Sentiment Still Eluding Chemtrade Logistics Income Fund (TSE:CHE.UN)

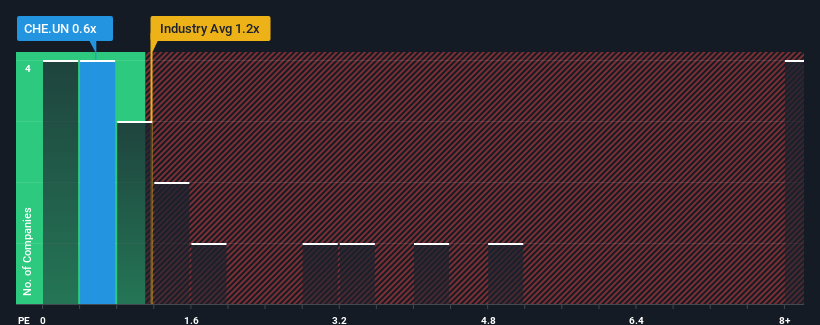

You may think that with a price-to-sales (or "P/S") ratio of 0.6x Chemtrade Logistics Income Fund (TSE:CHE.UN) is a stock worth checking out, seeing as almost half of all the Chemicals companies in Canada have P/S ratios greater than 1.2x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Chemtrade Logistics Income Fund

What Does Chemtrade Logistics Income Fund's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Chemtrade Logistics Income Fund has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chemtrade Logistics Income Fund.How Is Chemtrade Logistics Income Fund's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Chemtrade Logistics Income Fund's to be considered reasonable.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 33% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company are not great, suggesting revenue should decline by 3.4% over the next year. This is still shaping up to be materially better than the broader industry which is also set to decline 5.7%.

With this information, it's perhaps strange but not a major surprise that Chemtrade Logistics Income Fund is trading at a lower P/S in comparison. Even though the company may outperform the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. There's still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Chemtrade Logistics Income Fund currently trades on a much lower than expected P/S since its revenue forecast is not as bad as the struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the more attractive outlook. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. So, given the low P/S, risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Chemtrade Logistics Income Fund you should be aware of, and 1 of them is a bit unpleasant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CHE.UN

Chemtrade Logistics Income Fund

Offers industrial chemicals and services in Canada, the United States, and South America.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives