TSX Growth Companies With High Insider Ownership January 2025

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating through a landscape shaped by recent U.S. policy shifts, with particular attention on energy and tariffs that could impact economic sentiment. Despite these uncertainties, the TSX index has shown resilience, supported by a solid economic foundation and positive earnings growth. In this context, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business in its long-term potential amidst evolving market conditions.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Robex Resources (TSXV:RBX) | 28.2% | 130.7% |

| Allied Gold (TSX:AAUC) | 17.7% | 79.2% |

| West Red Lake Gold Mines (TSXV:WRLG) | 13.4% | 77.6% |

| Almonty Industries (TSX:AII) | 17.2% | 43.9% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 33% |

| Aritzia (TSX:ATZ) | 18.6% | 45.1% |

| Enterprise Group (TSX:E) | 32.2% | 56.3% |

| Colliers International Group (TSX:CIGI) | 14.1% | 24.1% |

| CHAR Technologies (TSXV:YES) | 10.8% | 58.3% |

Let's explore several standout options from the results in the screener.

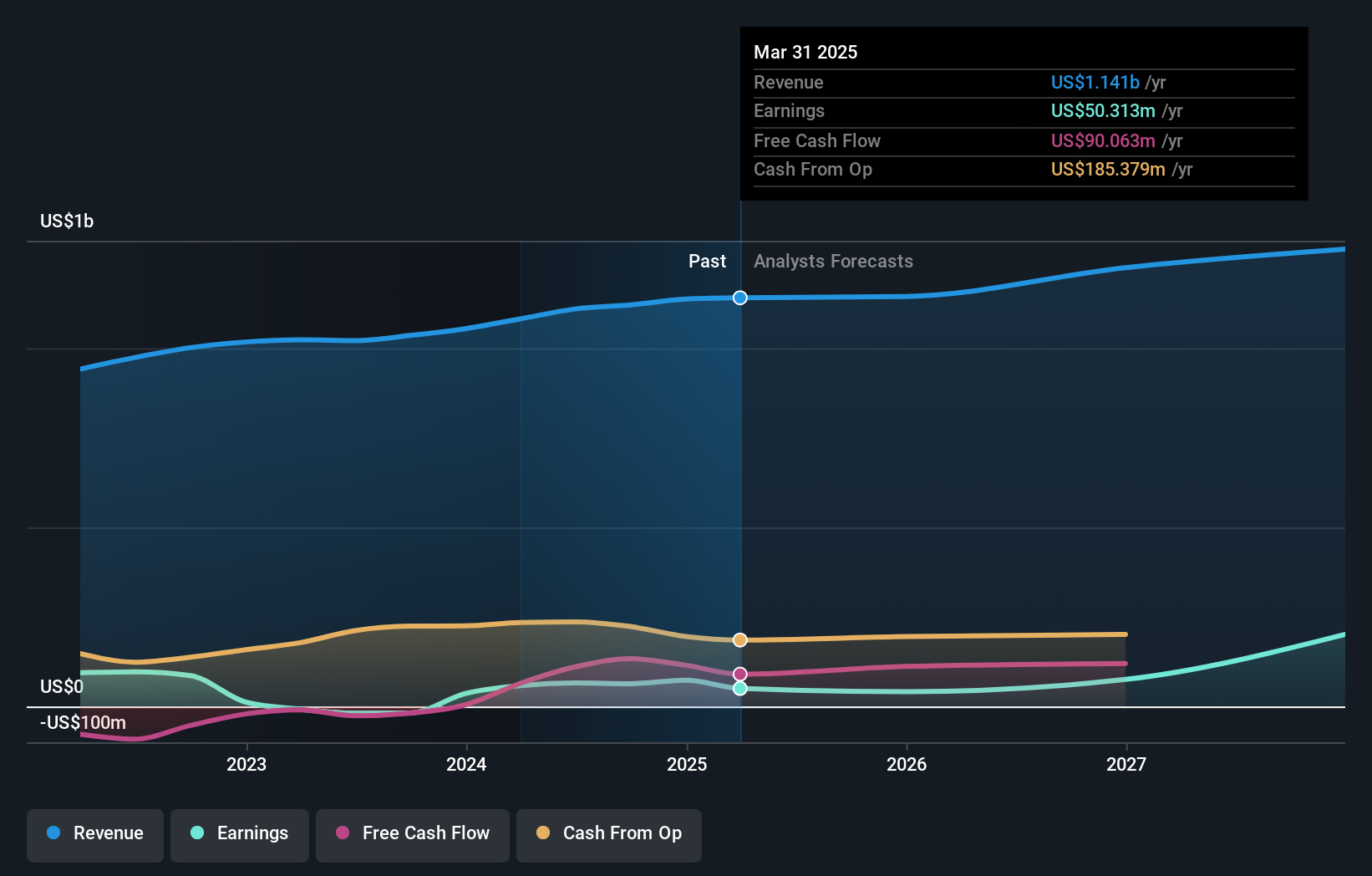

Green Thumb Industries (CNSX:GTII)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Green Thumb Industries Inc. is engaged in the manufacturing, distribution, marketing, and sale of cannabis products for medical and adult-use in the United States, with a market cap of CA$2.48 billion.

Operations: The company's revenue segments include $823.68 million from retail and $619.12 million from consumer packaged goods in the United States.

Insider Ownership: 10.1%

Green Thumb Industries, a growth-focused company with significant insider ownership, is expanding its retail footprint with the opening of its 100th and 101st RISE Dispensaries. Revenue growth is forecasted to outpace the Canadian market at 5.5% annually, while earnings are expected to grow significantly at 27.8% per year. Despite no substantial insider buying recently, insiders have bought more shares than sold over the past three months, indicating confidence in future prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Green Thumb Industries.

- According our valuation report, there's an indication that Green Thumb Industries' share price might be on the cheaper side.

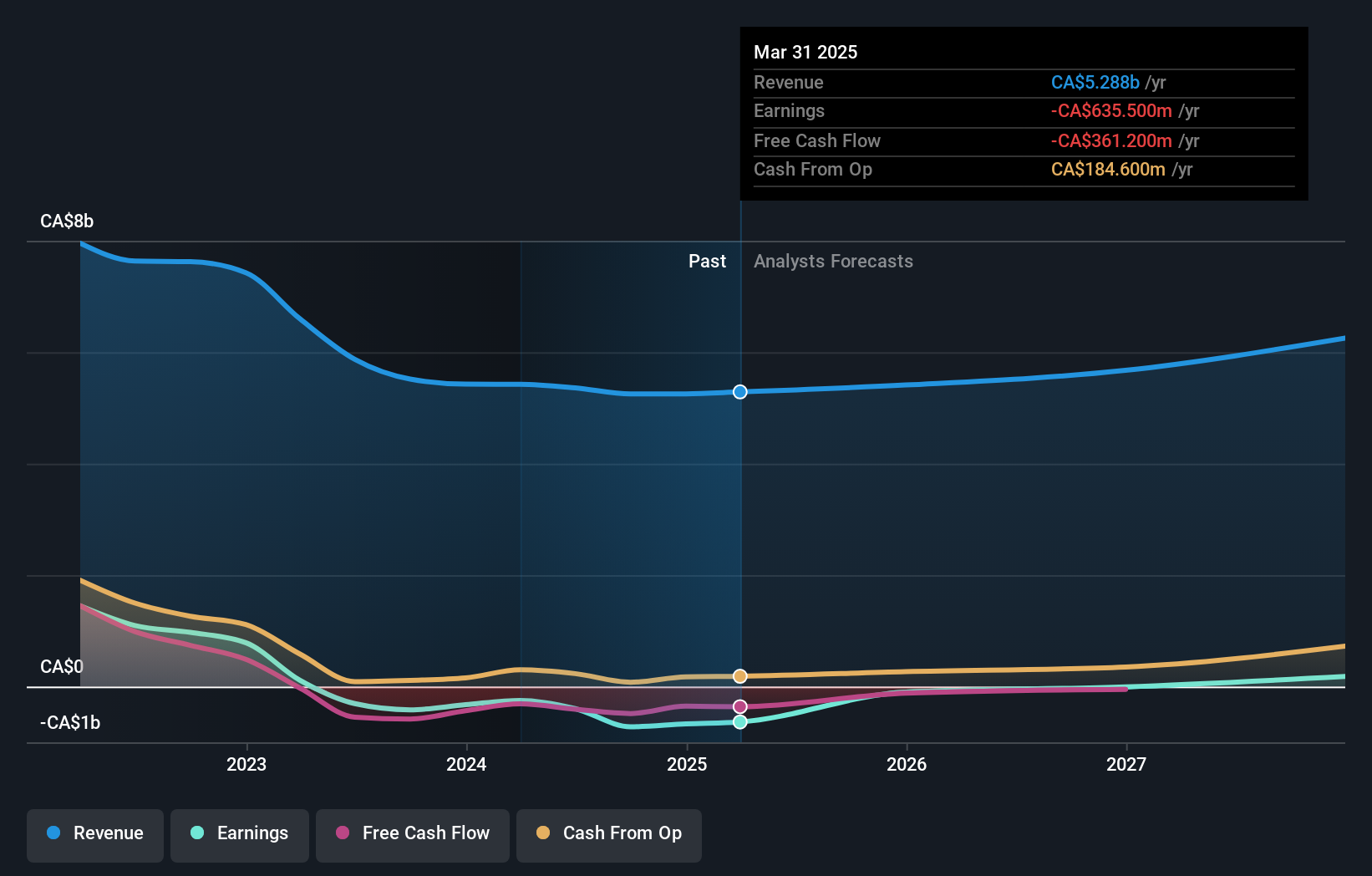

Canfor (TSX:CFP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canfor Corporation is an integrated forest products company with operations in the United States, Asia, Canada, Europe, and internationally, and has a market cap of CA$1.83 billion.

Operations: The company's revenue segments are comprised of Lumber at CA$4.56 billion and Pulp & Paper at CA$829.40 million.

Insider Ownership: 22.4%

Canfor, with considerable insider ownership, is expected to see earnings grow significantly at 61.72% annually and become profitable within three years, surpassing average market growth. Revenue growth is projected at 5.9% per year, outpacing the Canadian market's rate of 4.7%. Analysts anticipate a stock price increase of 31.6%, suggesting good relative value compared to peers and industry standards. Recent buyback activity completed shares repurchase worth C$4.6 million underlining strategic financial management efforts.

- Click to explore a detailed breakdown of our findings in Canfor's earnings growth report.

- The analysis detailed in our Canfor valuation report hints at an deflated share price compared to its estimated value.

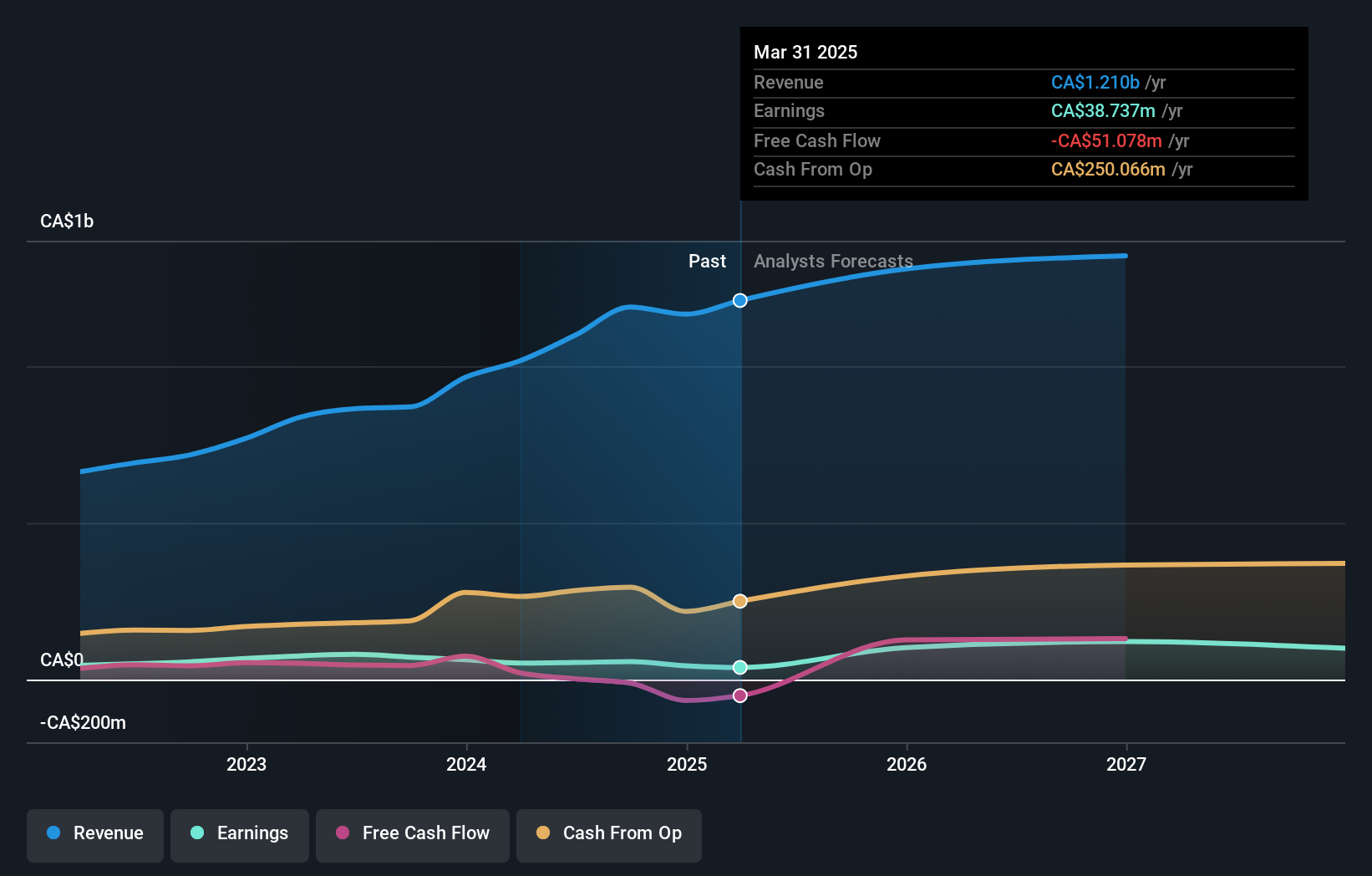

North American Construction Group (TSX:NOA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: North American Construction Group Ltd. offers mining and heavy civil construction services to the resource development and industrial construction sectors in Australia, Canada, and the United States, with a market cap of CA$780.93 million.

Operations: Revenue segments for North American Construction Group Ltd. include mining and heavy civil construction services across the resource development and industrial construction sectors in Australia, Canada, and the United States.

Insider Ownership: 11.5%

North American Construction Group, featuring significant insider ownership, is projected to achieve annual earnings growth of 31.1%, outpacing the Canadian market's 15.7%. Despite lower profit margins than last year and high debt levels, the company is trading at a considerable discount to its estimated fair value. Recent strategic moves include a share repurchase program and an extended contract in the oil sands region valued at C$500 million, indicating robust operational prospects.

- Click here to discover the nuances of North American Construction Group with our detailed analytical future growth report.

- Our expertly prepared valuation report North American Construction Group implies its share price may be lower than expected.

Where To Now?

- Click here to access our complete index of 44 Fast Growing TSX Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:GTII

Green Thumb Industries

Manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives