- Canada

- /

- Metals and Mining

- /

- TSX:CS

A Look at Capstone Copper (TSX:CS) Valuation Following Sustainability Milestones and Mantoverde Launch

Reviewed by Kshitija Bhandaru

Capstone Copper (TSX:CS) has released its 2024 Sustainability Report, highlighting a series of achievements on the environmental and operational front. These include newly launched production at the Mantoverde concentrator, steps forward in renewable energy adoption, and improved water management.

See our latest analysis for Capstone Copper.

Capstone Copper’s year has been eventful, with momentum building around the launch of its Mantoverde concentrator and strategic deals such as the sale of a 25% stake in the Santo Domingo Project. Despite some large insider sales, the 90-day share price return of 43.5% and a strong five-year total shareholder return of 549.7% reflect sustained outperformance. However, the one-year total return softened to 6%.

If you’re looking to expand your search after Capstone’s surge, now is a great opportunity to discover fast growing stocks with high insider ownership.

But with the stock up sharply over the past three months and trading near its price target, the big question is whether Capstone Copper is still undervalued, or if the market has already factored in its future upside.

Most Popular Narrative: 8% Undervalued

The narrative’s fair value calculation puts Capstone Copper’s shares higher than the recent close, reflecting a case for further upside. This view builds on new growth projects and the Company’s improving profit outlook, inviting investors to look past near-term skepticism.

The imminent execution of the Mantoverde Optimized project, following recent permit approval, will materially increase throughput and sustain higher copper production at lower incremental cost. This is expected to positively impact both revenue and net margins as expanded volumes are realized.

Want to know the single biggest driver behind this valuation target? The secret lies in the expected transformation of margins and a profit profile that most miners could only hope for. Discover which powerful assumptions are fueling this bold fair value. See what makes analysts so confident in their outlook.

Result: Fair Value of $12.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, severe water shortages at Pinto Valley or unexpected setbacks at key projects could dampen Capstone’s future profitability and investor optimism.

Find out about the key risks to this Capstone Copper narrative.

Another View: What Do Market Comparisons Say?

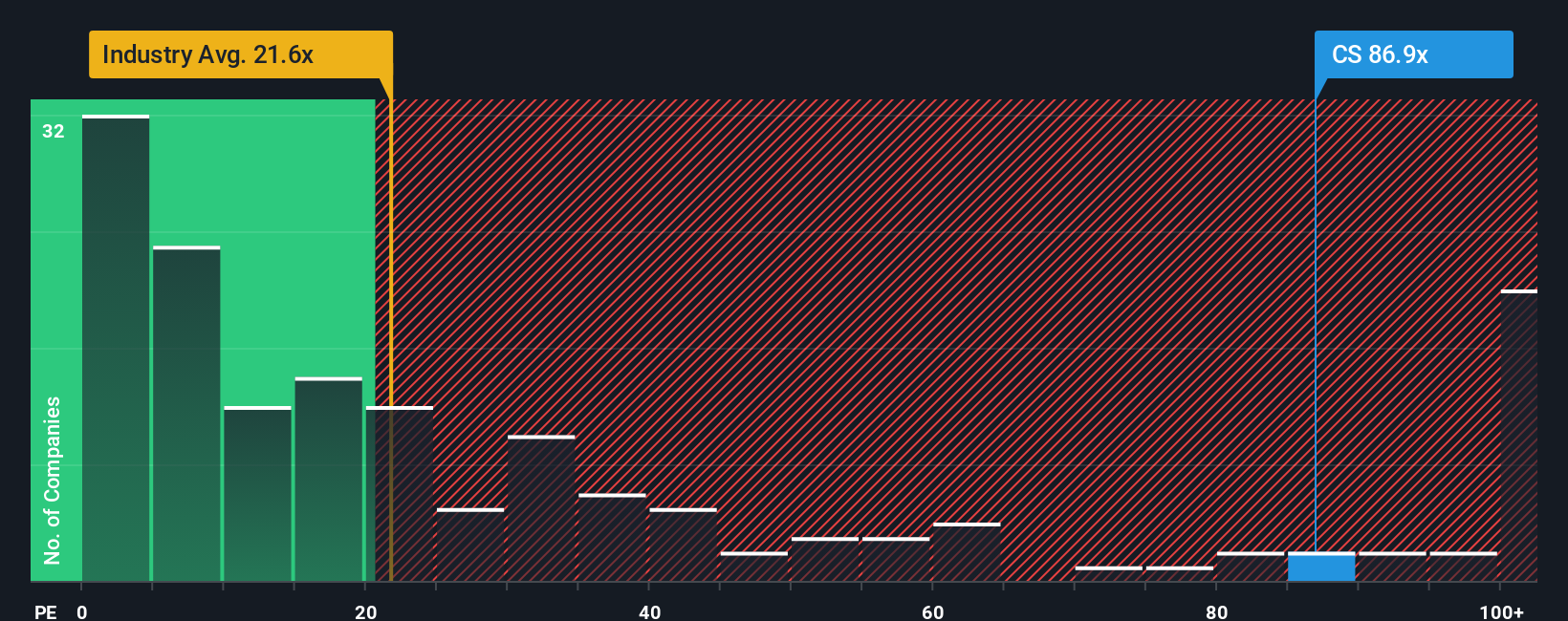

Taking a closer look at valuation based on earnings, Capstone Copper trades at an 80x price-to-earnings ratio, significantly above both peer averages (49.7x) and the industry standard (22.5x). The fair ratio of 38.3x suggests the stock's price could trend lower if sentiment shifts. Is the market overlooking concrete risks, or pricing in growth that may be challenging to deliver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capstone Copper Narrative

If you want to challenge these perspectives or dig deeper into the numbers yourself, you can explore the insights and shape your own view in just a few minutes, all at your own pace. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Capstone Copper.

Looking for more investment ideas?

Unlock a world of opportunity with carefully chosen investment themes designed to help you get ahead and seize what others might miss.

- Capture strong yields for your portfolio by targeting these 18 dividend stocks with yields > 3%, offering consistent returns and attractive income potential above 3%.

- Ride emerging market shifts and seek outgrowth prospects with these 24 AI penny stocks as artificial intelligence transforms industries and ignites new winners.

- Position yourself early by identifying tomorrow’s leaders through these 878 undervalued stocks based on cash flows, where quality companies with untapped value still fly under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CS

Capstone Copper

A copper mining company, mines, explores for, and develops mineral properties in the United States, Chile, and Mexico.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives