- Canada

- /

- Specialty Stores

- /

- TSX:ACQ

AutoCanada And 2 Other Undervalued Small Caps With Insider Buying In Canada

Reviewed by Simply Wall St

The recent rate cut by the Federal Reserve, alongside similar moves by the Bank of Canada, has created a more favorable environment for small-cap stocks in Canada. In this context, identifying undervalued small caps with insider buying can offer promising opportunities for investors looking to capitalize on market shifts.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Vermilion Energy | NA | 1.1x | 47.93% | ★★★★★★ |

| Trican Well Service | 7.8x | 1.0x | 12.17% | ★★★★★☆ |

| Nexus Industrial REIT | 3.8x | 3.8x | 20.18% | ★★★★★☆ |

| Flagship Communities Real Estate Investment Trust | 3.6x | 3.8x | 46.00% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 46.88% | ★★★★★☆ |

| Rogers Sugar | 15.8x | 0.6x | 46.90% | ★★★★☆☆ |

| Sagicor Financial | 1.2x | 0.3x | -33.16% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -55.44% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.7x | 3.4x | 41.18% | ★★★★☆☆ |

| Hemisphere Energy | 6.3x | 2.4x | -227.48% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

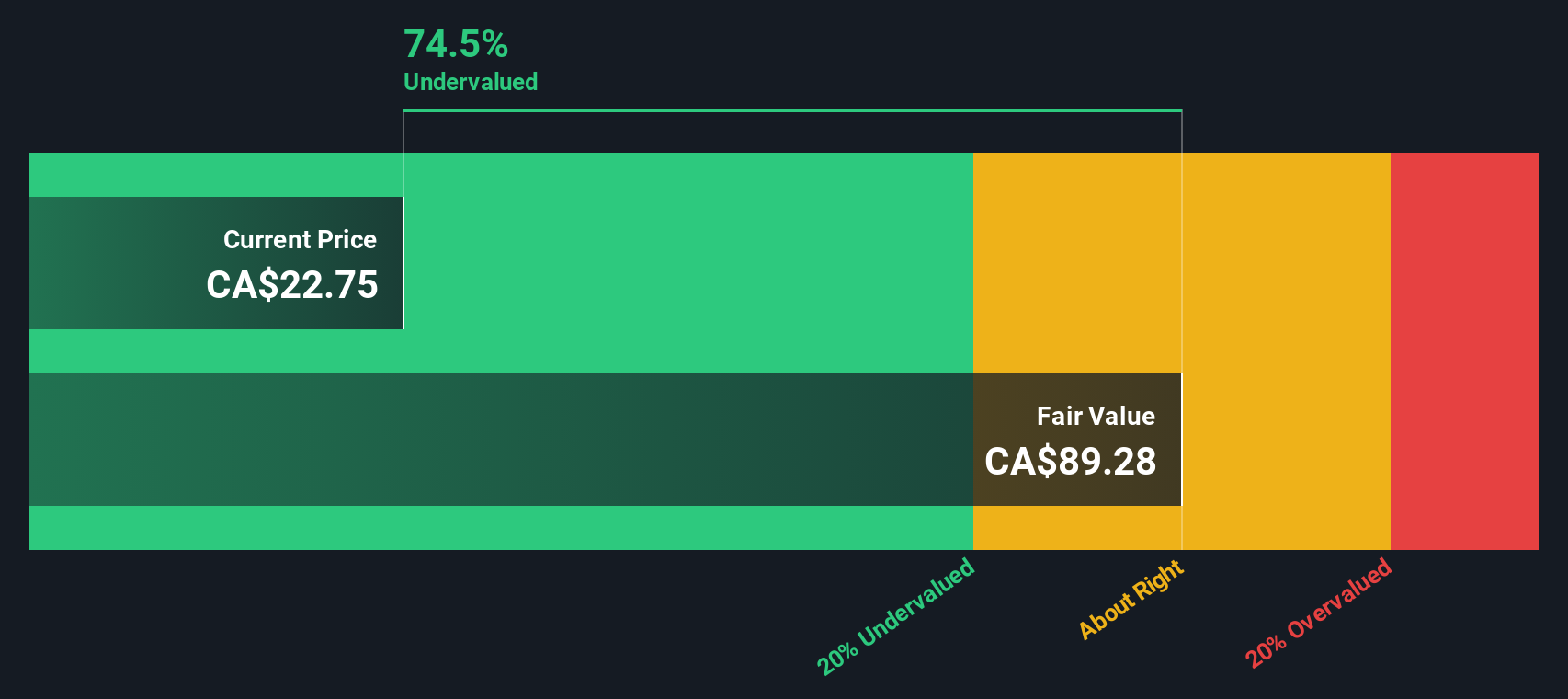

AutoCanada (TSX:ACQ)

Simply Wall St Value Rating: ★★★★★☆

Overview: AutoCanada operates a network of retail automobile dealerships across Canada, with a market cap of approximately CA$0.54 billion.

Operations: AutoCanada generates revenue primarily from its retail automobile dealerships, which amounted to CA$6.16 billion as of the latest period. The company’s cost of goods sold (COGS) was CA$5.14 billion, resulting in a gross profit margin of 16.66%.

PE: -10.6x

AutoCanada, a smaller Canadian company, recently completed strategic divestitures to enhance profitability and reduce leverage. Despite reporting a net loss of C$34.28 million for Q2 2024, the company forecasts earnings growth of 73.23% annually. Insider confidence is evident with Christopher Harris purchasing 7,500 shares valued at C$103,500 in recent months. Additionally, AutoCanada repurchased 452,345 shares for C$9.74 million between April and August 2024 to bolster shareholder value amidst challenging financial conditions.

- Take a closer look at AutoCanada's potential here in our valuation report.

Explore historical data to track AutoCanada's performance over time in our Past section.

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Centerra Gold is a Canadian-based gold mining and exploration company with operations in Turkey, Canada, and the United States, and has a market cap of approximately $1.85 billion CAD.

Operations: Centerra Gold generates revenue from its Öksüt, Molybdenum, and Mount Milligan segments. The company's gross profit margin has shown variability, with a recent figure of 44.22% as of June 30, 2024. Operating expenses and non-operating expenses significantly impact net income margins, which have fluctuated over time.

PE: 12.6x

Centerra Gold, a smaller Canadian mining company, has recently shown insider confidence with significant share purchases. Between April and June 2024, the company repurchased 1.44 million shares for $9.8 million, contributing to a total of 3.59 million shares repurchased since November 2023 for $21.9 million. For Q2 2024, Centerra reported sales of $282 million and net income of $37.67 million compared to a loss last year, highlighting improved financial performance despite forecasted earnings decline over the next three years by an average of 9.8%.

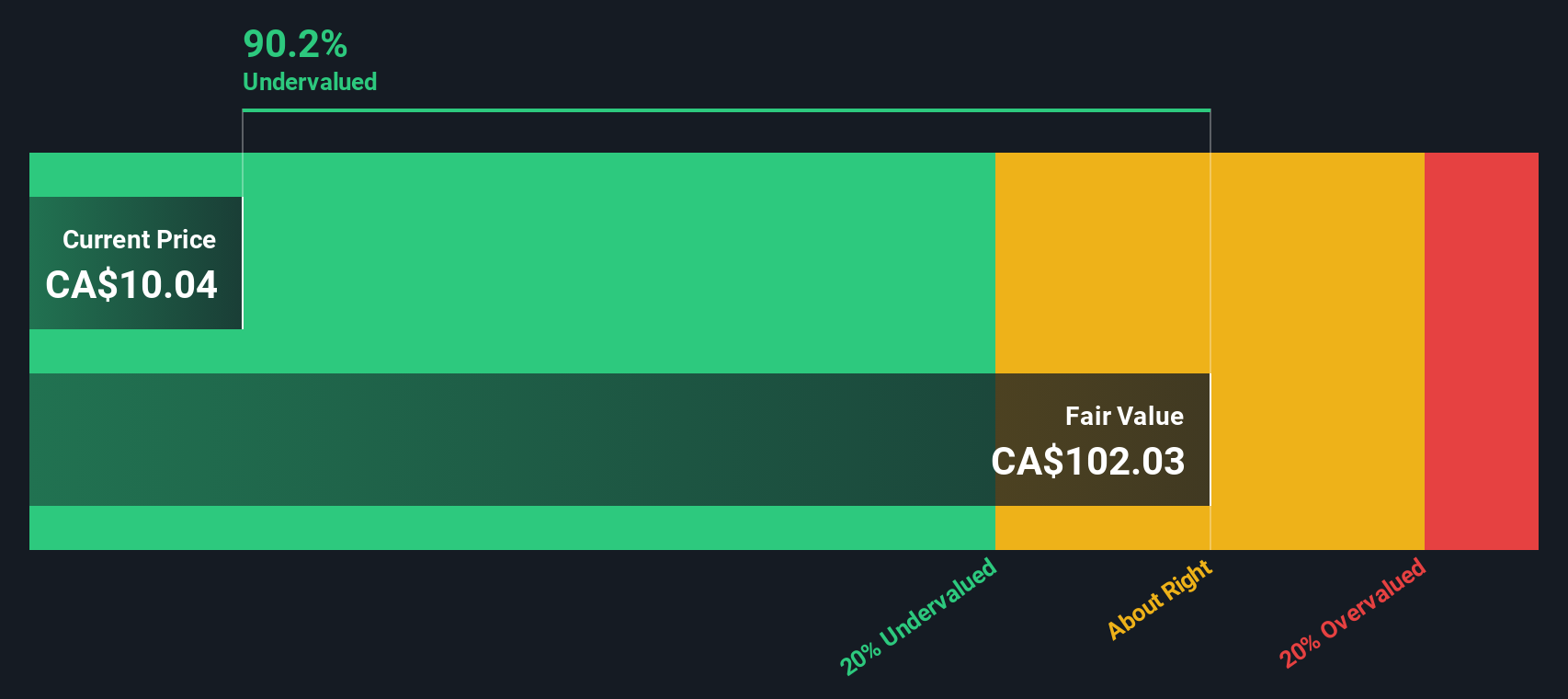

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust operates a portfolio of healthcare real estate properties and has a market cap of approximately CA$2.63 billion.

Operations: The company generates revenue primarily from the healthcare real estate industry, with recent figures showing CA$523.85 million. Notably, gross profit margins have fluctuated over time, reaching as high as 94.83% and as low as 69.89%. Operating expenses and non-operating expenses significantly impact net income, leading to variable net income margins ranging from -75.29% to 86.50%.

PE: -3.6x

NorthWest Healthcare Properties Real Estate Investment Trust, with a focus on healthcare properties, shows potential as an undervalued stock in Canada. Despite recent financial challenges, including a net loss of C$122 million for Q2 2024 and declining sales, insider confidence is evident. Independent Trustee Peter Aghar bought 100,000 shares worth approximately C$478K recently. The REIT continues to provide steady dividends at C$0.03 per unit monthly, indicating resilience and commitment to shareholders even amid financial hurdles.

Seize The Opportunity

- Delve into our full catalog of 18 Undervalued TSX Small Caps With Insider Buying here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ACQ

AutoCanada

Through its subsidiaries, operates franchised automobile dealerships and related business.

Good value slight.

Similar Companies

Market Insights

Community Narratives