- Canada

- /

- Basic Materials

- /

- TSX:CEMX

Additional Considerations Required While Assessing CEMATRIX's (TSE:CEMX) Strong Earnings

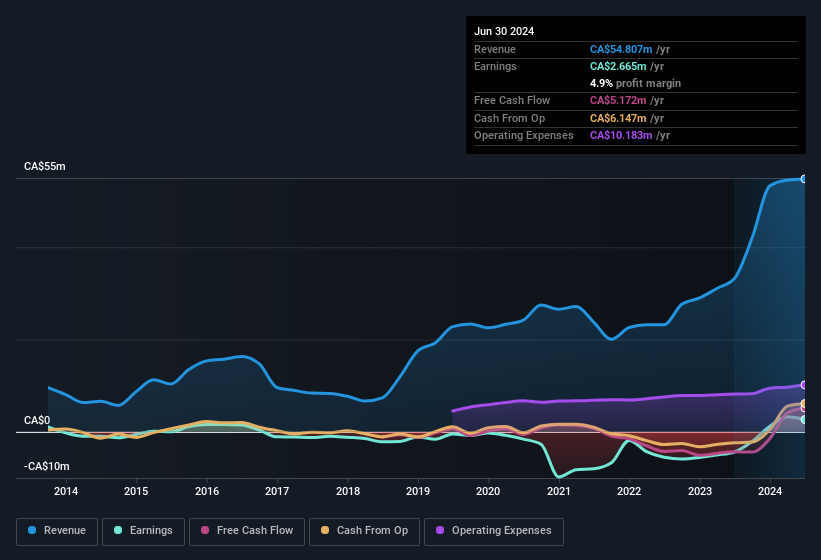

Last week's profit announcement from CEMATRIX Corporation (TSE:CEMX) was underwhelming for investors, despite headline numbers being robust. We think that the market might be paying attention to some underlying factors that they find to be concerning.

See our latest analysis for CEMATRIX

A Closer Look At CEMATRIX's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Over the twelve months to June 2024, CEMATRIX recorded an accrual ratio of -0.10. That indicates that its free cash flow was a fair bit more than its statutory profit. Indeed, in the last twelve months it reported free cash flow of CA$5.2m, well over the CA$2.67m it reported in profit. Given that CEMATRIX had negative free cash flow in the prior corresponding period, the trailing twelve month resul of CA$5.2m would seem to be a step in the right direction. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, CEMATRIX issued 12% more new shares over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of CEMATRIX's EPS by clicking here.

A Look At The Impact Of CEMATRIX's Dilution On Its Earnings Per Share (EPS)

Three years ago, CEMATRIX lost money. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if CEMATRIX's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On CEMATRIX's Profit Performance

In conclusion, CEMATRIX has a strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share are dropping faster than its profit. Based on these factors, it's hard to tell if CEMATRIX's profits are a reasonable reflection of its underlying profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. You'd be interested to know, that we found 3 warning signs for CEMATRIX and you'll want to know about them.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CEMX

CEMATRIX

Through its subsidiaries, engages in the onsite production of cellular concrete for infrastructure, industrial, and commercial construction markets in North America.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Alexandria Real Estate Equities Is Going to Transform With a 27.2% Future Pe Ratio

The "Molecular Pencil": Why Beam's Technology is Built to Win

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).