- Canada

- /

- Metals and Mining

- /

- TSX:ELD

Has Eldorado Gold’s 79% Rally in 2025 Run Ahead of Its Fundamentals?

Reviewed by Bailey Pemberton

If you’re wondering what to do with Eldorado Gold right now, you’re not alone. The stock has caught investors’ attention with its remarkable run, and it’s natural to wonder if the upside still outweighs the risks, or if it’s time to lock in gains. In just the last week, Eldorado Gold edged up 1.0%. That’s just a blip compared to its bigger story: the share price is up 12.2% in the last month, and a hefty 79.5% since the start of the year.

It’s not just a hot streak for the sake of headlines, either. The company’s performance over the last three years, an impressive 371.1% climb, suggests more than just short-term momentum. Part of this renewed enthusiasm comes from a favorable outlook for gold itself, as wide-reaching global uncertainties have investors seeking safer assets. Inflation concerns and ongoing geopolitical tensions have pushed more capital into gold producers, setting the stage for Eldorado Gold’s accelerated moves. While some of the surge may simply reflect changes in investor risk perception, the real question is whether Eldorado’s valuation justifies these gains or if expectations have gotten ahead of reality.

On a valuation scorecard, Eldorado Gold gets a 5 out of 6, meaning it’s considered undervalued on five out of six common checks and is outperforming many of its peers. But how does each method measure up, and what can investors learn from digging deeper? Let’s walk through the major approaches to valuing Eldorado and keep in mind, there’s a more nuanced way to see value here that we’ll touch on at the end.

Why Eldorado Gold is lagging behind its peers

Approach 1: Eldorado Gold Discounted Cash Flow (DCF) Analysis

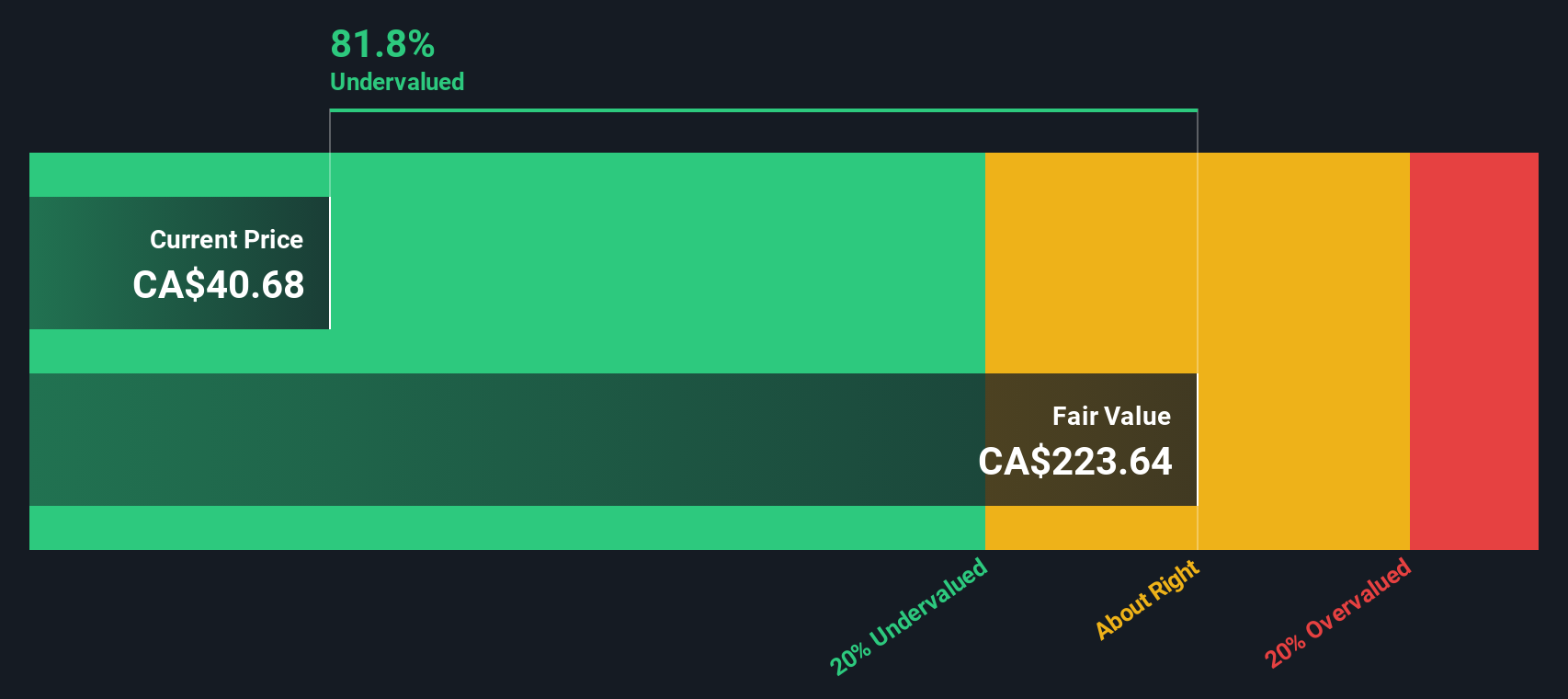

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future free cash flows and discounting them back to today’s dollars. This provides an intrinsic value reflecting the business’s earning power over time, rather than just its recent results.

For Eldorado Gold, the model starts with its latest reported Free Cash Flow of $45.1 Million. Analysts forecast steady growth in coming years, predicting Free Cash Flow will climb to $861.4 Million by 2027. Beyond the next five years, Simply Wall St extrapolates further increases, ultimately projecting Free Cash Flow to surpass $2.4 Billion by 2035. All figures are reported in dollars, and projections consider both analyst consensus and industry trends.

Using this forward-looking approach, the DCF calculation yields an estimated fair value of $277 per share. Compared to the company’s current trading price, this model implies Eldorado Gold is 85.3% undervalued, which may suggest shares have the potential for further appreciation if forecasts are accurate. However, DCF models rely on assumptions, so it is important for investors to be mindful of potential risks and the challenges of predicting future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eldorado Gold is undervalued by 85.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Eldorado Gold Price vs Earnings (PE)

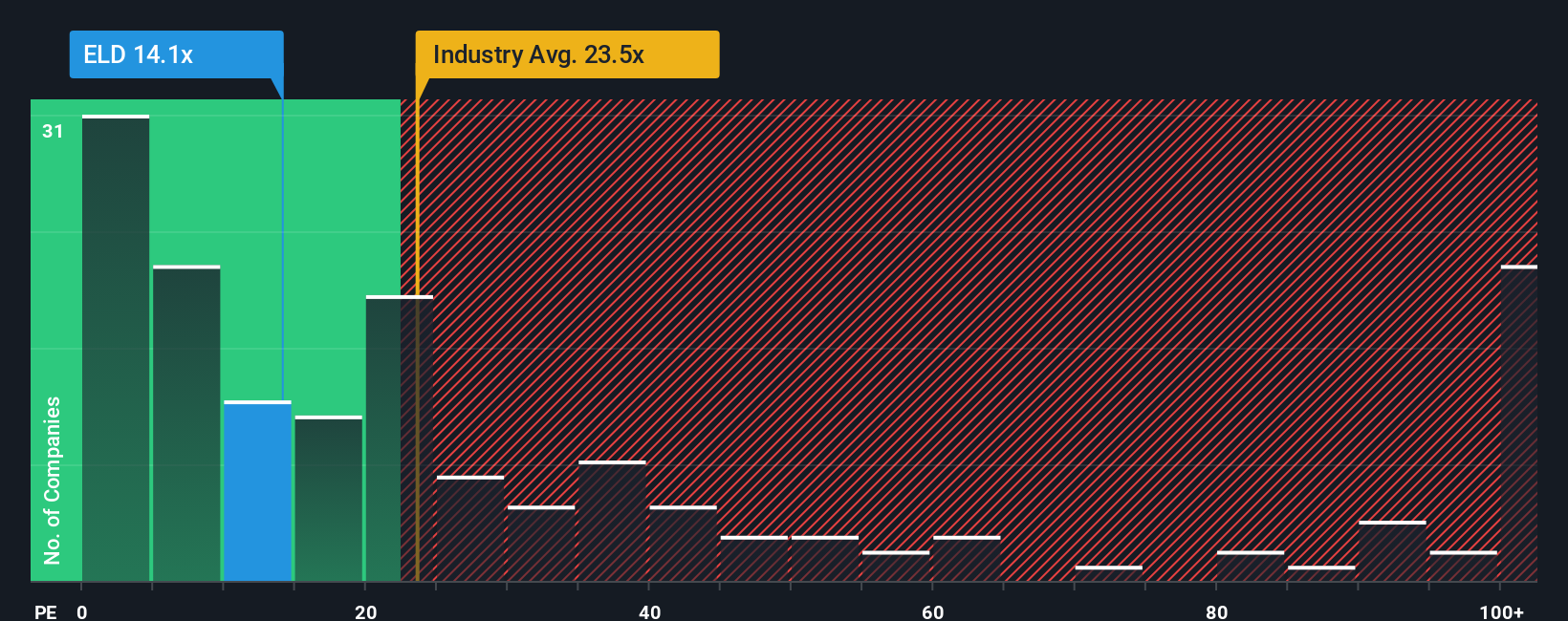

The Price-to-Earnings ratio, or PE multiple, is one of the most commonly used metrics for valuing profitable companies like Eldorado Gold. It essentially tells you how much investors are willing to pay today for a dollar of the company’s current earnings, offering a window into the market’s growth expectations and risk appetite for that business.

For fast-growing companies with stable profits and manageable risks, investors typically accept higher PE ratios, reflecting optimism for future earnings expansion. Conversely, higher risk or limited growth prospects usually call for a lower PE ratio. That is why it is crucial to not only check the current PE, but also to weigh it against relevant benchmarks.

Eldorado Gold is currently trading at a PE of 14.1x. This is noticeably lower than the industry average PE of 23.5x, and it sits well below the peer average of 27.5x in the Metals and Mining sector. Looking more deeply, Simply Wall St’s proprietary Fair Ratio for Eldorado Gold is 33.3x. This Fair Ratio factors in the company’s earnings growth profile, industry trends, profit margins, market cap and company-specific risks, giving a more tailored benchmark than generic sector averages.

The Fair Ratio approach provides extra insight as it moves beyond the ‘one-size-fits-all’ comparison against broad industry or peer benchmarks. Instead, it weighs what a reasonable investor might genuinely pay for Eldorado’s unique strengths and weaknesses in the current market landscape.

Comparing the company’s actual PE (14.1x) to its Fair Ratio (33.3x), Eldorado Gold still appears undervalued based on this method, suggesting room for share price appreciation if earnings keep delivering.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eldorado Gold Narrative

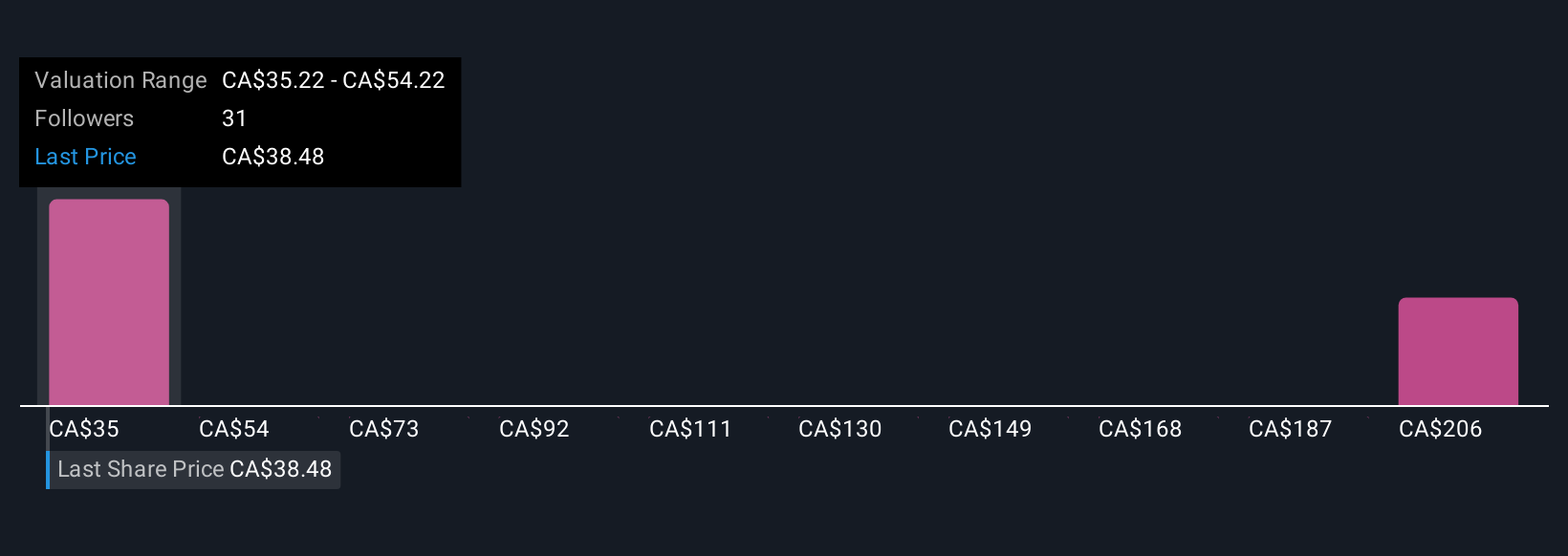

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about the company, where you combine your view on what drives Eldorado Gold's business with your own forecasts for key numbers like future revenue, earnings, and margins. Narratives make investing more intuitive by linking the big picture story to a financial forecast and then automatically calculating a Fair Value so you can see whether the stock is attractive to you, based on your view.

On Simply Wall St's platform, Narratives are easily accessible in the Community page, where millions of investors share their perspectives and stay updated. They allow you to compare your Fair Value with the current share price, helping you decide whether it might be time to buy, hold, or sell. Best of all, Narratives stay dynamic. If fresh news or updated earnings are released, your Narrative is automatically re-calculated so your Fair Value always reflects the latest information.

For example, with Eldorado Gold, some investors use a bullish Narrative that factors in revenue growth of over 32% per year and a future PE of 8.0x, which gives a Fair Value near CA$36.53, while others, more cautious, see slower growth or higher risks and arrive at Fair Values as low as CA$28.97. This range demonstrates how Narratives empower you to make smarter, more personalized investment decisions.

Do you think there's more to the story for Eldorado Gold? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eldorado Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELD

Eldorado Gold

Engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, and Greece.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives