Undervalued Small Caps With Insider Action In Global For July 2025

Reviewed by Simply Wall St

In July 2025, the global markets are experiencing a dynamic period marked by strong corporate earnings in the U.S., which have propelled major indices like the S&P 500 and Nasdaq Composite to new highs, while small-cap stocks represented by the Russell 2000 also show positive momentum. Amidst this backdrop of economic resilience and inflationary pressures, identifying undervalued small-cap stocks with insider activity can offer intriguing opportunities for investors seeking to capitalize on potential growth within this segment.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| East West Banking | 3.5x | 0.8x | 25.34% | ★★★★★☆ |

| Lion Rock Group | 5.1x | 0.4x | 49.45% | ★★★★☆☆ |

| Sagicor Financial | 10.2x | 0.4x | -169.24% | ★★★★☆☆ |

| CVS Group | 46.3x | 1.3x | 37.37% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 11.6x | 7.0x | 19.59% | ★★★★☆☆ |

| Seeing Machines | NA | 2.8x | 46.59% | ★★★★☆☆ |

| Dicker Data | 20.2x | 0.7x | -22.16% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.8x | 0.5x | -139.34% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.6x | 1.8x | 13.10% | ★★★☆☆☆ |

| Chinasoft International | 25.3x | 0.8x | 9.19% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

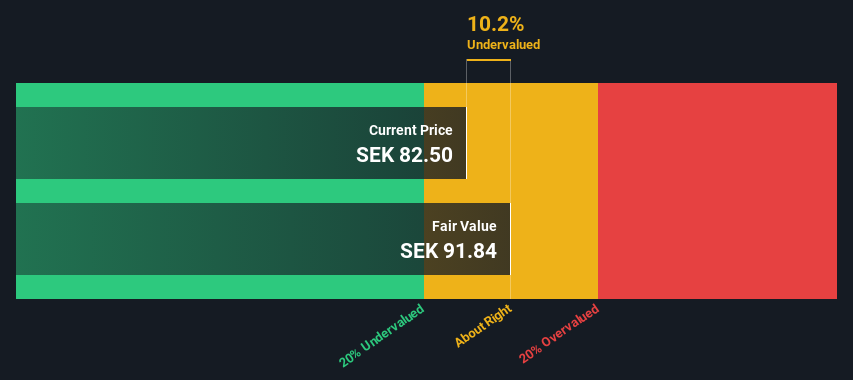

AcadeMedia (OM:ACAD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: AcadeMedia operates as a leading education provider, offering services across adult education, compulsory schools, upper secondary schools, and preschool & international segments with a market capitalization of approximately SEK 4.98 billion.

Operations: AcadeMedia generates revenue primarily from its Preschool & International segment (SEK 7.88 billion) and Upper Secondary Schools (SEK 6.54 billion). The company's gross profit margin has experienced fluctuations, with a recent figure of 31.17%. Operating expenses, including general and administrative costs, significantly impact the overall financial performance, with recent expenses totaling SEK 4.13 billion.

PE: 12.0x

AcadeMedia, a smaller company in its sector, shows potential as an undervalued player. With earnings forecasted to grow at 20% annually, they reported Q3 sales of SEK 5.04 billion and net income of SEK 241 million, both up from the previous year. Recent insider confidence is evident with share purchases in the past six months. Despite relying on external borrowing for funding, their financial guidance suggests continued growth with anticipated Q4 sales of SEK 5.12 billion.

- Dive into the specifics of AcadeMedia here with our thorough valuation report.

Examine AcadeMedia's past performance report to understand how it has performed in the past.

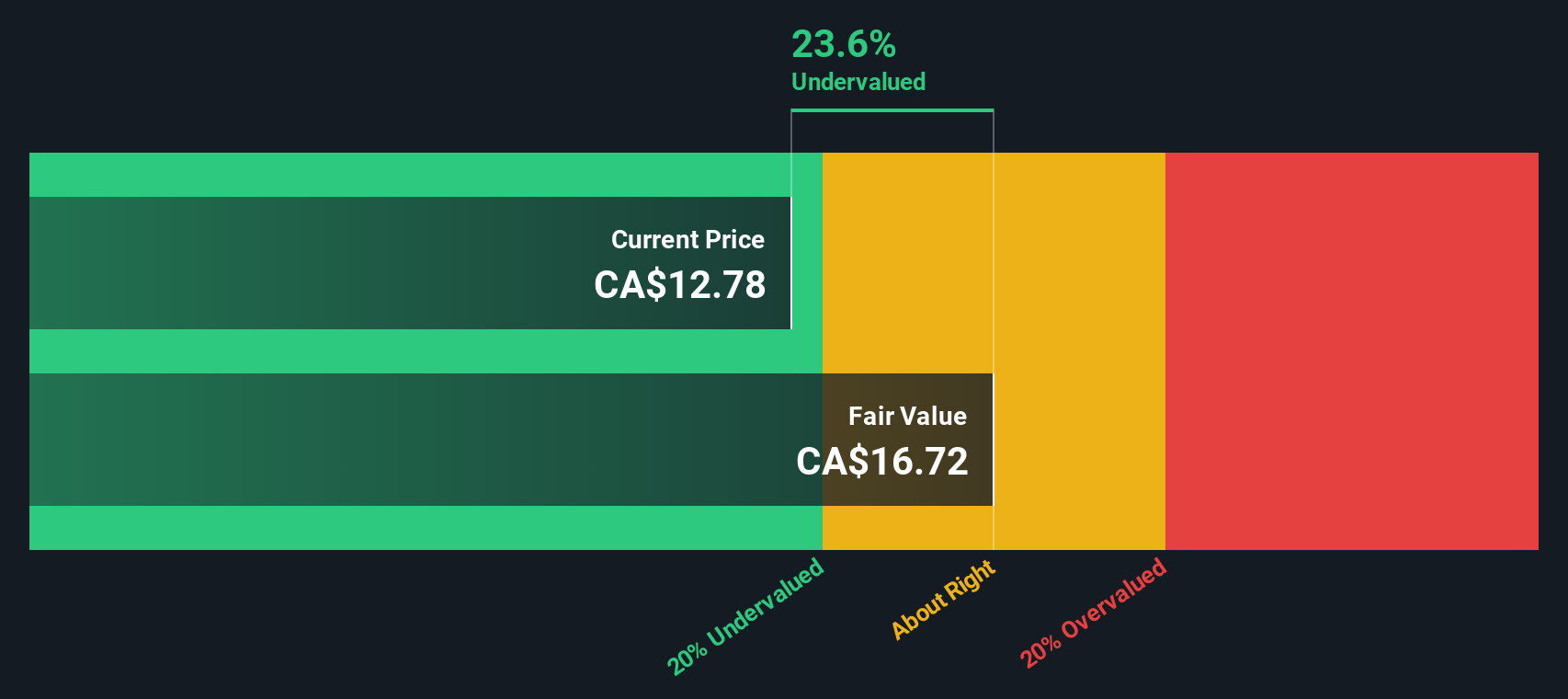

Aya Gold & Silver (TSX:AYA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Aya Gold & Silver is a mining company focused on the exploration, development, and production of silver and gold properties in Morocco, with a market cap of approximately $1.47 billion CAD.

Operations: Aya Gold & Silver's revenue primarily comes from its production activities at the Zgounder Silver Mine in Morocco, generating $67.87 million. In the most recent period, it reported a gross profit margin of 27.10%, reflecting its ability to manage costs relative to sales effectively.

PE: -118.0x

Aya Gold & Silver, a company with a focus on mineral exploration in Morocco, is gaining attention for its significant high-grade drill results at Boumadine and Zgounder. The firm recently secured a US$25 million credit facility from the EBRD to advance its projects, highlighting strategic growth plans. Insider confidence is reflected through recent stock purchases by key personnel. Despite relying heavily on external funding, Aya's potential for resource expansion and improved earnings forecasts positions it as an intriguing investment opportunity in the mining sector.

- Unlock comprehensive insights into our analysis of Aya Gold & Silver stock in this valuation report.

Evaluate Aya Gold & Silver's historical performance by accessing our past performance report.

Docebo (TSX:DCBO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Docebo is a company that specializes in providing educational software solutions, with a market capitalization of approximately $1.21 billion CAD.

Operations: The company generates revenue primarily from its educational software offerings, with the latest reported revenue at $222.82 million. The gross profit margin has shown a consistent trend around 80%, indicating effective cost management relative to COGS. Operating expenses are significant, with sales and marketing being the largest component, followed by research and development costs.

PE: 40.3x

Docebo, a company known for its e-learning platforms, recently achieved FedRAMP Moderate Authorization for its LearnGov platform, enhancing its credibility with U.S. federal agencies. Despite a dip in net income to US$1.47 million from US$5.17 million last year, Docebo's revenue rose to US$57.3 million in Q1 2025. CEO Alessio Artuffo's purchase of 2,845 shares signals insider confidence amidst leadership changes and strategic expansions in government sectors. With an expected annual revenue growth of up to 10%, Docebo continues to position itself for future growth while navigating higher-risk external funding sources effectively.

- Click here and access our complete valuation analysis report to understand the dynamics of Docebo.

Gain insights into Docebo's past trends and performance with our Past report.

Seize The Opportunity

- Unlock more gems! Our Undervalued Global Small Caps With Insider Buying screener has unearthed 116 more companies for you to explore.Click here to unveil our expertly curated list of 119 Undervalued Global Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCBO

Docebo

Develops and provides a learning management platform for training in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives