- Canada

- /

- Metals and Mining

- /

- TSX:BTO

There's No Escaping B2Gold Corp.'s (TSE:BTO) Muted Revenues Despite A 28% Share Price Rise

B2Gold Corp. (TSE:BTO) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 77%.

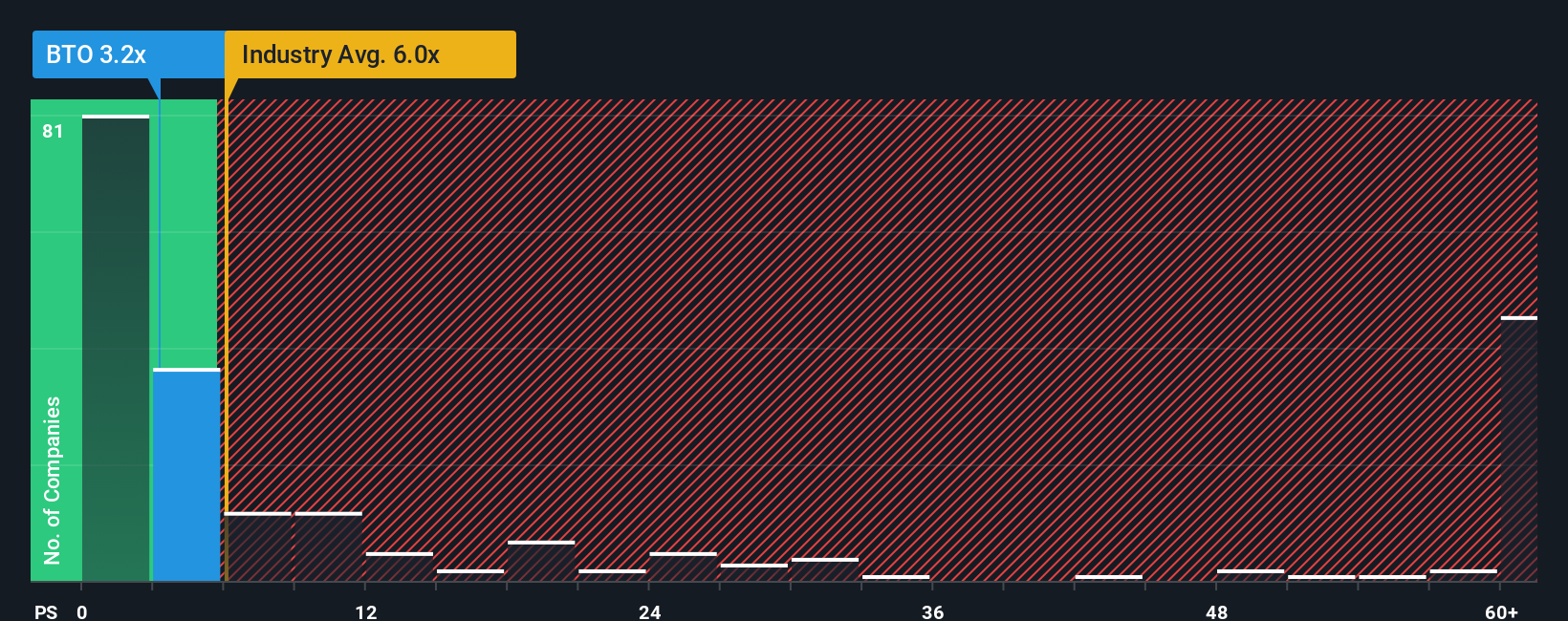

Even after such a large jump in price, B2Gold may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.2x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 6x and even P/S higher than 44x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for B2Gold

What Does B2Gold's Recent Performance Look Like?

B2Gold could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think B2Gold's future stacks up against the industry? In that case, our free report is a great place to start.How Is B2Gold's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like B2Gold's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The latest three year period has also seen a 22% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 16% each year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 36% growth per annum, the company is positioned for a weaker revenue result.

With this information, we can see why B2Gold is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does B2Gold's P/S Mean For Investors?

Despite B2Gold's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of B2Gold's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for B2Gold that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if B2Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BTO

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives