- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

The Bull Case For Aris Mining (TSX:ARIS) Could Change Following Juby Gold Project Sale to McFarlane

Reviewed by Sasha Jovanovic

- Aris Mining Corporation recently completed the sale of its Juby Gold Project in Ontario, Canada, to McFarlane Lake Mining Limited for US$22 million, with the transaction including both cash and a sizeable equity stake in McFarlane.

- This move reflects Aris Mining’s ongoing realignment toward expanding its gold operations in Colombia and Guyana, supported by recent capacity upgrades at its Segovia Operations.

- We’ll explore how the Juby Project divestment sharpens Aris Mining’s operational focus and informs its investment narrative going forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Aris Mining Investment Narrative Recap

To be a shareholder in Aris Mining, you need to believe in the company’s ability to deliver large-scale growth by focusing on Colombian and Guyanese gold assets, while managing execution risks and political complexities tied to its concentration in these regions. The sale of the Juby Gold Project does not materially shift the most important short term catalyst, the production ramp-up at Segovia and Marmato, but frees up capital and sharpens operational discipline, potentially improving resilience to cost overruns and project delays.

Aris Mining’s recently-commissioned second mill at its Segovia Operations is a key catalyst now that the Juby divestment has reduced distractions and non-core commitments. This increased processing capacity positions Aris to meet its annual production guidance and realize tangible revenue growth, reinforcing the importance of disciplined capital allocation and efficient project execution.

But on the flip side, investors should be aware that concentrated exposure to Colombia still means heightened sensitivity to...

Read the full narrative on Aris Mining (it's free!)

Aris Mining's narrative projects $1.5 billion in revenue and $695.3 million in earnings by 2028. This requires 32.4% yearly revenue growth and a $690.2 million increase in earnings from $5.1 million today.

Uncover how Aris Mining's forecasts yield a CA$17.05 fair value, a 22% upside to its current price.

Exploring Other Perspectives

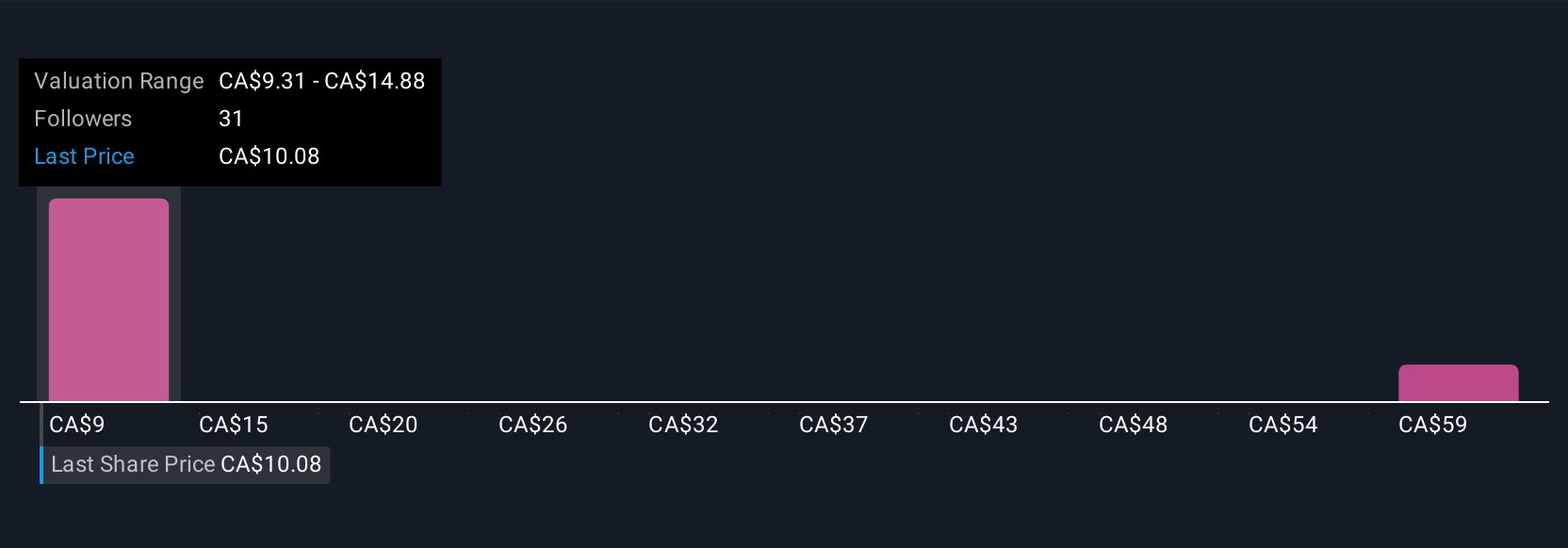

Simply Wall St Community members have produced a wide spectrum of fair value estimates for Aris Mining, from as low as US$2.09 to as high as US$65, across 7 viewpoints. While production growth is a key focus for many, keep in mind that project delays or cost overruns could shift future narratives, so consider exploring several distinct perspectives.

Explore 7 other fair value estimates on Aris Mining - why the stock might be worth over 4x more than the current price!

Build Your Own Aris Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aris Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aris Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aris Mining's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives