- Hong Kong

- /

- Real Estate

- /

- SEHK:535

Top Undervalued Small Caps With Insider Action For September 2024

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's first rate cut in over four years, small-cap stocks have shown notable resilience despite still trailing their previous peaks. The Russell 2000 Index, while outperforming recently, remains approximately 9% below its all-time high from November 2021. In this environment, identifying undervalued small-cap stocks with insider action can be particularly rewarding. These companies often present unique opportunities for growth and value creation amid broader market shifts and economic indicators.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Genus | 164.3x | 1.9x | 0.49% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 26.33% | ★★★★★☆ |

| Rogers Sugar | 15.8x | 0.6x | 46.90% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -55.44% | ★★★★☆☆ |

| Franklin Financial Services | 9.8x | 1.9x | 39.21% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.7x | 3.4x | 41.18% | ★★★★☆☆ |

| Studsvik | 20.2x | 1.2x | 42.32% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -102.15% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -220.20% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Shanghai Chicmax Cosmetic (SEHK:2145)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Chicmax Cosmetic is a company focused on the manufacture and sale of cosmetic products with operations generating CN¥6.11 billion.

Operations: The company generates revenue primarily from the manufacture and sale of cosmetic products, with a recent revenue figure reaching CN¥6106.30 million. The gross profit margin has shown an upward trend, peaking at 74.96% as of June 2024. Operating expenses are significant, driven largely by sales and marketing costs which amounted to CN¥3406.32 million in the same period.

PE: 19.2x

Shanghai Chicmax Cosmetic, a small cap company, has shown significant growth with sales reaching CNY 3.5 billion and net income hitting CNY 401.2 million for the half year ending June 30, 2024. Earnings per share rose to CNY 1.01 from CNY 0.25 a year ago, reflecting strong performance in its major brand KANS and second-tier brand newpage. Insider confidence is evident with recent share purchases by executives in the past six months, indicating potential undervaluation of the stock's current price levels.

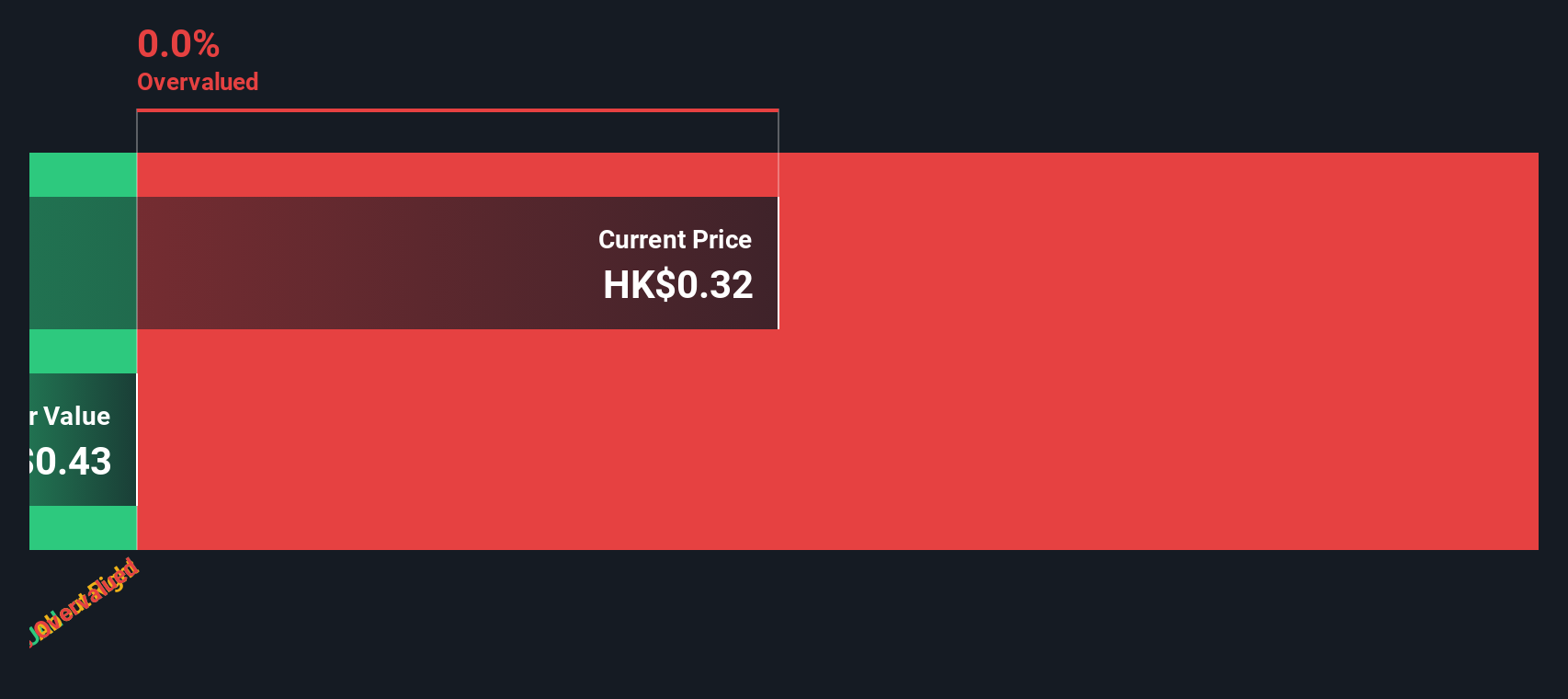

Gemdale Properties and Investment (SEHK:535)

Simply Wall St Value Rating: ★★★★☆☆

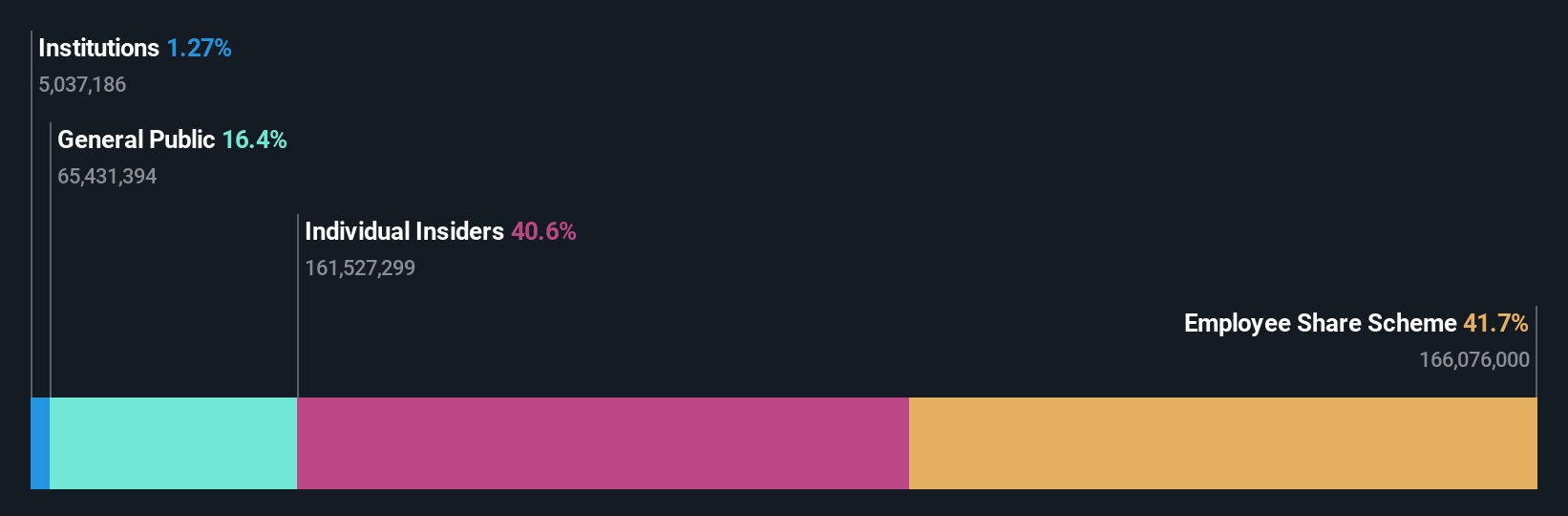

Overview: Gemdale Properties and Investment focuses on property development and property investment and management, with operations generating significant revenue in these segments.

Operations: The company's revenue primarily comes from Property Development (CN¥17.26 billion) and Property Investment and Management (CN¥1.23 billion). Notably, the gross profit margin has shown significant fluctuations, with a recent value of 0.08825%.

PE: -1.7x

Gemdale Properties and Investment, a smaller stock, recently reported aggregate contracted sales of RMB 1.29 billion for August 2024 with an average selling price of RMB 13,600 per square meter. Despite a net loss of CNY 2.18 billion for the first half of 2024 due to increased impairment losses, insider confidence is evident with Lian Huat Loh purchasing 10 million shares worth approximately US$2.6 million in August, reflecting significant faith in the company's potential despite current challenges.

- Click here to discover the nuances of Gemdale Properties and Investment with our detailed analytical valuation report.

Understand Gemdale Properties and Investment's track record by examining our Past report.

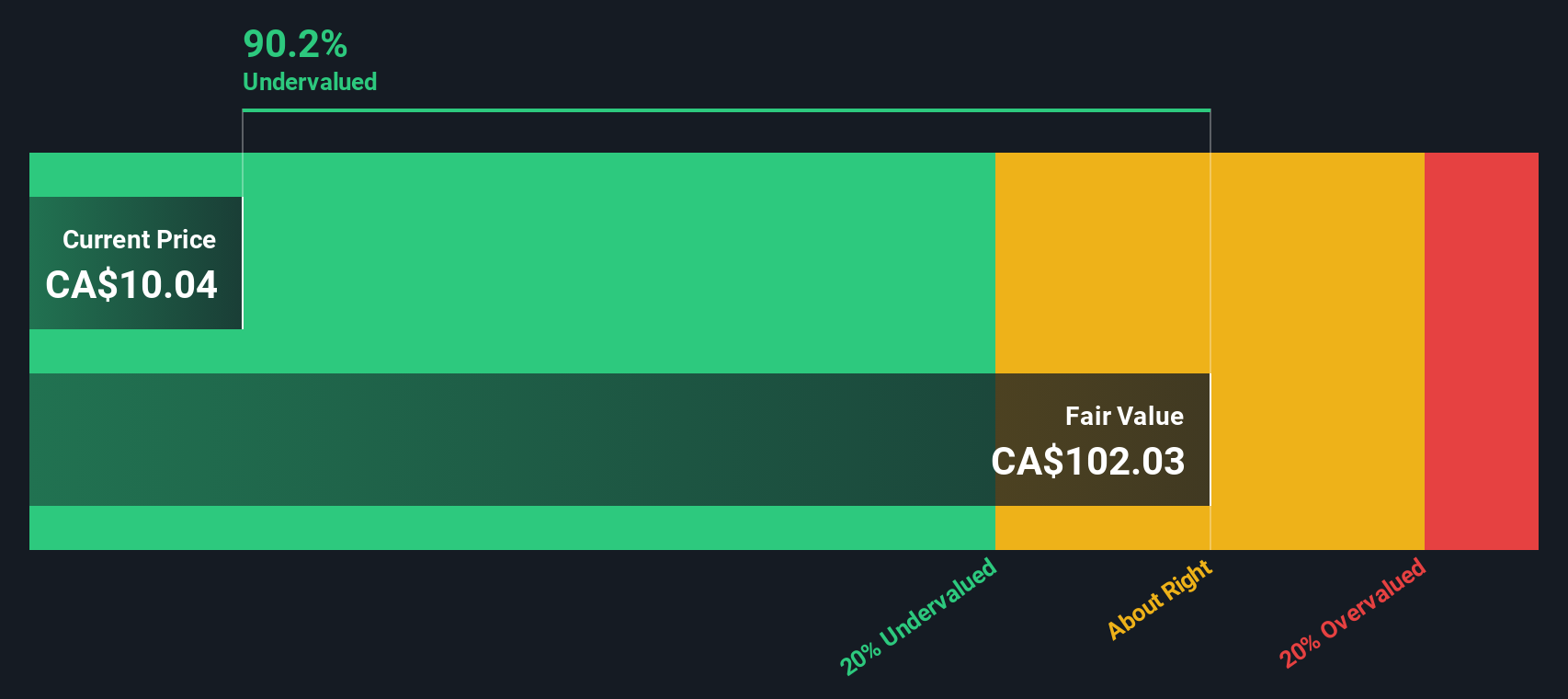

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Centerra Gold is a Canadian-based gold mining and exploration company with operations primarily in Turkey, Canada, and the United States, boasting a market cap of approximately C$1.77 billion.

Operations: Centerra Gold generates revenue from Öksüt, Molybdenum, and Mount Milligan segments. The company's net income margin has shown variability over the periods, with notable instances of negative margins like -0.34708% in 2023-06-30 and positive margins such as 0.49653% in 2021-12-31.

PE: 12.6x

Centerra Gold, a smaller player in the mining industry, has shown significant improvement in its financial performance. For Q2 2024, it reported sales of US$282.31 million and net income of US$37.67 million, reversing a loss from the previous year. The company’s gold production increased to 89,828 ounces from 61,622 ounces year-over-year. Insider confidence is evident with recent share repurchases totaling 1.44 million shares for US$9.8 million between April and June 2024.

- Navigate through the intricacies of Centerra Gold with our comprehensive valuation report here.

Gain insights into Centerra Gold's past trends and performance with our Past report.

Summing It All Up

- Click through to start exploring the rest of the 177 Undervalued Small Caps With Insider Buying now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:535

Gemdale Properties and Investment

An investment holding company, engages in the property investment, development, and management activities in Mainland China.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives