- Canada

- /

- Metals and Mining

- /

- TSX:CGG

Did Hang Seng Index Addition Just Shift China Gold International Resources' (TSX:CGG) Investment Narrative?

Reviewed by Sasha Jovanovic

- China Gold International Resources Corp. Ltd has recently been added to the Hang Seng China Affiliated Corporations Index, highlighting its rising profile among Hong Kong-listed companies.

- This index inclusion often positions companies for greater visibility among institutional investors and can influence fund allocations due to index-tracking investment strategies.

- With index inclusion now confirmed, we'll explore how increased exposure from institutional investors could impact China Gold International Resources' investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is China Gold International Resources' Investment Narrative?

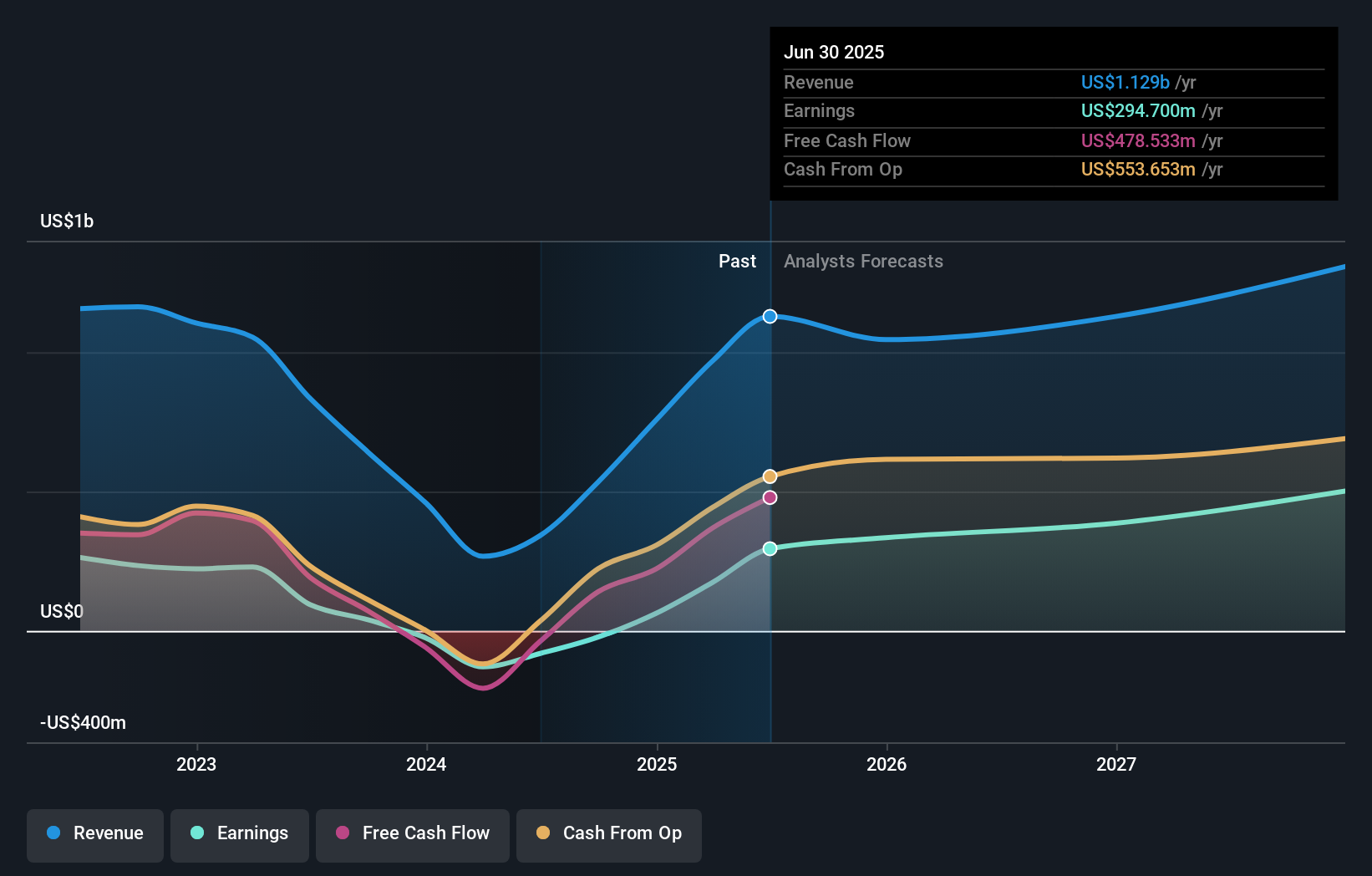

To be a shareholder in China Gold International Resources, you need to believe in the company's ability to maintain profitable production and capitalize on recent momentum in both gold and copper outputs. The inclusion in the Hang Seng China Affiliated Corporations Index could meaningfully shape short-term catalysts, potentially bringing new institutional buyers and liquidity that might influence price action. While operational progress, such as surging sales and a strong move to profitability, has been reflected in recent performance, index inclusion has a way of amplifying both positive and negative trends, depending on execution and sentiment. The main risks remain around earnings volatility, ongoing board transitions, and a recent auditor change, which now take on added importance as the company faces a new level of market scrutiny. For investors, the shift in index status elevates both the potential for short-term upside from higher visibility and the stakes if any operational or governance issues re-emerge. However, risks around leadership changes could still weigh on confidence for some.

China Gold International Resources' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on China Gold International Resources - why the stock might be worth 26% less than the current price!

Build Your Own China Gold International Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Gold International Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free China Gold International Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Gold International Resources' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CGG

China Gold International Resources

A gold and base metal mining company, acquires, explores, develops, and mines mineral resources in the People’s Republic of China and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives