- Canada

- /

- Metals and Mining

- /

- TSX:CG

How QCM Drilling Progress Will Impact Centerra Gold (TSX:CG) Investors

Reviewed by Simply Wall St

- Earlier this month, Centerra Gold provided an update on its ongoing $3 million exploration program at the QCM gold property in central British Columbia, reporting the completion of 2,640 metres of diamond drilling across nine holes at the Main Zone and outlining plans for continued drilling at the recently discovered 14 Vein zone.

- The improved access to the property, paired with historical and recent intersections of gold-bearing mineralization, highlights growing exploration potential that could enhance project value going forward.

- We’ll examine how this progress in QCM drilling may influence perceptions of Centerra Gold’s resource expansion potential and investment outlook.

Centerra Gold Investment Narrative Recap

Centerra Gold’s investment case rests on confidence in its ability to expand and convert resources at its key North American properties, balancing rising costs at existing operations with new exploration-driven growth. The news of ongoing drilling at QCM adds incremental substance to the company’s short-term catalyst, growing reserves, but does not materially shift the immediate picture, as the main risk continues to be production headwinds at established mines like Mount Milligan and Öksüt.

Among recent announcements, Centerra’s decision to double exploration guidance at Kemess stands out, as it underscores management’s intent to diversify future production beyond its current cornerstone assets. This is particularly relevant against the backdrop of QCM’s exploration update, as both highlight management’s drive to uncover new sources of potential value that could help offset operational challenges elsewhere.

However, investors should also recognize that, despite exploration updates, continued declines in gold and copper grades or rising input costs at Mount Milligan remain unresolved risks worth watching...

Read the full narrative on Centerra Gold (it's free!)

Centerra Gold's outlook anticipates $1.3 billion in revenue and $174.5 million in earnings by 2028. This is based on a 2.9% annual revenue growth rate and a $94.1 million increase in earnings from the current $80.4 million.

Exploring Other Perspectives

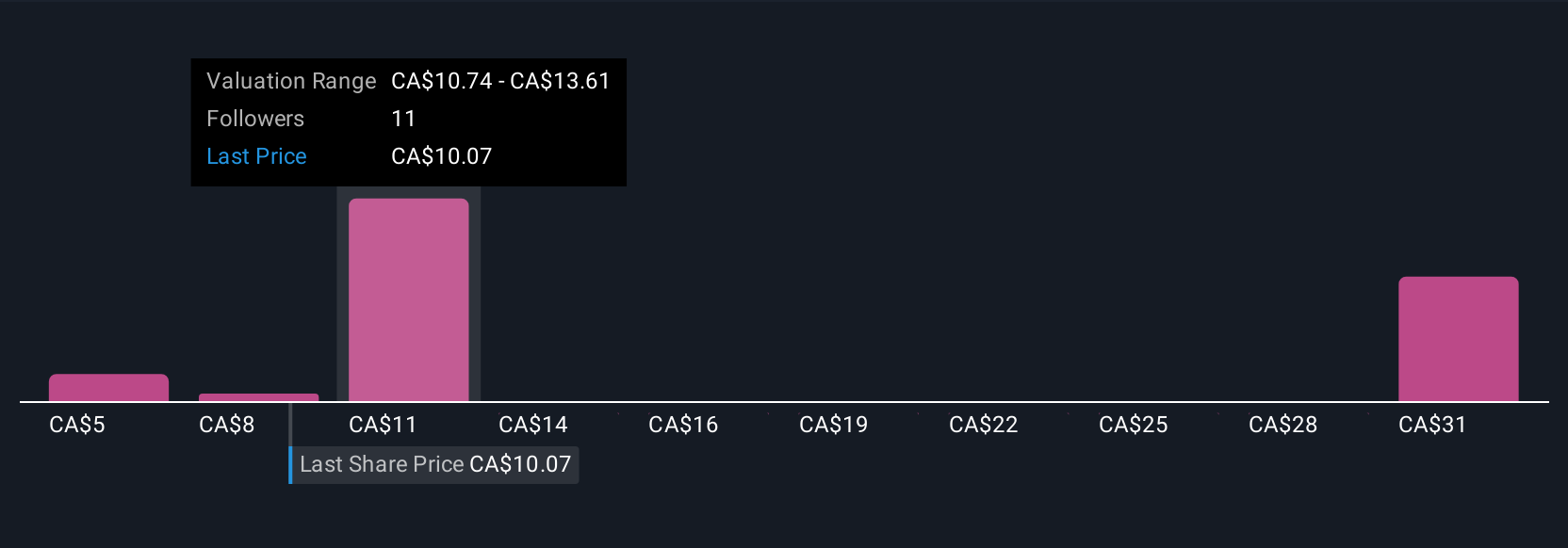

Five fair value estimates from the Simply Wall St Community range from CA$5 to CA$101.05 per share, revealing vast differences in expected upside. While exploration results at QCM provide a catalyst for resource expansion, ongoing cost pressures at core mines could impact how these valuations play out, readers should weigh these perspectives carefully.

Build Your Own Centerra Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centerra Gold research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centerra Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centerra Gold's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives