- Canada

- /

- Metals and Mining

- /

- TSX:ELD

Introducing Eldorado Gold (TSE:ELD), The Stock That Zoomed 118% In The Last Three Years

It might be of some concern to shareholders to see the Eldorado Gold Corporation (TSE:ELD) share price down 13% in the last month. But in three years the returns have been great. Indeed, the share price is up a very strong 118% in that time. So the recent fall in the share price should be viewed in that context. The thing to consider is whether the underlying business is doing well enough to support the current price.

View our latest analysis for Eldorado Gold

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

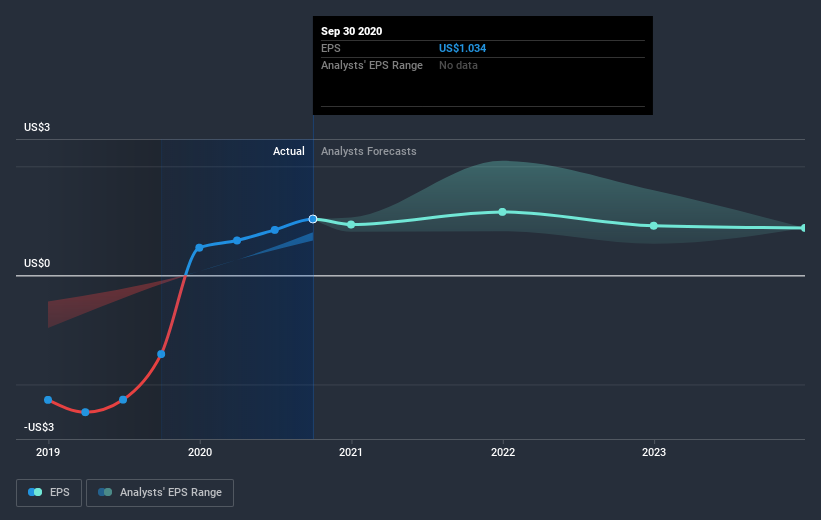

Eldorado Gold became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Eldorado Gold has grown profits over the years, but the future is more important for shareholders. This free interactive report on Eldorado Gold's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Eldorado Gold shareholders have received a total shareholder return of 68% over one year. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Eldorado Gold you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade Eldorado Gold, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eldorado Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:ELD

Eldorado Gold

Engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, and Greece.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026