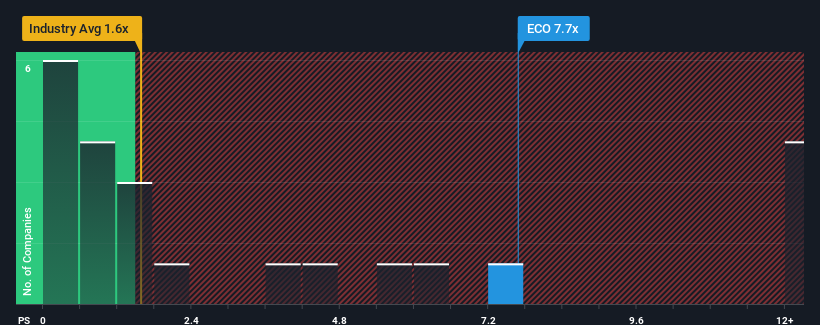

When close to half the companies in the Chemicals industry in Canada have price-to-sales ratios (or "P/S") below 1.6x, you may consider EcoSynthetix Inc. (TSE:ECO) as a stock to avoid entirely with its 7.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for EcoSynthetix

What Does EcoSynthetix's Recent Performance Look Like?

As an illustration, revenue has deteriorated at EcoSynthetix over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on EcoSynthetix will help you shine a light on its historical performance.How Is EcoSynthetix's Revenue Growth Trending?

In order to justify its P/S ratio, EcoSynthetix would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.6%. The last three years don't look nice either as the company has shrunk revenue by 1.9% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to decline by 15% over the next year, even worse than the company's recent medium-term annualised revenue decline.

In light of this, it's understandable that EcoSynthetix's P/S sits above the majority of other companies. However, even if the company's recent growth rates were to continue outperforming the industry, shrinking revenues are unlikely to make the P/S premium sustainable over the longer term. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From EcoSynthetix's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of EcoSynthetix revealed its narrower three-year contraction in revenue is contributing to its higher than industry P/S, given the industry is set to shrink even more. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under any additional threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Although, if the company's relative outperformance doesn't change it will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for EcoSynthetix with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EcoSynthetix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ECO

EcoSynthetix

A renewable chemicals company, develops and commercializes bio-based technologies that are used as replacement solutions for synthetic, petrochemical-based chemicals, and other related products in the Americas, Europe, the Middle East, Africa, and Asia Pacific.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026