- Canada

- /

- Metals and Mining

- /

- TSX:CG

Centerra Gold (TSX:CG) One-Off Gain Lifts Profit Margin, Challenges Quality of Earnings Narratives

Reviewed by Simply Wall St

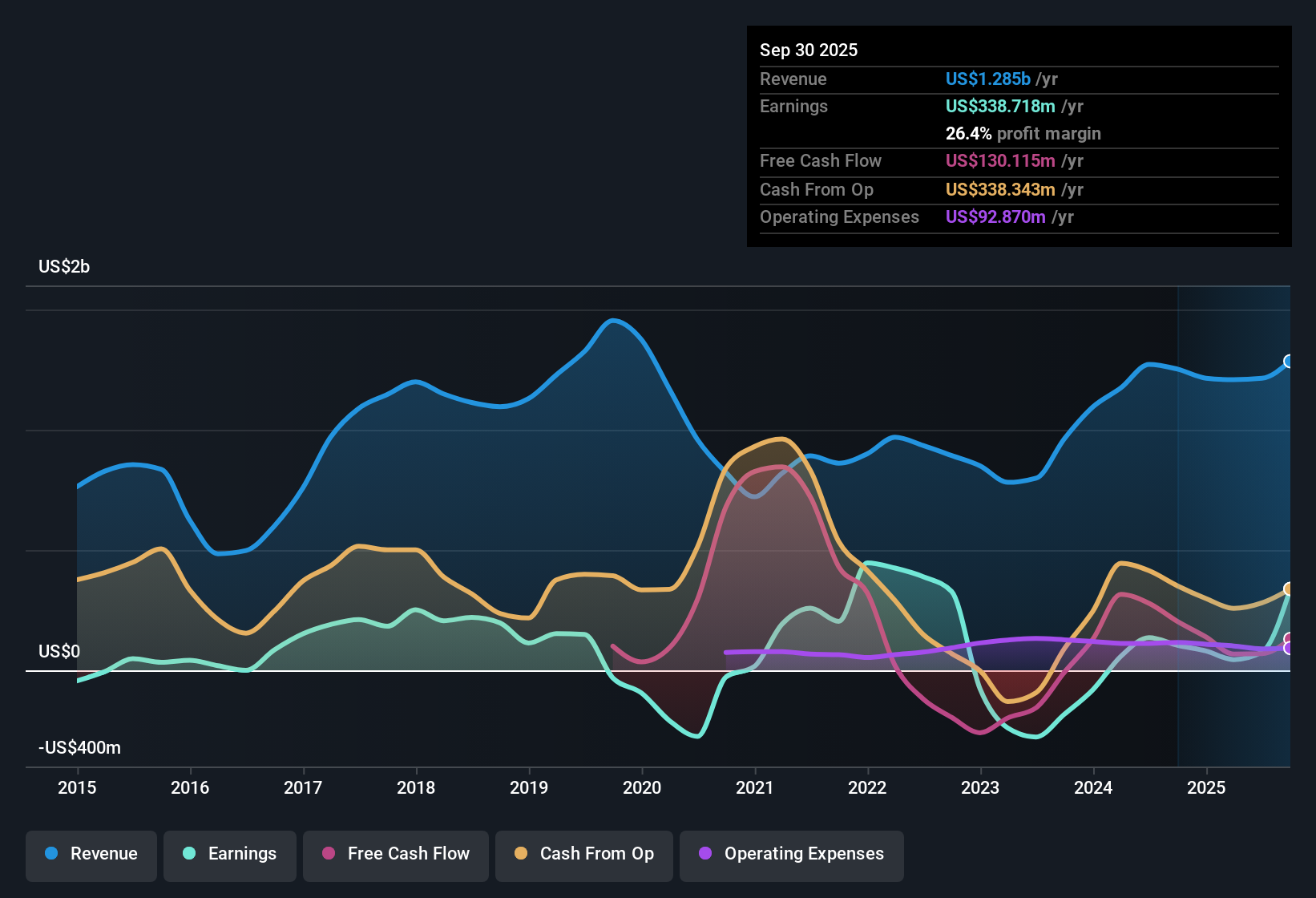

Centerra Gold (TSX:CG) reported a one-off gain of $288.0 million over the past twelve months to September 30, 2025, which drove its net profit margin up to 26.4%. This marks a significant jump from last year’s 8.3%. Earnings surged 225.3% year-over-year, a sharp turnaround from the company’s 5-year average decline of -12.3% per year. Profit margins and earnings have both seen marked improvements as Centerra returned to profitability. Investors are now weighing strong headline numbers and attractive valuation multiples against questions around the sustainability of earnings and future growth rates.

See our full analysis for Centerra Gold.Next, we’ll see how the current results compare to the prevailing narratives in the market. Some expectations will be reinforced, while others might get a second look.

See what the community is saying about Centerra Gold

Analyst Price Target Just Edges Current Price

- The current share price of CA$15.71 sits only 7.4% below the latest analyst consensus target of CA$16.96, highlighting a muted near-term upside according to coverage.

- Analysts' consensus view points out a nuanced stance, with most expecting Centerra Gold to be fairly priced at present, based on assumptions that future revenues will rise to $1.6 billion, earnings to reach $106.3 million by 2028, and the valuation to normalize to a price-to-earnings ratio of 18.6x, which is modestly above the sector average.

- Despite the impressive one-off gain, there is considerable divergence among analysts: the highest earnings estimate for 2028 is $350 million, while the lowest is $52 million, revealing uncertainty about whether headline growth can translate into sustained performance.

- The small difference between the share price and the target reflects a broad expectation that most of the recent improvement is either already priced in or is offset by risks around earnings quality.

Curious how the Street is weighing up both sides? Get the full run-down in the consensus narrative and see what numbers might push the stock in either direction. 📊 Read the full Centerra Gold Consensus Narrative.

Revenue Growth Tops Industry, Margins in Focus

- Revenue is forecast to grow at 8.3% annually, which stands solidly above the broader Canadian market’s 4.9% expected pace through 2028.

- Analysts' consensus narrative calls out that new gold projects and ongoing enhancements, such as expansion at Mount Milligan and optimized recovery at Goldfield, are seen as key engines to maintain this outperformance. At the same time, cost pressures across the industry mean profit margin improvements are likely to be incremental, not dramatic.

- Consensus notes that technical upgrades may support higher output and margins, yet warns that industry-wide inflation and royalty changes (especially in Turkey) could erode some of these benefits over time.

- While liquidity and “self-funding” are strengths, all-in sustaining costs are rising, and future growth will depend on whether operational improvements outpace these industry headwinds.

Low Price-to-Earnings Ratio Signals Deep Value

- Centerra’s price-to-earnings ratio is just 6.7x, a steep discount compared to peers (15.1x) and the Canadian metals and mining industry (21.2x), while the DCF fair value estimate stands at CA$74.23, far above the current market price.

- According to the analysts' consensus view, this valuation gap heavily supports the deep value case for Centerra, suggesting the market may be skeptical about the durability of recent profits given the non-recurring nature of the latest gain and the expectation for earnings to decline by 3% per year ahead.

- Consensus cautions that valuation will only close if Centerra’s organic growth projects deliver as modeled. Otherwise, sustained low multiples could persist if earnings retrace as forecast.

- The wide gap to DCF fair value reflects market demands for clearer evidence that earnings quality and profit margins are firmly improving beyond one-off effects.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Centerra Gold on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Share your insight and build your own perspective in just a few minutes with Do it your way.

A great starting point for your Centerra Gold research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Centerra Gold’s impressive rebound, questions remain about whether its earnings momentum can last. Consensus warns that recent gains may prove unsustainable.

If you want more confidence in long-term track records, check out stable growth stocks screener (2121 results) to highlight companies with consistent, reliable growth that stands up in any environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CG

Centerra Gold

Engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives