- Canada

- /

- Paper and Forestry Products

- /

- TSX:CFP

How Investors Are Reacting To Canfor (TSX:CFP) After New U.S. Tariffs on Softwood Imports

Reviewed by Sasha Jovanovic

- On October 1, 2025, the U.S. administration imposed a new tariff on Canadian softwood imports, with the policy effective from mid-October and directly impacting major industry exporters such as Canfor.

- This move introduces increased trade uncertainty for one of Canada's cornerstone export sectors and signals heightened sensitivity in cross-border economic relations.

- We'll take a closer look at how these U.S. tariffs create new risks for Canfor's previously discussed potential for improving earnings and margins.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Canfor Investment Narrative Recap

To be a Canfor shareholder today, you need to believe that operational changes, global diversification, and long-term demand for sustainable building materials will offset ongoing industry and trade volatility. The new U.S. softwood tariff tightens near-term pressure on Canfor’s earnings potential and acts as a key risk to any rapid improvement in profit margins, directly tying into broader concerns about persistent global trade uncertainty.

In this context, Canfor’s June 2025 announcement to permanently close two U.S. South sawmills stands out, reducing annual lumber capacity by 350 million board feet. While this move addressed high-cost operations and may support margin stability, it heightens the company’s reliance on fewer regions just as U.S. tariffs resurface, affecting the short-term outlook for both earnings and risk.

Yet, in contrast to the catalyst of operational streamlining, investors should also think carefully about how unpredictable policy moves could limit Canfor’s ability to recover margins if...

Read the full narrative on Canfor (it's free!)

Canfor's narrative projects CA$6.1 billion in revenue and CA$280.7 million in earnings by 2028. This requires 5.0% yearly revenue growth and a CA$927.9 million increase in earnings from the current CA$-647.2 million.

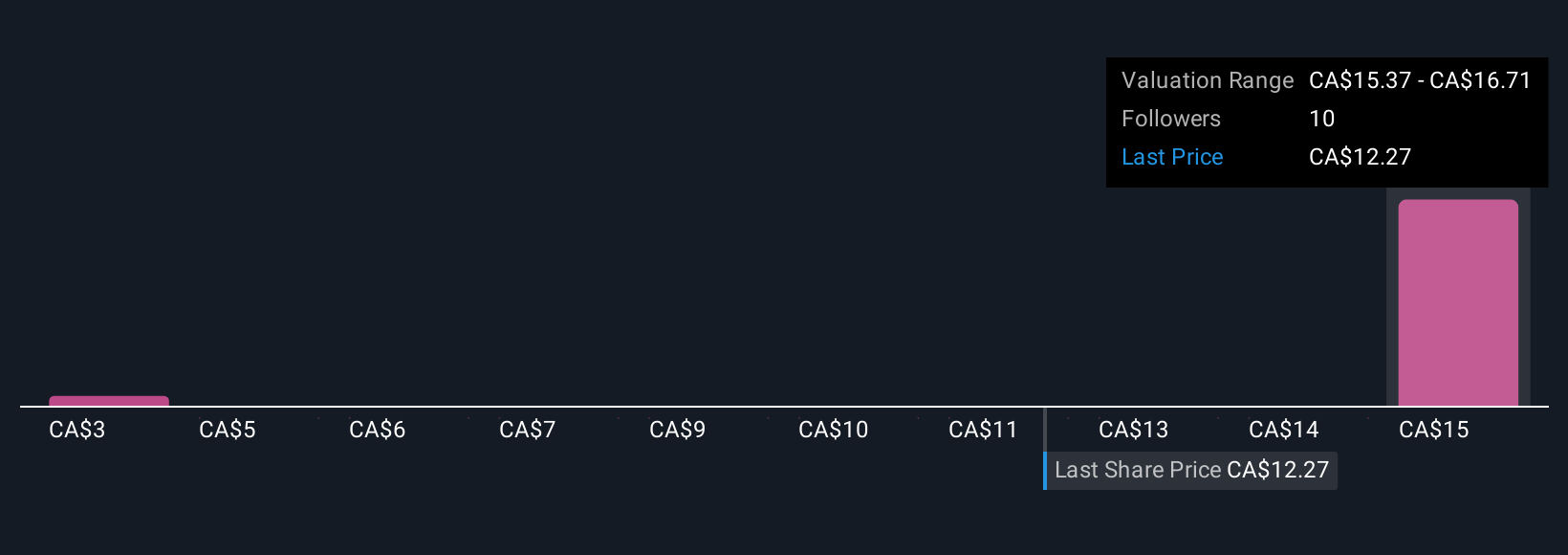

Uncover how Canfor's forecasts yield a CA$16.71 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely from CA$3.25 to CA$16.71 based on two contributors. As opinions on market access risks and recovery potential differ substantially, take the time to review these alternative viewpoints to inform your own perspective.

Explore 2 other fair value estimates on Canfor - why the stock might be worth less than half the current price!

Build Your Own Canfor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canfor research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Canfor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canfor's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CFP

Canfor

Operates as an integrated forest products company in the United States, Asia, Canada, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives