- Canada

- /

- Metals and Mining

- /

- TSX:DPM

Dundee Precious Metals (TSX:DPM): Valuation Check After New Serbian Resource Estimates at Coka Rakita

Reviewed by Simply Wall St

DPM Metals (TSX:DPM) just put fresh numbers around its Serbian growth story, unveiling initial mineral resource estimates near its Coka Rakita project that point to district scale gold copper potential and future expansion options.

See our latest analysis for DPM Metals.

The market seems to be catching on, with a 30 day share price return of 25.67 percent and a 90 day gain of 32.92 percent. The 3 year total shareholder return of 561.51 percent underlines how powerful this rerating cycle has been.

If this kind of growth story has your attention, it could be a good moment to scan the market for other fast movers and discover fast growing stocks with high insider ownership.

Yet with Coka Rakita’s rapid progress, low projected costs and fresh Serbian resource upside now on the table, does DPM still trade at a discount to its growth runway, or is the market already pricing in the next leg higher?

Most Popular Narrative Narrative: 5.7% Undervalued

With a narrative fair value of CA$41.99 versus a last close of CA$39.61, the story leans modestly positive and hinges on a few pivotal growth levers.

The successful advancement of the Coka Rakita project, including additional discoveries and the ongoing feasibility study, is expected to significantly increase high margin gold production by 2028, positively impacting future revenue and earnings. Dundee Precious Metals' strong cash position of over $800 million provides financial capacity to fund growth opportunities, which could support revenue and earnings growth through strategic investments and developments.

Curious why a miner with forecast earnings compression still screens as undervalued? The narrative leans on richer margins, shrinking share count, and a bolder future multiple. Want to see how those moving parts translate into today’s fair value call?

Result: Fair Value of $41.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain, with potential Coka Rakita delays and higher labor and exploration costs both capable of squeezing margins and unsettling sentiment.

Find out about the key risks to this DPM Metals narrative.

Another Angle on Value

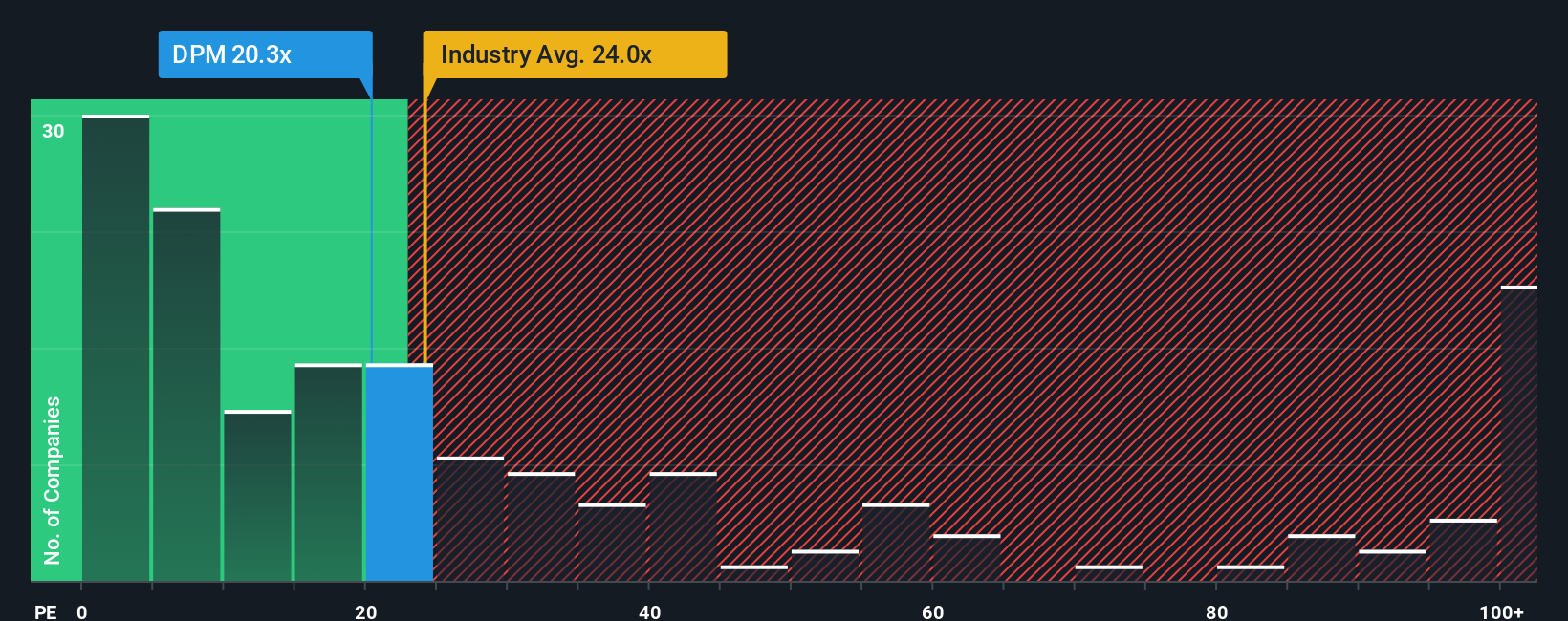

On earnings, the picture looks tighter. DPM trades at 21.3 times earnings, almost identical to the Canadian metals and mining average of 21.2 times but below peer levels at 25.7 times. Our fair ratio sits higher at 22.4 times, hinting at upside, but also a thinner margin for error if the story stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DPM Metals Narrative

If you see things differently or want to dig into the numbers yourself, you can shape a personalized view in just a few minutes: Do it your way.

A great starting point for your DPM Metals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep fresh opportunities on their radar, so now is the moment to use the Simply Wall Street Screener to uncover focused ideas that fit your strategy.

- Capture potential mispricing by targeting companies trading below their estimated cash flow value through these 908 undervalued stocks based on cash flows and position yourself before sentiment catches up.

- Ride powerful secular trends by zeroing in on innovators reshaping markets with these 26 AI penny stocks and sharpen your exposure to transformative technology themes.

- Strengthen your income stream by scanning for reliable payers with attractive yields using these 12 dividend stocks with yields > 3% and avoid missing out on steady cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DPM

DPM Metals

A gold mining company, engages in the acquisition, exploration, development, mining, and processing of precious metals.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026