- Canada

- /

- Metals and Mining

- /

- TSX:ORE

Undiscovered Gems In Canada Featuring Three Promising Small Caps

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of global trade uncertainties and economic fluctuations, small-cap stocks present intriguing opportunities for investors seeking diversification beyond U.S. mega-cap technology giants. In this environment, identifying promising small-cap companies involves looking for robust fundamentals and growth potential that can withstand market volatility and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| Pulse Seismic | NA | 11.60% | 32.30% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Zoomd Technologies | 8.92% | 10.04% | 44.63% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Amerigo Resources (TSX:ARG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amerigo Resources Ltd., via its subsidiary Minera Valle Central S.A., focuses on producing copper and molybdenum concentrates in Chile, with a market cap of CA$350.40 million.

Operations: The company generates revenue primarily from the production of copper concentrates under a tolling agreement with DET, amounting to $192.03 million.

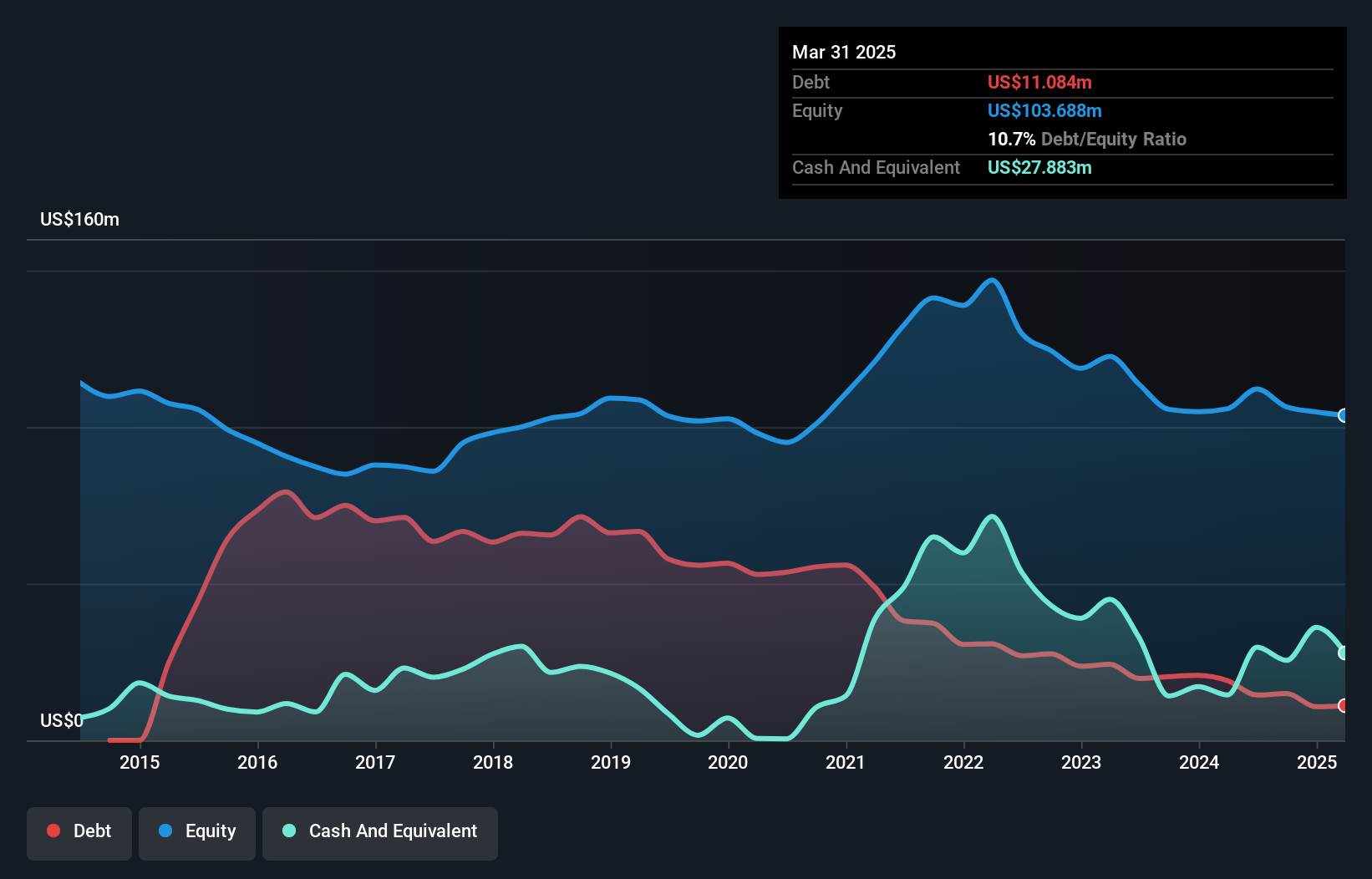

Amerigo Resources, a nimble player in the mining sector, is making waves with its recent profitability and strategic moves. The company has reduced its debt to equity ratio from 54% to 10.7% over five years, indicating strong financial management. With cash exceeding total debt and interest payments well covered by EBIT at 17.8x, Amerigo shows solid fiscal health. Trading significantly below estimated fair value by about 76.7%, it seems undervalued despite insider selling concerns in the past quarter. Recent share buybacks of CAD 2.9 million suggest confidence in future prospects while maintaining high-quality earnings amidst industry challenges.

- Unlock comprehensive insights into our analysis of Amerigo Resources stock in this health report.

Gain insights into Amerigo Resources' past trends and performance with our Past report.

Orezone Gold (TSX:ORE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Orezone Gold Corporation focuses on the mining, exploration, and development of gold properties with a market capitalization of CA$602.21 million.

Operations: Orezone Gold Corporation generates revenue primarily from the acquisition, exploration, and potential development of precious metal properties, totaling $301.55 million.

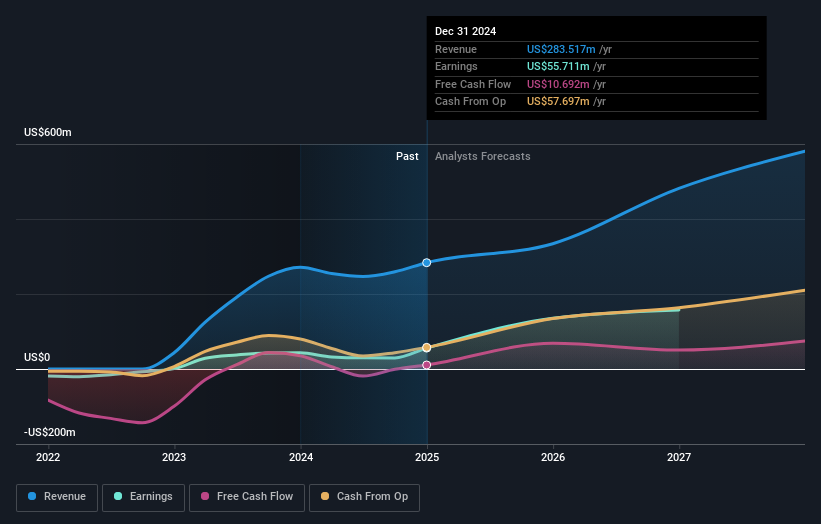

Orezone Gold, a Canadian mining company, has been making strides with its Bombore Gold Mine. Recent drilling results show promising high-grade mineralization, with highlights like 11.33g/t Au over 11m and 7.40g/t Au over 6.70m, supporting long-term resource expansion goals of up to 10 million ounces. The company reported Q1 sales of US$82.72 million and net income at US$15.98 million, reflecting solid financial performance despite substantial shareholder dilution in the past year. Orezone's earnings grew by an impressive 85% last year, outpacing industry growth rates significantly while maintaining a debt-to-equity ratio increase to 31%.

EMX Royalty (TSXV:EMX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EMX Royalty Corporation focuses on exploring and generating royalties from metals and minerals properties, with a market cap of CA$370.41 million.

Operations: EMX Royalty Corporation generates revenue primarily through acquiring, managing, and generating royalties from metals and minerals properties, amounting to $29.63 million.

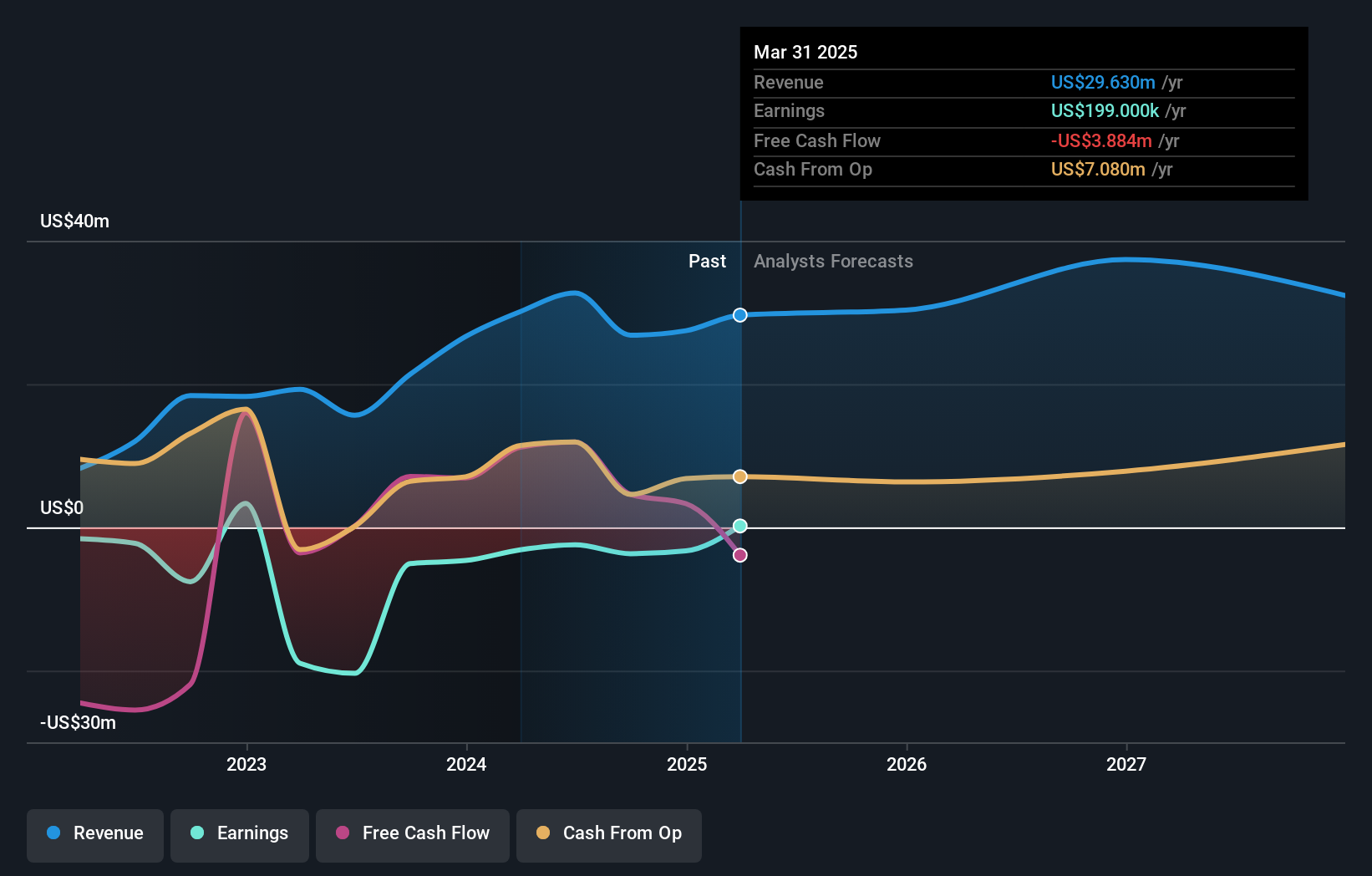

EMX Royalty, a burgeoning player in the Canadian mining sector, has recently turned profitable with net income of US$1.26 million for Q1 2025, a stark contrast to last year's US$2.23 million loss. Its debt-to-equity ratio has climbed to 30% over five years but remains manageable with a satisfactory net debt-to-equity of 7.5%. Despite EBIT covering interest payments only 0.9 times, EMX showcases high-quality earnings and anticipates revenue growth of 6.9% annually. The company also repurchased shares worth CAD2.49 million, reflecting confidence in its market position and future prospects within the industry landscape.

- Delve into the full analysis health report here for a deeper understanding of EMX Royalty.

Examine EMX Royalty's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Embark on your investment journey to our 45 TSX Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ORE

Orezone Gold

Engages in the mining, exploration, and development of gold properties.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives