- Canada

- /

- Metals and Mining

- /

- TSX:CG

Did Goldfield Advancements Just Shift Centerra Gold's (TSX:CG) Long-Term Growth Narrative?

Reviewed by Simply Wall St

- Earlier this month, Centerra Gold announced the completion of a technical study for its Goldfield project in Nevada, confirming plans to move forward with detailed engineering and procurement after finding strong project economics at an assumed long-term gold price of US$2,500 per ounce.

- This decision accompanies Centerra’s release of improved second quarter earnings, a revised gold production guidance, dividend affirmation, share buyback update, and production results, reflecting a period of significant operational and strategic developments for the company.

- We’ll now explore how the advancement of the Goldfield project may enhance Centerra Gold’s overall investment narrative and growth outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Centerra Gold Investment Narrative Recap

Centerra Gold’s investment story has long hinged on the belief that disciplined project execution, prudent capital allocation, and new mine developments can offset existing operational headwinds and gold price volatility. The company’s decision to advance the Goldfield project brings a significant long-term growth catalyst, but recent reductions in consolidated production guidance highlight that output stability at operating mines remains the most important short-term driver, while geological uncertainty at Mount Milligan continues to be the biggest immediate risk; these news events do not materially change that risk profile.

The revised gold production guidance for 2025 is the key recent announcement tied to this update, reducing expectations from 270,000–310,000 ounces to 250,000–290,000 ounces, directly reflecting ongoing headwinds at core assets and underscoring the importance of careful execution as Centerra brings new projects online and seeks to maintain steady free cash flow.

Yet, it’s important for investors to recognize that, despite Goldfield’s progress, ongoing challenges at Mount Milligan could...

Read the full narrative on Centerra Gold (it's free!)

Centerra Gold's outlook projects $1.6 billion in revenue and $193.3 million in earnings by 2028. This assumes a 9.2% annual revenue growth rate and a $118 million increase in earnings from $75.3 million today.

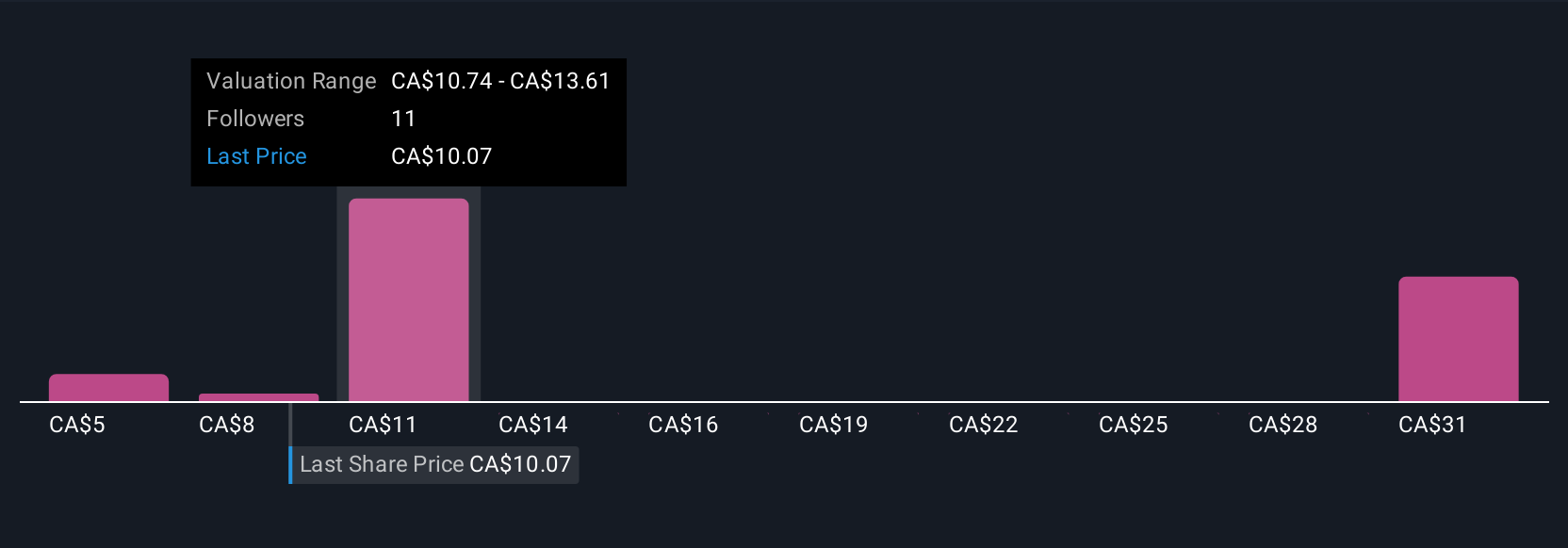

Uncover how Centerra Gold's forecasts yield a CA$12.49 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted fair value estimates from CA$5.35 to CA$15.03 based on seven different forecasts. Many cite uncertainties around Mount Milligan’s resource predictability and its broad implications for near-term production, signaling how much opinions on Centerra Gold’s prospects can differ.

Explore 7 other fair value estimates on Centerra Gold - why the stock might be worth as much as 50% more than the current price!

Build Your Own Centerra Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centerra Gold research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Centerra Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centerra Gold's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives