- Canada

- /

- Metals and Mining

- /

- TSX:AYA

High Growth TSX Stocks Insiders Are Betting On

Reviewed by Simply Wall St

The Canadian market has shown positive momentum, rising 1.3% in the last week and climbing 23% over the past year, with earnings projected to grow by 15% annually in the coming years. In this environment of robust growth, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations and potential.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 11.8% | 70.7% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 76.5% |

| Aritzia (TSX:ATZ) | 18.9% | 59.7% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 71.4% |

| Allied Gold (TSX:AAUC) | 18.3% | 73% |

| Ivanhoe Mines (TSX:IVN) | 12.3% | 69.8% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

Let's uncover some gems from our specialized screener.

Aya Gold & Silver (TSX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc., along with its subsidiaries, focuses on the exploration, evaluation, and development of precious metals projects in Morocco and has a market cap of CA$2.40 billion.

Operations: The company's revenue segment is derived from the production at the Zgounder Silver Mine in Morocco, totaling $41.54 million.

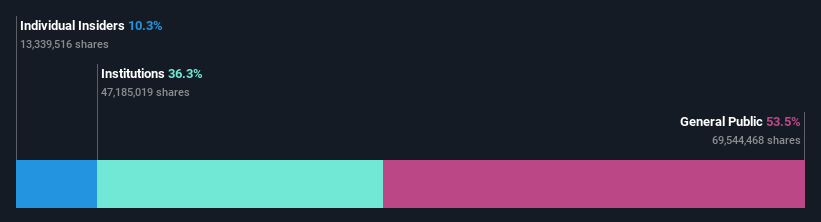

Insider Ownership: 10.2%

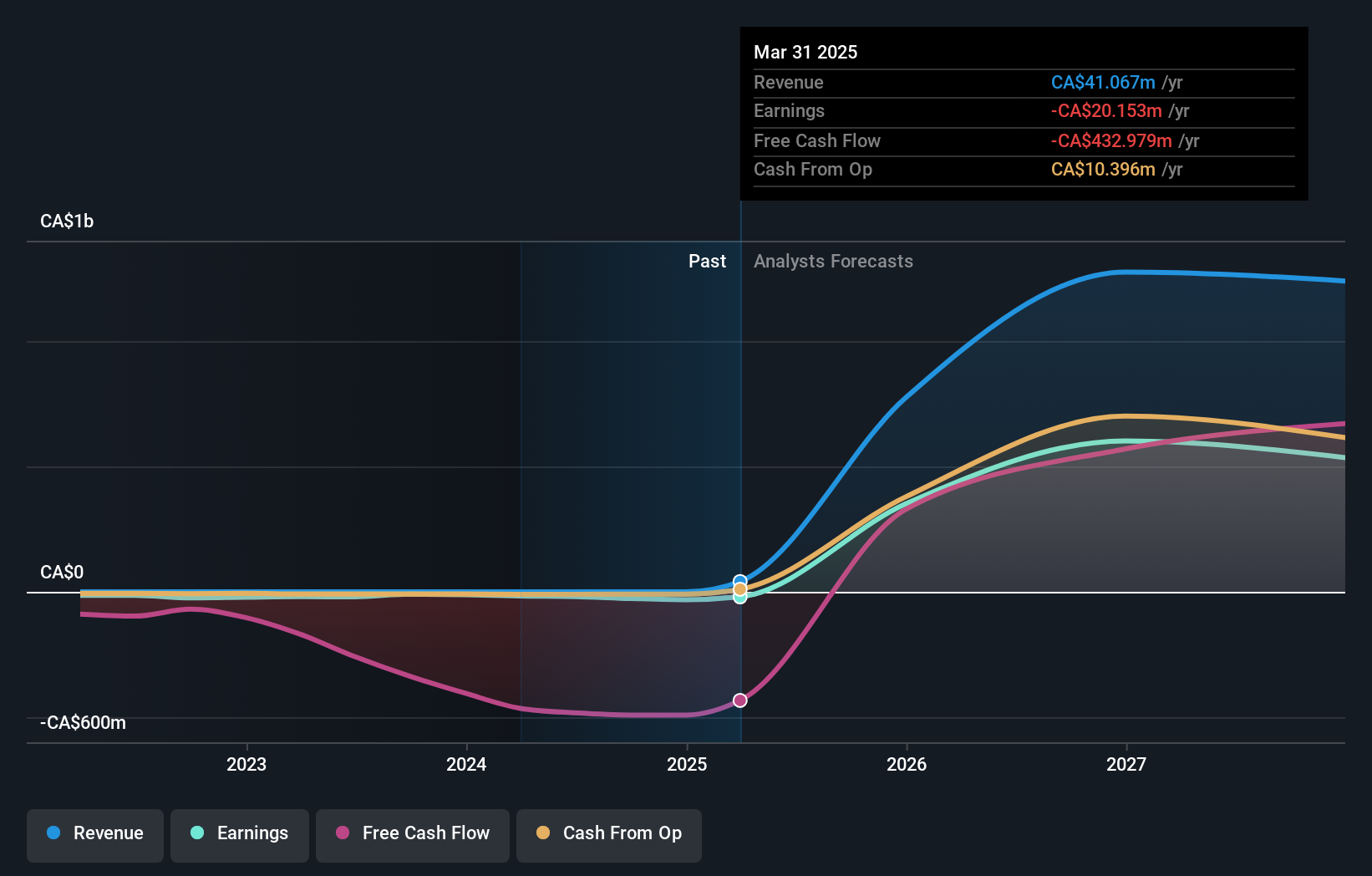

Aya Gold & Silver is experiencing substantial growth, with earnings increasing by 220.3% over the past year and revenue expected to grow at 46.7% annually, significantly outpacing the Canadian market. Despite recent shareholder dilution, Aya's strategic moves like spinning off its Amizmiz Gold Project into Mx2 Mining indicate a focus on expanding its North African operations. Recent exploration results from Morocco show promising potential for resource expansion, supporting Aya's growth trajectory in the mining sector.

- Take a closer look at Aya Gold & Silver's potential here in our earnings growth report.

- According our valuation report, there's an indication that Aya Gold & Silver's share price might be on the expensive side.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. offers commercial real estate and investment management services to corporate and institutional clients across the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of CA$10.38 billion.

Operations: The company's revenue segments include the Americas at $2.59 billion, Asia Pacific at $614.55 million, Investment Management at $496.42 million, and Europe, Middle East & Africa (EMEA) at $734.93 million.

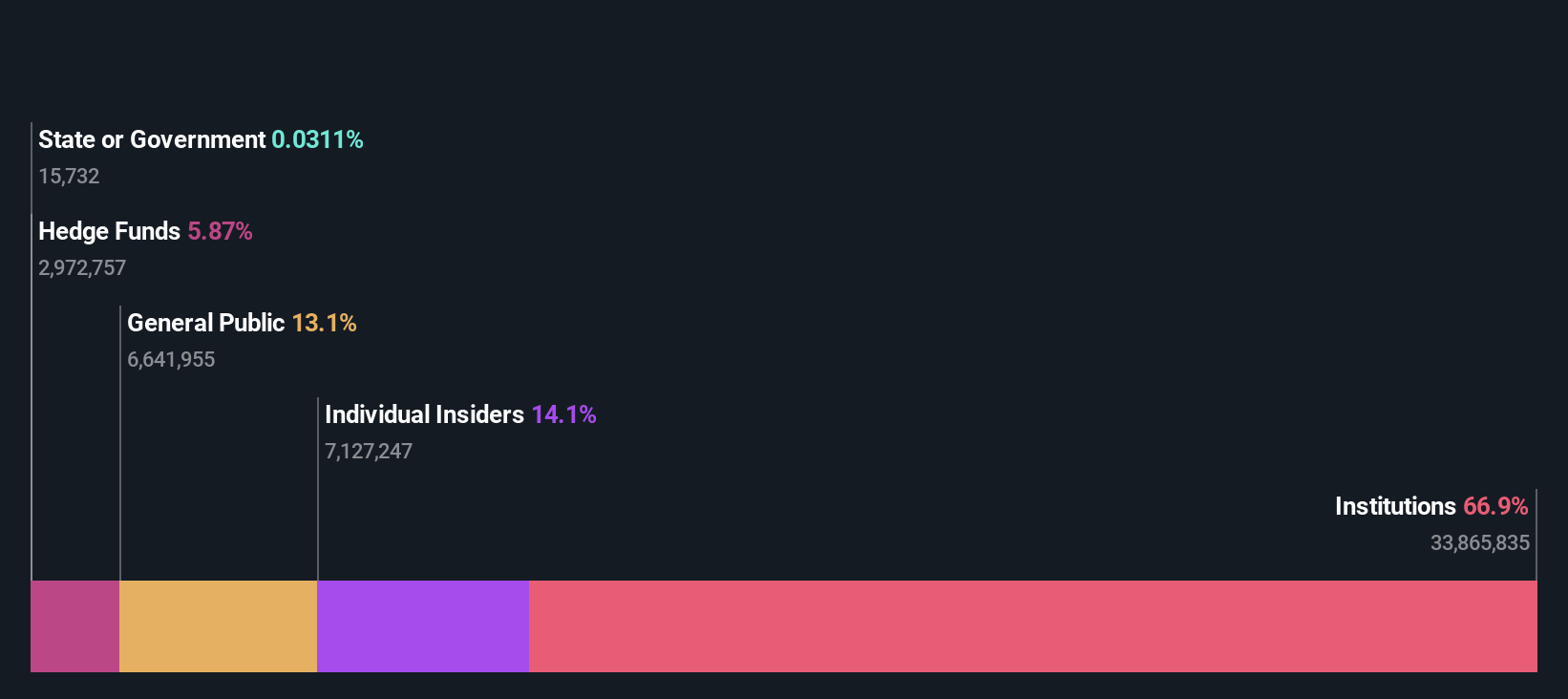

Insider Ownership: 14.1%

Colliers International Group is experiencing robust growth, with earnings rising by a very large margin over the past year and forecasted to grow at 20.81% annually, surpassing Canadian market expectations. Revenue is also expected to increase by 11% per year. Despite recent insider selling and shareholder dilution, the company maintains strong financial performance with a significant turnaround in profitability reported for the second quarter of 2024 compared to last year's losses.

- Unlock comprehensive insights into our analysis of Colliers International Group stock in this growth report.

- In light of our recent valuation report, it seems possible that Colliers International Group is trading beyond its estimated value.

Artemis Gold (TSXV:ARTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company that specializes in identifying, acquiring, and developing gold properties, with a market cap of CA$3.09 billion.

Operations: Artemis Gold Inc. currently does not report any revenue segments.

Insider Ownership: 29.9%

Artemis Gold is on track for significant growth, with revenue forecasted to increase by 45.9% annually, outpacing the Canadian market. The Blackwater Mine's construction is over 95% complete, targeting first gold pour in late Q4 2024. Despite wildfire-related delays increasing costs, the project remains fully funded. Recent earnings show a net loss of CA$5.73 million for Q2 2024 but profitability is expected within three years as operations commence.

- Get an in-depth perspective on Artemis Gold's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Artemis Gold implies its share price may be lower than expected.

Make It Happen

- Unlock our comprehensive list of 35 Fast Growing TSX Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential with proven track record.

Market Insights

Community Narratives