- Canada

- /

- Metals and Mining

- /

- TSX:CNL

Collective Mining (TSX:CNL): Assessing Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

Collective Mining (TSX:CNL) is attracting fresh attention, and investors are left wondering what’s driving the interest. There hasn’t been a specific news event or material development to spark the latest move. Sometimes the market shifts for reasons that don’t immediately make headlines. These moments can serve as catalysts in disguise and may offer a chance to reassess what the market is anticipating for the company’s future prospects.

Over the past year, Collective Mining has delivered a return of 3 percent, which is a modest gain. The momentum has noticeably picked up in the past month, with shares climbing over 43 percent. Even though revenue remains at zero and profitability is still out of reach, the company’s annual revenue growth and narrowing net losses have not gone unnoticed. For investors watching closely, these developments fit into a larger pattern of volatility and optimism that is becoming more pronounced as the year progresses.

After a sharp run-up in the past month, the question remains whether Collective Mining is trading at an attractive level or if the market has already factored in expectations for growth ahead.

Price-to-Book of 16.3x: Is it justified?

Collective Mining is currently trading at a price-to-book (P/B) ratio of 16.3, which is significantly higher than both its peer average of 2.3 and the broader Canadian Metals and Mining industry average of 2.2. This elevated multiple suggests that investors are pricing in a great deal of future potential or assigning value to intangible assets, despite the current lack of profitability.

The price-to-book ratio measures the market's valuation of a company relative to its book value. For mining and resource companies, this metric is often used because traditional earnings-based multiples like price-to-earnings can be misleading when companies are pre-revenue or unprofitable, as is the case with Collective Mining. A high P/B ratio can indicate strong confidence in the company's resource potential or management, but it can also signal overvaluation if future growth does not materialize.

Given the company’s persistent losses and zero current revenue, the market appears to be heavily overpricing expected growth. While high P/B ratios are not unusual in speculative growth sectors, investors should consider whether Collective Mining’s projected revenue and operational milestones can justify such an aggressive valuation.

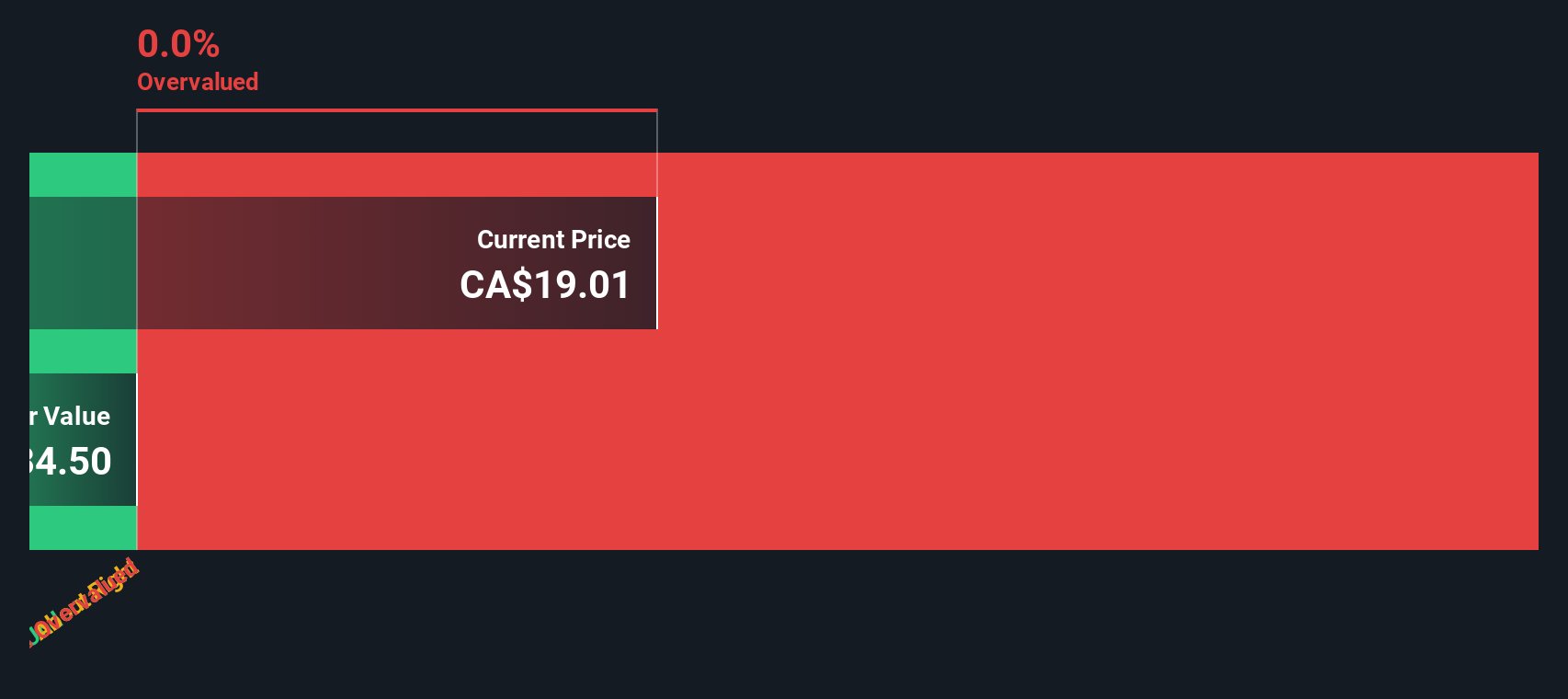

Result: Fair Value of $18.88 (OVERVALUED)

See our latest analysis for Collective Mining.However, sustained operating losses and lack of meaningful revenue could quickly shift sentiment if progress stalls. This could add further pressure to the current valuation.

Find out about the key risks to this Collective Mining narrative.Another View: How Does Our DCF Model Stack Up?

Taking a different approach, the SWS DCF model provides another lens for Collective Mining’s valuation. While it may challenge what the market’s multiples are saying, it could suggest a revised outlook for investors.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Collective Mining Narrative

Readers who want to dig deeper or draw their own conclusions can explore the numbers and insights on their own. This allows them to create an independent view in just a few minutes. Do it your way

A great starting point for your Collective Mining research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let potential winners slip by while you focus on a single stock. Give yourself an edge by uncovering stocks that match your goals and strategy.

- Spot undervalued gems and seize growth potential before the crowd by checking stocks that stand out for their price-to-cash-flow strength with undervalued stocks based on cash flows.

- Target high-yield income streams and secure your portfolio with companies offering market-beating dividends using dividend stocks with yields > 3%.

- Get ahead of the AI revolution and gain exposure to game-changing technologies by exploring firms backed by artificial intelligence innovation via AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNL

Collective Mining

Engages in the acquisition, exploration, and development of mineral properties located in Colombia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives