Chemtrade Logistics Income Fund (TSE:CHE.UN) Will Pay A Dividend Of CA$0.05

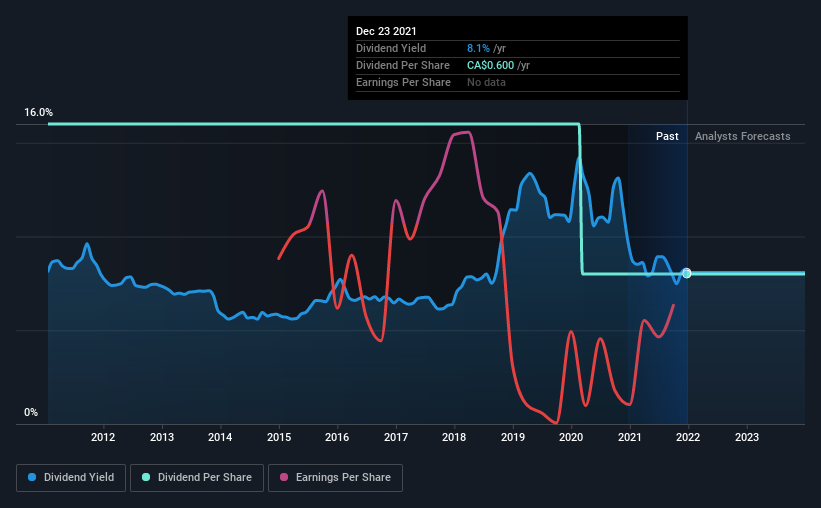

Chemtrade Logistics Income Fund (TSE:CHE.UN) has announced that it will pay a dividend of CA$0.05 per share on the 26th of January. This means the annual payment is 8.1% of the current stock price, which is above the average for the industry.

View our latest analysis for Chemtrade Logistics Income Fund

Chemtrade Logistics Income Fund Might Find It Hard To Continue The Dividend

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. While Chemtrade Logistics Income Fund is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

Looking forward, earnings per share is forecast to expand by 86.8% over the next year. It's encouraging to see things moving in the right direction, but this probably won't be enough for the company to turn a profit. However, the positive cash flow ratio gives us some comfort about the sustainability of the dividend.

Chemtrade Logistics Income Fund's Track Record Isn't Great

The company hasn't been particularly volatile, but it has been steadily decreasing which of course is not what investors like to see. Since 2011, the first annual payment was CA$1.20, compared to the most recent full-year payment of CA$0.60. Doing the maths, this is a decline of about 6.7% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Over the past five years, it looks as though Chemtrade Logistics Income Fund's EPS has declined at around 36% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

We'd also point out that Chemtrade Logistics Income Fund has issued stock equal to 12% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 2 warning signs for Chemtrade Logistics Income Fund you should be aware of, and 1 of them is significant. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you're looking to trade Chemtrade Logistics Income Fund, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CHE.UN

Chemtrade Logistics Income Fund

Offers industrial chemicals and services in Canada, the United States, and South America.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives