- Canada

- /

- Metals and Mining

- /

- TSX:ASM

Avino Silver & Gold Mines (TSE:ASM) Is In A Good Position To Deliver On Growth Plans

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Avino Silver & Gold Mines (TSE:ASM) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Avino Silver & Gold Mines

Does Avino Silver & Gold Mines Have A Long Cash Runway?

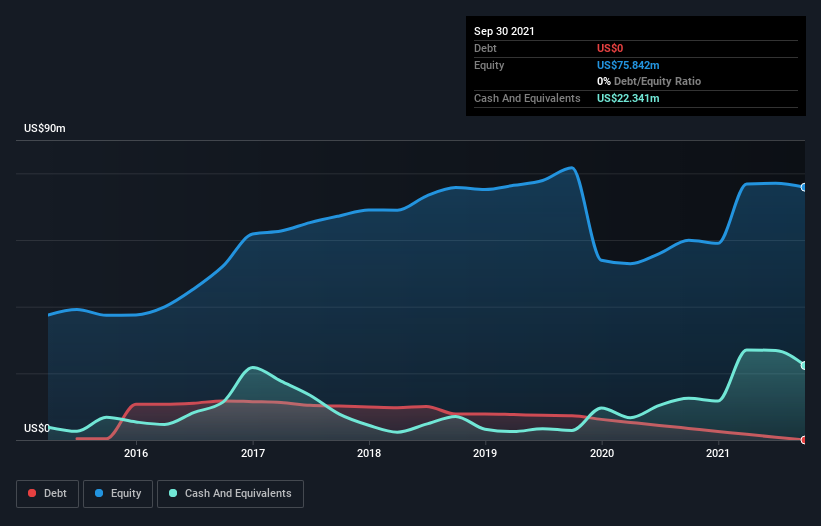

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at September 2021, Avino Silver & Gold Mines had cash of US$22m and no debt. In the last year, its cash burn was US$5.4m. So it had a cash runway of about 4.1 years from September 2021. There's no doubt that this is a reassuringly long runway. You can see how its cash balance has changed over time in the image below.

Is Avino Silver & Gold Mines' Revenue Growing?

Given that Avino Silver & Gold Mines actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. The bad news for shareholders is that operating revenue actually plummeted 87% in the last year, which is a real concern in our view. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Avino Silver & Gold Mines Raise More Cash Easily?

Since its revenue growth is moving in the wrong direction, Avino Silver & Gold Mines shareholders may wish to think ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Avino Silver & Gold Mines' cash burn of US$5.4m is about 6.8% of its US$80m market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Avino Silver & Gold Mines' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Avino Silver & Gold Mines' cash burn. For example, we think its cash runway suggests that the company is on a good path. While we must concede that its falling revenue is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. An in-depth examination of risks revealed 4 warning signs for Avino Silver & Gold Mines that readers should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade Avino Silver & Gold Mines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Canada.

Flawless balance sheet with solid track record.