 | 47.9% |

| K92 Mining (TSX:KNT) | CA$16.34 | CA$27.62 | 40.8% |

| Haivision Systems (TSX:HAI) | CA$5.15 | CA$9.43 | 45.4% |

| GURU Organic Energy (TSX:GURU) | CA$4.88 | CA$8.97 | 45.6% |

| goeasy (TSX:GSY) | CA$209.20 | CA$377.71 | 44.6% |

| First Majestic Silver (TSX:AG) | CA$14.87 | CA$25.97 | 42.7% |

| CareRx (TSX:CRRX) | CA$3.23 | CA$6.28 | 48.5% |

| BRP (TSX:DOO) | CA$88.99 | CA$161.63 | 44.9% |

Let's take a closer look at a couple of our picks from the screened companies.

First Majestic Silver (TSX:AG)

Overview: First Majestic Silver Corp. is involved in the acquisition, exploration, development, and production of mineral properties in North America and has a market cap of CA$7.13 billion.

Operations: The company generates revenue from various segments, including Mexico's San Dimas at $230.87 million, Santa Elena at $308.78 million, La Encantada at $79.33 million, and the United States' First Mint at $27.36 million and Jerritt Canyon at $2.71 million.

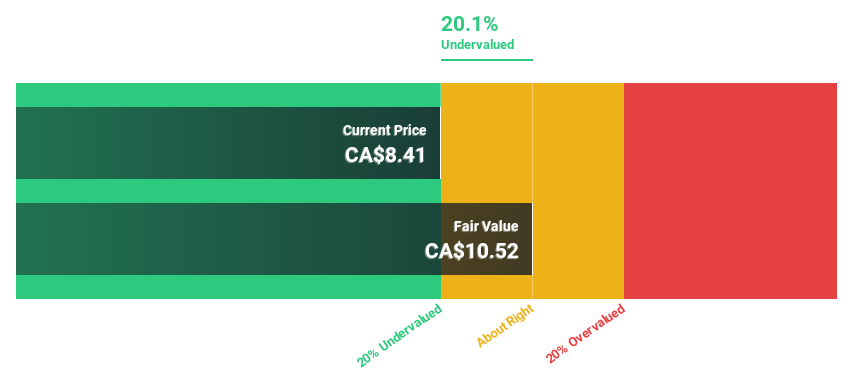

Estimated Discount To Fair Value: 42.7%

First Majestic Silver's recent exploration successes at Los Gatos and San Dimas mines indicate potential for expanded mineral resources, enhancing future cash flows. The company reported a turnaround with significant revenue growth in the latest quarter, reaching US$264.23 million, and net income of US$52.55 million. Despite past shareholder dilution, it trades at CA$14.87 per share—42.7% below its estimated fair value of CA$25.97—suggesting an undervaluation based on discounted cash flow analysis amidst expected strong earnings growth.

- Upon reviewing our latest growth report, First Majestic Silver's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of First Majestic Silver stock in this financial health report.

Equinox Gold (TSX:EQX)

Overview: Equinox Gold Corp. is involved in the acquisition, exploration, development, and operation of mineral properties across the Americas and has a market cap of CA$11.19 billion.

Operations: The company's revenue segments include RDM at $165.36 million, Aurizona at $204.52 million, Mesquite at $219.69 million, Los Filos at $376.91 million, Greenstone at $550.16 million, and Castle Mountain contributing $40.06 million.

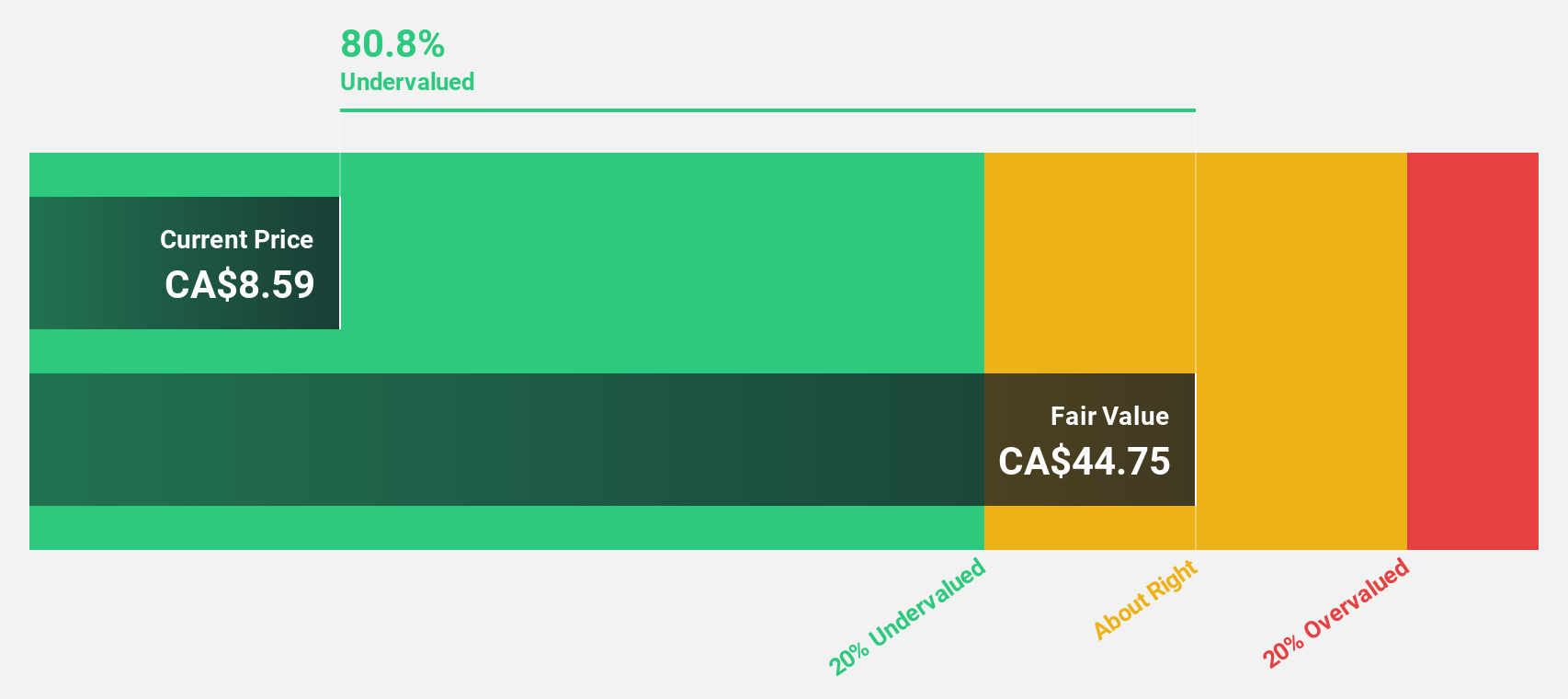

Estimated Discount To Fair Value: 21.5%

Equinox Gold's recent developments at the Valentine and Greenstone mines highlight significant production potential, with Valentine expected to produce up to 200,000 ounces of gold annually. Despite past shareholder dilution and a net loss in the first half of 2025, Equinox trades at CA$14.93—21.5% below its estimated fair value of CA$19.01—indicating undervaluation based on discounted cash flow analysis amidst anticipated profitability within three years and robust revenue growth forecasts.

- The growth report we've compiled suggests that Equinox Gold's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Equinox Gold.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd., along with its subsidiaries, focuses on the mining, development, and exploration of minerals and precious metals in Africa, with a market cap of CA$17.19 billion.

Operations: Ivanhoe Mines Ltd. operates through revenue segments primarily focused on the mining, development, and exploration of minerals and precious metals in Africa.

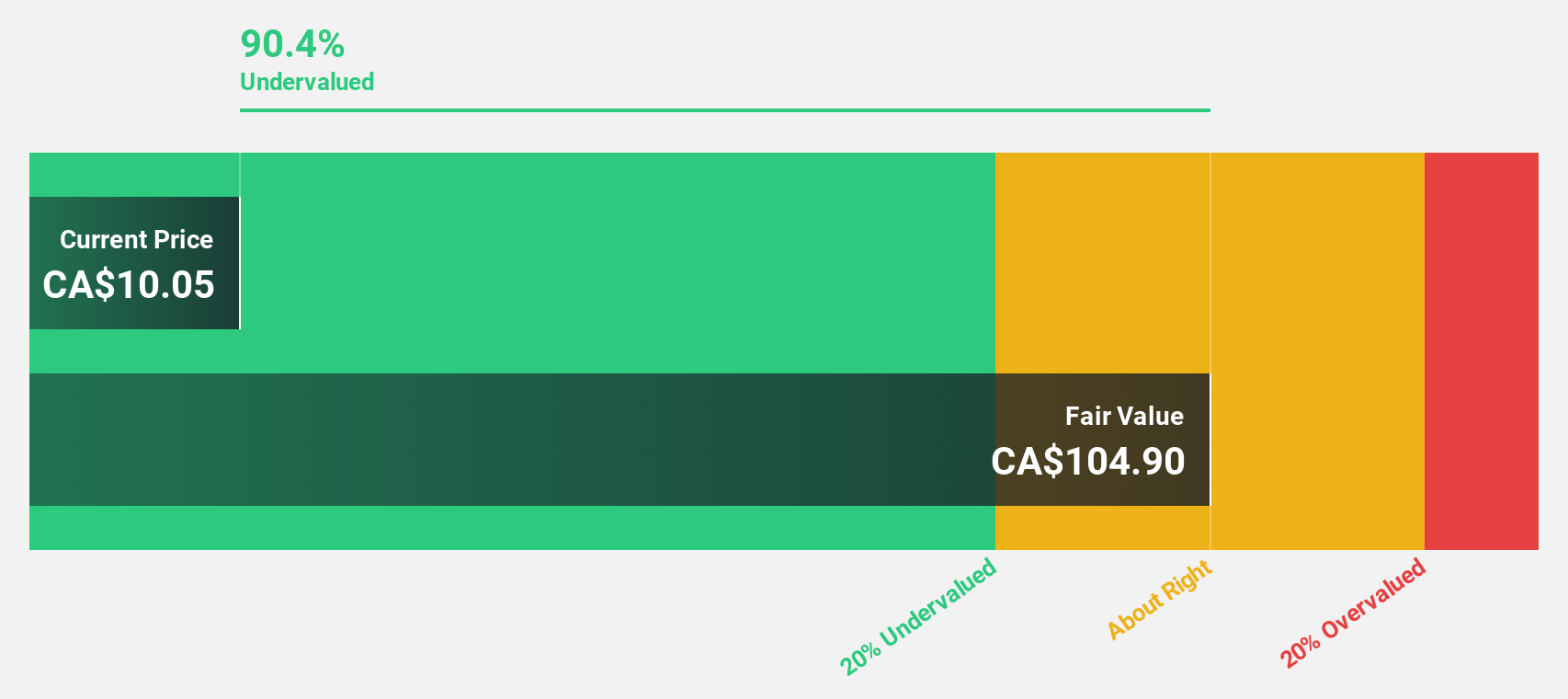

Estimated Discount To Fair Value: 33.6%

Ivanhoe Mines, trading at CA$12.83, is undervalued by 33.6% against its fair value of CA$19.34 based on discounted cash flow analysis. The company's earnings and revenue are forecast to grow significantly faster than the Canadian market, with expected annual increases of over 25% and 32%, respectively. Recent operational improvements at Kipushi Zinc Mine and exploration in Kazakhstan further bolster Ivanhoe's growth prospects despite a low future return on equity forecast of 12.1%.

- Our growth report here indicates Ivanhoe Mines may be poised for an improving outlook.

- Get an in-depth perspective on Ivanhoe Mines' balance sheet by reading our health report here.

Where To Now?

- Click here to access our complete index of 27 Undervalued TSX Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives